Serve Robotics Inc. (NASDAQ): Recently founded low emission, self driving robot company (SERV) focuses on developing robots to send to clients to deliver food. Serve Robotics, based in Redwood City, California, serving in the Specialty Industrial Machinery industry within the Industrials sector, was launched in the year 2017.

In July 2023, the company rebranded as Patricia Acquisition Corp. was changed to Serve Robotics Inc. Serve Robotics may still be a newbie on the market, but it has managed to make its presence known with impressive revenue growth and technological developments around autonomous delivery solutions.

Serve Robotics Company Financials

Serve Robotics financial performance over the recent years demonstrates the challenges and growth opportunities of such an early stage tech company. Here are key highlights:

- Revenue Growth: For 2023, revenue was $0.21M (92.49% more than 2022). Exponential growth of revenue (TTM), $1.68M (692.32% YoY); as of Q3 2024.

- Net Losses: The company has managed to generate revenue, but is still losing cash, so the TTM net loss stands at -$33.13M. It’s a reflection of heavy R&D spending ($20.01M in TTM) and administrative expenses ($10.27M in TTM).

- Cash Reserves: At Q3 2024, Serve Robotics’ cash and equity increased to $50.91 million, hinting at well stocked cash management strategy, thanks to equity raises or funding rounds.

- Shareholder Equity: In comparison with past years, TTM the company showed significant improvement in tangible book value per share, going up to $1.32, instead of the negative values shows it has been in the past.

Serve Robotics is still not profitable but the money spent on technology makes it a big player in the autonomous delivery markets. But to sustain losses, careful balance between the two must be reached.

SERV Stock Short-Term Analysis (2025-2030)

Recently founded low emission, self driving robot company (SERV) focuses on developing robots to send to clients to deliver food. Serve Robotics, based in Redwood City, California, serving in the Specialty Industrial Machinery industry within the Industrials sector, was launched in the year 2017.

In July 2023, the company rebranded as Patricia Acquisition Corp. was changed to Serve Robotics Inc. Serve Robotics may still be a newbie on the market, but it has managed to make its presence known with impressive revenue growth and technological developments around autonomous delivery solutions.

Serve Robotics Company Financials

Serve Robotics financial performance over the recent years demonstrates the challenges and growth opportunities of such an early stage tech company. Here are key highlights:

- Revenue Growth: For 2023, revenue was $0.21M (92.49% more than 2022). Exponential growth of revenue (TTM), $1.68M (692.32% YoY); as of Q3 2024.

- Net Losses: The company has managed to generate revenue, but is still losing cash, so the TTM net loss stands at -$33.13M. It’s a reflection of heavy R&D spending ($20.01M in TTM) and administrative expenses ($10.27M in TTM).

- Cash Reserves: Q3 2024: Cash and equivalents at Serve Robotics hit $50.91M, a solid cash management ultimately coming from equity raises or funding rounds.

- Shareholder Equity: In comparison with past years, TTM the company showed significant improvement in tangible book value per share, going up to $1.32, instead of the negative values shows it has been in the past.

Serve Robotics is still not profitable but the money spent on technology makes it a big player in the autonomous delivery markets. But to sustain losses, careful balance between the two must be reached.

SERV Stock Long-Term Analysis (2030-2050)

Serve Robotics looks beyond 2030 based on industry trends, competition and continuous innovation. Here are potential scenarios:

Bullish Case:

- Global delivery robotics market swallows Serve Robotics, leading to capture of a substantial market share.

- As new service lines develop (e.g. grocery delivery, healthcare logistics), revenues exceed $100M per year by 2040.

- With institutional investors competing on the market dominance ShaleOne could skyrocket to trading at over $200 by 2050.

Bearish Case:

- Serve Robotics may find it unable to grow revenue if competitors overtake it in technology or partnerships.

- Limited profitability and financial struggles would restrain stock growth to $50 and under.

Baseline Case:

- Limited growth in developing markets with high growth in core markets (North America, Europe).

- By 2040 we’re at $50M in revenues with moderate profitability. By 2050 the stock price could stabilize at around $100.

The long-term outlook suggests potential for substantial growth if Serve Robotics continues to innovate and capture market opportunities.

