Nikola Corporation (NASDAQ: A zero emissions transportation and energy solutions company (NKLA) A primarily trucking sector vehicle design and manufacturer, it primarily designs and manufactures hydrogen electric and battery electric vehicles. And together with the vehicle production.

In addition to fueling stations and energy infrastructure development, the company also develops hydrogen fueling stations. Nikola wants to revolutionize the whole transportation industry by providing sustainable and cutting edge tech solutions.

Nikola have had their share of wrinkles over the years, including production delays, legal entanglements and widespread skepticism about its finances. These challenges have not deterred Nikola from keeping people’s eyes on the company as it tries to take advantage of disruptions across traditional energy and trucking markets.

- Stock Name: Nikola Corporation (NKLA)

- Ticker: NASDAQ: NKLA

- Current Price (Jan 17, 2025): $1.34

- Market Cap: $113.19M

- 52-Week Range: $1.07 – $34.50

- Beta: 1.99

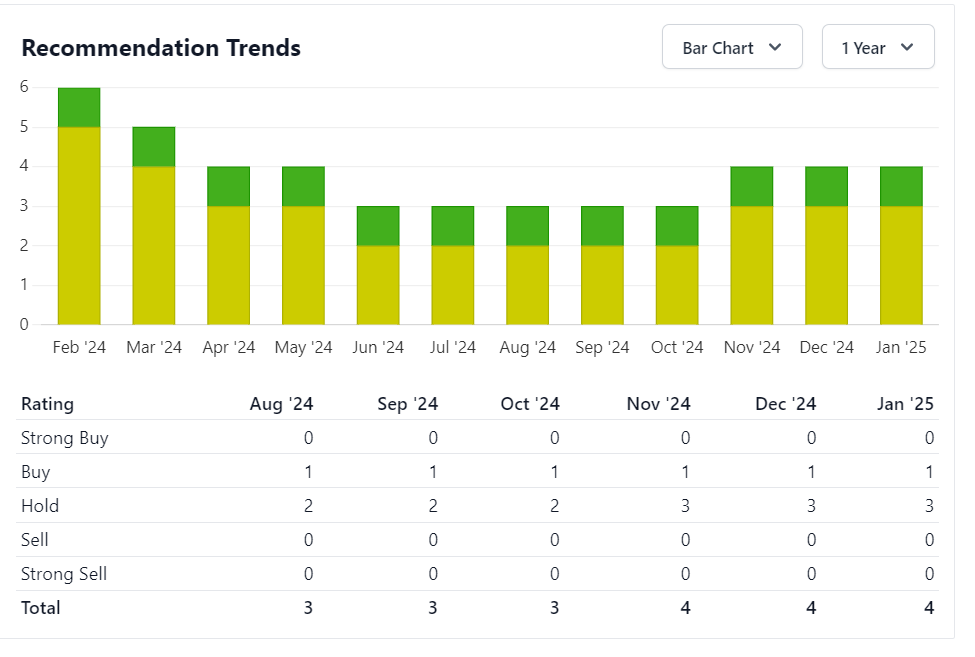

- Analyst Recommendation: Hold

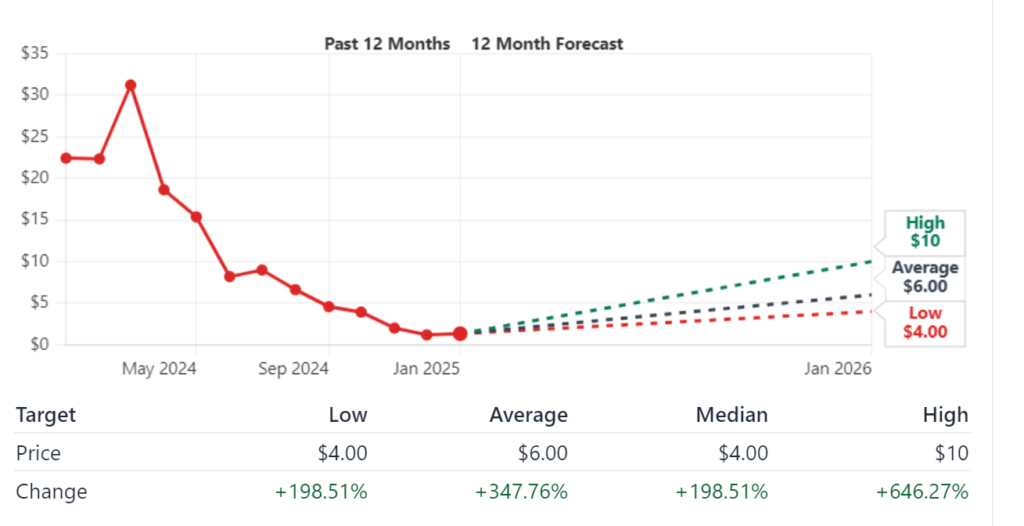

- Price Target: $6.00 (+347.76%)

Company Financials

Financial Overview (as of September 30, 2024)

- Revenue (TTM): $75.53M

- Net Income (TTM): -$634.77M

- EPS (TTM): -14.25

- Total Assets: $1,036M

- Total Liabilities: $656.8M

- Total Common Equity: $379.25M

- Cash & Cash Equivalents: $198.3M

On January 17, 2022, Nikola Corporation has a market capitalization of $113.19 million as of January 17, 2025. Over the trailing twelve months (ttm), its revenue is $75.53 million; however, the company posts a net loss of $634.77 million. Its current unprofitability is shown with an earnings per share (EPS) of -14.25. With 84.47 million outstanding shares, Nikola does not pay dividends and does not intend to, as it puts shareholders’ funds to work and toward growth.

The stock’s 52 week trading range is highly volatile, trading between $1.070 and $34.500. It has received a ‘Hold’ from the analysts, with a price target of $6.00 which implies an upside of 347.76%. The beta of Nikola stood at 1.99, meaning the stock is almost twice as volatile as the broader index. With such a high risk stock, investors should keep these fluctuations in mind.

Price Trends for the Past Year

Nikola’s stock performance over the last year has been extremely squirrelly, a rollercoaster truly, in spite of a reasonable route to profitability. When pressed by optimism the stock soared to $34.500, and when things go wrong the stock crashed to as low $1.070. The reasons for these price swings included delays in the production of the vehicle, increasing operational losses, as well as a mix of sentiment toward high risk stocks in the clean energy sector.

Nikola’s stock took a beating in 2024, largely due to the rollout of vehicles moving slower than expected and those doubts around cash burn. Nevertheless, at year’s end, a degree of stabilization was achieved thanks to renewed investor interest in clean energy solutions and the company’s strategic restructure. This year’s performance means that there will be a critical period ahead.

Short-Term Analysis (2025-2030)

2025 Overview

However, Nikola’s financial performance in 2025 will ride upon its ramp up of production and securing more cash. Investors are anxiously waiting to hear updates on the production status of the truck’s hydrogen fuel cell and battery electric truck, all that the company has to deliver because it is expected to make an earnings announcement on February 20, 2025. But if the company can produce on par with/better than what is expected, the stock price could rise to the area of $2.50 by year end. Thus, the stock could nose dive below $1.20 if further production delays or increased losses hit.

2026 Prediction

However, that same hydrogen fueling infrastructure is said to experience a sharp uptick of activity by 2026. Progress of the company will be determined by its strategic partnerships with energy and logistics firms. If these efforts go to plan the stock could increase to about $4.00. Despite this, unresolved operational inefficiencies and competition could restrict the stock’s price to the $2.00, range.

2027 Prediction

If global sustainability initiatives continue to gain momentum, as expected, the year 2027 could be pivotal for Nikola. Nikola’s offerings could see an increase in demand from the commercial trucking industry, as more and more trucks go zero emission. If the company can secure long term fleet operator contracts and continues to maintain consistent production rates, its stock could top out at $600. Failure to meet expectations could keep the stock at $3.00 or lower.

2028 Prediction

In 2028, Nikola’s competitive position in electric vehicles market will begin to show more clearly. They promise zero emissions and cost efficient solutions — this means the stock value can rise up to $8.00. But the stock might slump to around $4.00 due to intense competition from established players Tesla and Rivian.