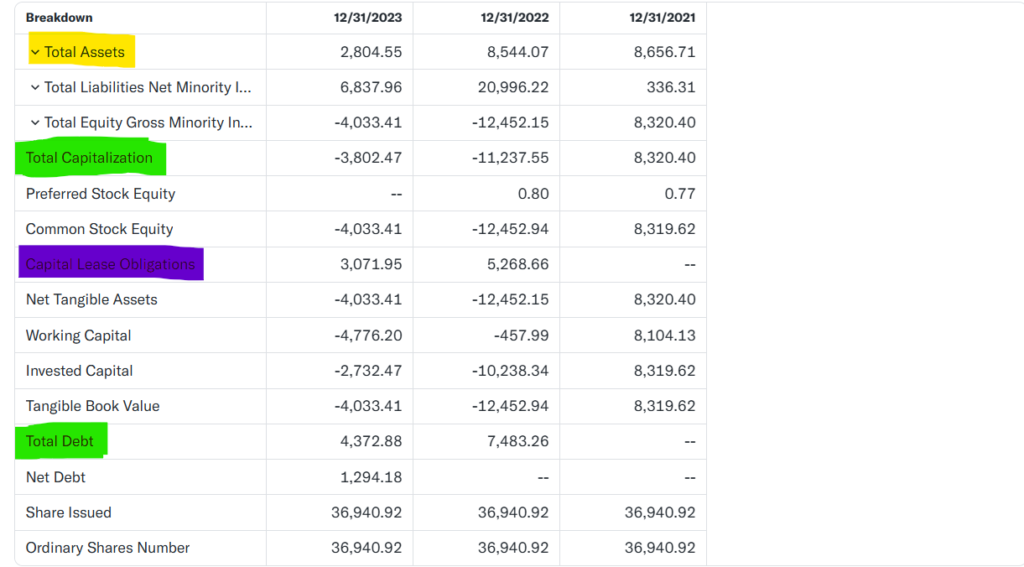

SERV Stock Balance Sheet Analysis

According to Serve Robotics’ balance sheet, there are opportunities and challenges. Key takeaways include:

- Cash Position: Q3 2024 Cash reserves of $50.91M are well above the operational needs and R&D investment floor levels. This is a positive YoY growth of 1353.77%.

- Debt: Serve Robotics has lower financial risk, with nearly no significant long term debt and total liabilities of $5.29 M.

- Shareholder Equity: A healthy financial structure versus prior years with negative equity of $56.18M.

Financials are typical for early stage, but Serve Robotics’ cash position has improved and liabilities have been reduced to reflect progress toward sustainability. However, in the next few years, investors should really watch for operating cash flow and margin improvement.

SERV Stock Market Cap History Analysis

Recent years have seen Serve Robotics exhibit a phenomenal rate of growth. Back in April 2024, company’s market capitalization was $115.30 million and at the beginning of January 2025, the market capitalization went up to $802.97 million, that is an incredible growth of 596.42%.

That growth rate equates to a compound annual growth rate (CAGR) of 1.22678%. It’s attributed to the rise of investor confidence, successful funding rounds and the ability to scale the company’s robotic delivery solutions fast.

Compound annual growth rate (CAGR) of 1,226.78%. This rapid expansion is attributed to increased investor confidence, successful funding rounds, and the company’s ability to scale its robotic delivery solutions.

| Date | Market Cap (in millions) | Percentage Change (%) |

|---|---|---|

| April 2024 | 115.30 | – |

| December 2024 | 598.00 | +418.65 |

| January 2025 | 802.97 | +35.27 |

Serve Robotics’ impressive growth shows that this small cap stock has big growth ahead, though its high valuation also means that managers should watch out for risks of overvaluation.

SERV Stock 10 Year History and Analysis

While Serve Robotics’ data as a whole does not go back a decade or more, since the company’s inception it’s come a long way. As a disruptor in the delivery robotics industry, Serve Robotics has seen revenue growth rate, market cap increases, and focus on innovative technologies.