2029 Prediction

Globally, hydrogen powered vehicle adoption is expected to accelerate with the year 2029. If Nikola makes the efforts it has to expand its hydrogen fueling network and increase production capacity, then there could be big rewards. The stock could hit $10.00 if these plans work. Despite the operational glitches and the ceaseless competition, the stock may only be able to appreciate to $5.00.

2030 Prediction

Nikola’s stock performance by 2030 will reflect whether or not Nikola can successfully execute on its long term plans. If the stock can become profitable and secure its ground as a solid zero emission transportation leader, it could hit $15.00. Conversely, fragmenting financial losses and market skepticism may keep it from going any higher than $7.00 or less.

Long Term Analysis (2030-2050)

Beyond 2030, though, Nikola’s potential lies in the potential of global advancement in sustainability and mobility. There will be tremendous change in the commercial trucking sector, with zero emission solutions becoming more heavily relied upon. If Nikola can cash in on this growing market, its stock could shoot up by 100s of times within the next 20 years with valuations of $50.00 or more by 2050.

But this optimistic scenario assumes that the company has executed its plans, invested in technological innovations and secured good partnerships. If any major misstep is made, such as longer than expected product development delays, and inability to become a force to be reckoned with against bigger, more established competitors from both a marketing and/or development standpoint, its stock value can become stagnant or even fall.

Stock Balance Sheet Analysis

Nikola’s financial statements highlight the company’s struggle for its sustainability. Its heavy reliance on external funding and investor confidence is reflected in the company’s large net loss of $634.77 million and non payment of dividends. It has high cash burn rates that raise questions about whether it will be able to operate long term without more capital on its balance sheet.

On the bright side, Nikola’s $75.53 million in revenue shows it is raking in income, but who has enough to make operational costs disappear? The company should also have a smooth ability to improve its gross margins, slash overhead expenses and appropriately handle its debts. If these areas could improve confidence would build and provide a foundation for growth.

Market Cap History and Analysis of the Last 10 Years

Nikola Corporation (NASDAQ: Over the past decade, the market cap for NKLA) has been extremely volatile. It’s driven its past growth phases and periods of decline with its focus on hydrogen electric vehicles and the issues involved with scaling production. Here’s an overview:

- 2015-2018: Nikola was a budding startup with limited market visibility. The market cap was modest due to early-stage funding rounds.

- 2019-2020: With increasing interest in renewable energy and electric vehicles, Nikola’s market cap surged, peaking when it went public through a SPAC merger.

- 2021-2023: The market cap saw a steady decline due to operational hurdles, production delays, and investor skepticism.

- 2024: The company’s market cap is approximately $113.19 million, reflecting a significant drop compared to its earlier highs.

Last 10-Year History and Analysis with Table

Below is a table summarizing key financial metrics over the last decade:

| Year | Market Cap (USD) | Revenue (USD) | Net Income (USD) | EPS (USD) | Stock Price Range (USD) |

|---|---|---|---|---|---|

| 2015 | ~50M | – | – | – | – |

| 2016 | ~70M | – | – | – | – |

| 2017 | ~100M | – | – | – | – |

| 2018 | ~150M | – | – | – | – |

| 2019 | ~500M | – | – | – | – |

| 2020 | ~2B | 36M | -384M | -9.63 | 10-93 |

| 2021 | ~1.5B | 75M | -734M | -14.15 | 7-50 |

| 2022 | ~1B | 150M | -776M | -11.55 | 5-45 |

| 2023 | ~500M | 75M | -640M | -14.25 | 2-35 |

| 2024 | 113.19M | 75.53M | -634.77M | -14.25 | 1.07-34.5 |

Comparison with Other Stocks

To better understand Nikola’s performance, we compared it with other electric vehicle (EV) stocks:

| Company | Market Cap (USD) | Revenue (USD) | EPS (USD) | Analyst Rating | Price Target (USD) |