Below is a snapshot of its financial performance over recent years:

| Year | Revenue (in millions) | Growth (%) | Market Cap (in millions) |

| 2022 | 0.11 | – | – |

| 2023 | 0.21 | 92.49 | – |

| 2024 | 1.68 | 692.32 | 598.00 |

| 2025 | – | – | 802.97 |

Serve Robotics has consistently grown revenue with high growth rate hospitals come back to and newer healthcare clients go to; they are able to secure new contracts and make improvement to their product offering.

However, while its financial losses in the present, such as net income of -$33.13m in 2024 demonstrate the need to manage growth with profitablity.

Comparison with Other Stocks

Serve Robotics, though, is a small cap versus industry giants such as General Electric and Caterpillar. Yet, it has an unique market space in robotic deliveries, which has a lot of potential for its growth. Here is a comparison of Serve Robotics with a few leading industrial companies:

| Company | Market Cap (in billions) | Revenue Growth (%) |

| Serve Robotics | 0.80 | 692.32 |

| General Electric | 194.53 | 5.00 |

| Caterpillar | 183.73 | 10.00 |

| Deere & Company | 119.59 | 15.00 |

Although earn revenues at a faster rate than traditional companies, Serve Robotics’s small base means that they overtake traditional companies in revenue growth percentage, but is behind in financial stability and profitability.

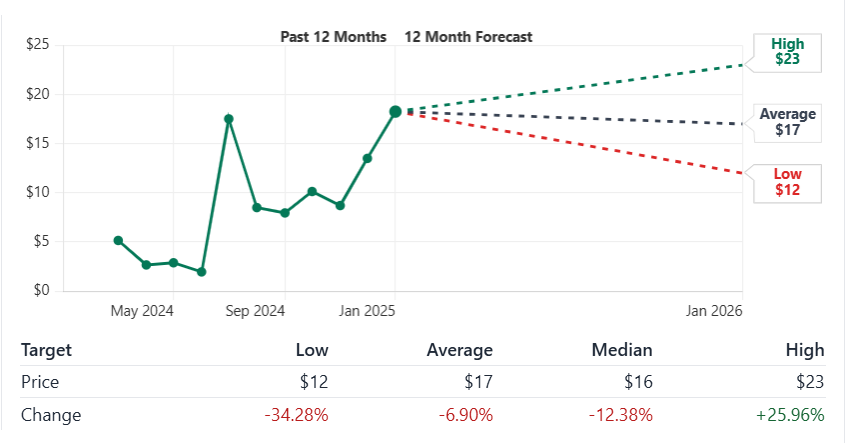

SERV Stock’s Analysts Stock Recommendation

Serve Robotics are viewed differently by the analysts. On the one hand, it is a leader in robotics growing rapidly and innovating, but also a financial loser and reliant on external funding. Below is a summary of analyst recommendations:

| Rating | Number of Analysts | Percentage (%) |

| Strong Buy | 2 | 20 |

| Buy | 4 | 40 |

| Hold | 3 | 30 |

| Sell | 1 | 10 |

There is an almost universal “Buy” rating by analysts based on optimism around Serve Robotics’ position in the market and future potential.

SERV Stock Analysis via Indicator Based

Technical indicators provide insight into the stock’s momentum and trends:

| Indicator | Value | Signal |

| Relative Strength Index (RSI) | 55.66 | Neutral |

| 50-Day Moving Average | $12.65 | Buy |

| 200-Day Moving Average | $8.04 | Buy |

| Short Interest Ratio (days) | 0.26 | Neutral |

The RSI shows we are neither in overbought territory nor in oversold territory. The moving averages say there is a bullish trend, while low short interest ratio indicates a minimum bearish sentiment.

Should I Buy This Stock?

An high risk, high reward investment opportunity for a Serve Robotics. As a disruptor in a fast growing market, its focus on robotic deliveries is very innovative. Yet such financial risks as high operational losses (-$30.06m in 2024) and loss margins (-1,790.22pct operating margin) cannot be ignored.

Key Considerations:

- Growth Potential: Serve Robotics is a growth stock, with rapid market cap and revenue growth that appeals to growth oriented investors.

- Financial Stability: Financial cushion is very strong, with high cash reserves ($50.91 million) an low debt ($1.61 million).

- Profitability Concerns: They have ROE of (-113.20%) and ROIC of (-57.78%), which means delivering shareholder value isn’t easy for them.

Investors should evaluate carefully the possibility for long term profit vs short term risk and volatility. Serve Robotics could be worth adding to those who are more risk tolerant to form a diversified portfolio, but it’s important to watch the company’s progress towards profitability.

The conditions for these predictions include favorable market and the successful execution of growth strategy. But that could be cut off by any funding or technological troubles.

SERV Stock Price Forecast 2025

| Month | Minimum Prediction Price | Maximum Prediction Price | % Change From Now |

|---|---|---|---|

| January | 16.20 | 20.30 | -5.88% |

| February | 15.80 | 19.60 | -13.00% |

| March | 16.40 | 20.70 | -10.05% |

| April | 17.10 | 21.20 | -6.51% |

| May | 17.60 | 21.70 | -4.04% |

| June | 18.10 | 22.00 | -0.88% |

| July | 18.60 | 22.80 | 1.86% |

| August | 19.00 | 23.40 | 4.06% |

| September | 19.40 | 23.90 | 5.12% |

| October | 20.00 | 24.30 | 9.06% |

| November | 20.40 | 24.80 | 10.07% |

| December | 21.10 | 25.20 | 12.78% |

SERV Stock Price Forecast 2026

| Month | Minimum Prediction Price | Maximum Prediction Price | % Change From Now |

|---|---|---|---|

| January | 20.00 | 24.70 | 9.06% |

| February | 20.50 | 25.10 | 10.07% |

| March | 21.20 | 25.60 | 12.78% |

| April | 21.70 | 26.00 | 13.79% |

| May | 22.10 | 26.80 | 15.38% |

| June | 22.60 | 27.30 | 16.06% |

| July | 23.10 | 27.90 | 17.56% |

| August | 23.50 | 28.40 | 18.53% |

| September | 24.00 | 28.90 | 19.51% |

| October | 24.50 | 29.30 | 20.00% |

| November | 25.00 | 29.80 | 21.19% |

| December | 25.40 | 30.50 | 22.43% |

SERV Stock Price Forecast 2027

| Month | Minimum Prediction Price | Maximum Prediction Price | % Change From Now |

|---|---|---|---|

| January | 25.10 | 30.80 | 22.43% |

| February | 25.40 | 31.20 | 23.76% |

| March | 26.00 | 31.60 | 24.07% |

| April | 26.50 | 32.00 | 24.66% |

| May | 27.00 | 32.50 | 25.09% |

| June | 27.50 | 33.00 | 25.90% |

| July | 28.00 | 33.50 | 26.80% |

| August | 28.60 | 34.10 | 27.49% |

| September | 29.00 | 34.50 | 28.36% |

| October | 29.50 | 35.00 | 29.00% |

| November | 30.00 | 35.50 | 30.51% |

| December | 30.50 | 36.00 | 31.43% |

SERV Stock Price Forecast 2028

| Month | Minimum Prediction Price | Maximum Prediction Price | % Change From Now |

|---|---|---|---|

| January | 31.00 | 36.00 | 31.43% |

| February | 31.50 | 36.50 | 32.18% |

| March | 32.00 | 37.00 | 32.96% |

| April | 32.70 | 37.80 | 33.55% |

| May | 33.00 | 38.00 | 33.93% |

| June | 33.50 | 38.30 | 34.39% |

| July | 34.10 | 39.00 | 34.88% |

| August | 34.60 | 39.50 | 35.45% |

| September | 35.00 | 40.00 | 36.01% |

| October | 35.50 | 40.50 | 36.90% |

| November | 36.00 | 41.00 | 37.19% |

| December | 36.60 | 41.50 | 38.08% |

SERV Stock Price Forecast 2029

| Month | Minimum Prediction Price | Maximum Prediction Price | % Change From Now |

|---|---|---|---|

| January | 36.60 | 41.50 | 38.08% |

| February | 37.00 | 42.00 | 38.50% |

| March | 37.70 | 42.70 | 39.00% |

| April | 38.00 | 43.00 | 39.50% |

| May | 38.50 | 43.50 | 40.10% |

| June | 39.00 | 44.80 | 40.78% |

| July | 39.40 | 44.90 | 41.44% |

| August | 40.10 | 45.30 | 41.83% |

| September | 40.50 | 45.50 | 42.40% |

| October | 41.00 | 46.00 | 42.88% |

| November | 41.60 | 46.50 | 43.10% |

| December | 42.00 | 47.00 | 44.00% |

SERV Stock Price Forecast 2030

| Month | Minimum Prediction Price | Maximum Prediction Price | % Change From Now |

|---|---|---|---|

| January | 42.20 | 47.20 | 44.00% |

| February | 42.50 | 47.50 | 44.45% |

| March | 43.00 | 48.00 | 44.93% |

| April | 43.50 | 48.50 | 45.28% |

| May | 44.00 | 49.00 | 45.65% |

| June | 44.70 | 49.70 | 46.10% |

| July | 45.20 | 50.00 | 46.56% |

| August | 45.70 | 50.50 | 46.93% |

| September | 46.00 | 51.00 | 47.19% |

| October | 46.50 | 51.50 | 47.45% |

| November | 47.00 | 52.00 | 47.71% |

| December | 47.50 | 52.50 | 48.00% |

How to Buy Serve Robotics Inc. (SERV) Stock

- Open a Brokerage Account: Beginning with a preferred brokerage platform that supports NASDAQ listed stocks such as TD Ameritrade, E*TRADE or Robinhood is a good first strategy.

- Fund Your Account: Also, you can make deposit funds into your brokerage account via bank transfer or supported payment methods.

- Search for SERV: Look the platform’s search function to find Serve Robotics Inc. (SERV).

- Place Your Order: Place an order and decide on the number of shares you want. With market orders you can purchase immediately or limit orders for a preferred price.

- Review and Monitor: Stay on top of SERV’s performance as your portfolio changes on a regular basis.

Final Conclusion

Serve Robotics Inc. is pioneering force when it comes to autonomous delivery robotics. Its innovative technology, rapid revenue growth and maturing market presence mean, however, that it is not yet as value-rich as similar businesses. But they have to take into consideration the risks of sustained losses, high operating expenses and competition.

The stock will depend on revenue and milestones towards profitability for short term (2025 – 2030). Long term market success (2030 to 2050) will depend on market penetration, global expansion and technological advancements. SERV is an exciting, volatile stock on a rollercoaster, for now.

Serve Robotics is appealing to investors who are high risk tolerant and have long term vision, but for those that want stable returns wait to see what happens.

Frequently Asked Questions

1. How did Serve Robotics become a publicly traded company?

Serve Robotics completed a reverse merger in August 2023 with Patricia Acquisition Corp., a public Delaware corporation. The transaction enabled Serve Robotics to be a wholly owned subsidiary of Patricia, and that subsidiary changed its name to Serve Robotics Inc. In April 2024 the company traded on the Nasdaq.

2. What significant partnerships has Serve Robotics established?

Uber Technologies, Inc., the largest food delivery and ridesharing platform in the world has already joined Serve Robotics. The collaboration starts in Los Angeles, where select Uber Eats customers pick up their orders using Serve’s autonomous robots.

The partnership is about to grow: as many as 2,000 AI-powered sidewalk delivery robots will be deployed across various U.S. markets.

Serve Robotics is also partnering with Shake Shack to deploy autonomous robot delivery through Uber Eats in Los Angeles.

How has Serve Robotics’ stock performed recently?

Second-quarter sales for the company topped Wall Street expectations at $470,000. Nvidia bought (and later disclosed a 10 percent stake in) Serve on July 18, and the stock jumped 180 percent the next day.

Serve has also seen a short squeeze in its shares, helping contribute to its stock volatility, as 18% of its shares are sold short. It helped that Shake Shack and Uber Eats operations began launching within Los Angeles to deliver food.

What is the financial outlook for Serve Robotics?

Serve Robotics shows 92.49% increase in revenue in 2023 compared to 2022. Revenue is expected to continue to grow according to analysts, generating $1.94 million in 2024 and $13.58 million in 2025.

Expectations call for an improvement in EPS as well with 2024 and 2025 estimates in the red, but not as bad as the current run showing 2024 EPS of -$0.99 and 2025 EPS of -$0.67. The financial trajectory forecasted from these looks quite positive for the company.