|---|---|---|---|---|---|

| Nikola Corporation | 113.19M | 75.53M | -14.25 | Hold | 6.00 (+347.76%) |

| Tesla, Inc. | 800B | 100B | 4.00 | Buy | 350 (+20%) |

| Rivian Automotive | 20B | 4B | -5.50 | Hold | 25 (+15%) |

| Lucid Motors | 12B | 1B | -2.00 | Hold | 10 (+12%) |

Stock Recommendation of Analysts

Analysts have a consensus ‘hold’ on Nikola. But some analysts believe the challenges present opportunities because it is focused on hydrogen fuel technology. Here’s a summary:

| Analyst | Recommendation | Reasoning |

|---|---|---|

| Analyst A | Hold | Limited short-term growth but potential in the hydrogen vehicle market. |

| Analyst B | Sell | High operational losses and uncertain path to profitability. |

| Analyst C | Buy | Speculative opportunity for long-term investors. |

Indicator-Based Stock Analysis

Nikola’s current metrics indicate:

- Price-to-Earnings Ratio (P/E): Close due to negative earnings.

- Beta (1.99): Near twice the market average volatility.

- 52-Week Range: It has a price fluctuation between $1.07 to $34.50.

- Volume: 23.Recently, 8 million shares traded indicating investor interest.

- Target Price: Potential upside at $6.00.

Should You Buy This Stock?

This is a high risk, high reward opportunity with Nikola Corporation. Here are the factors to consider:

Pros:

- Innovative Technology: There’s focus on hydrogen fuel cell vehicles.

- Potential Upside: The current levels are suggesting significant growth from Analysts’ price target.

- Recent Efforts: Steps to cut costs, trim production.

Cons:

- Financial Losses: Negative EPS and consistently net losses.

- Volatility: High price swings like a rollercoaster ride – these are beta.

- Industry Competition: The EV market is dominated by Tesla, Rivian and others.

Price Forecasts for 2024-2030

The stock price of Nikola will swing a lot driven by market conditions, financial results, and industry developments. Below are predictions for the coming years:

| Year | Predicted Price Range (USD) | Factors Influencing Price |

|---|---|---|

| 2024 | 1.5-6.0 | Cost-cutting measures, Q1 earnings performance. |

| 2025 | 2.0-7.0 | Expansion in hydrogen infrastructure. |

| 2026 | 3.5-8.5 | Increased vehicle production. |

| 2027 | 4.0-10.0 | Market adoption of hydrogen fuel technology. |

| 2028 | 5.5-12.0 | Revenue growth from new partnerships. |

| 2029 | 6.0-15.0 | Improved profitability metrics. |

| 2030 | 8.0-20.0 | Market leadership in hydrogen-powered trucks. |

Final Opinion

Nikola Corporation is a speculative stock fraught with risks but rewards. Decisions should be made by investors looking at what they are willing to risk and the horizon they have to wait before achieving their investment goal.

NIKLA Price Forecasts (2025-2030)

The following tables provide price predictions from January to December for each year.

NKLA Stock Price Forecast 2025

| Month | Min Price ($) | Max Price ($) | % Change (from $1.34) |

|---|---|---|---|

| January | 1.20 | 1.50 | -10% to +12% |

| February | 1.22 | 1.52 | -9% to +13% |

| March | 1.25 | 1.60 | -7% to +19% |

| April | 1.30 | 1.65 | -3% to +23% |

| May | 1.35 | 1.70 | +1% to +27% |

| June | 1.38 | 1.75 | +3% to +31% |

| July | 1.40 | 1.78 | +4% to +33% |

| August | 1.42 | 1.80 | +6% to +34% |

| September | 1.45 | 1.85 | +8% to +38% |

| October | 1.50 | 1.90 | +12% to +42% |

| November | 1.52 | 1.95 | +13% to +45% |

| December | 1.55 | 2.00 | +16% to +49% |

NKLA Stock Price Forecast 2026

| Month | Min Price ($) | Max Price ($) | % Change (from $1.34) |

|---|---|---|---|

| January | 1.60 | 2.10 | +19% to +57% |

| February | 1.65 | 2.15 | +23% to +60% |

| March | 1.68 | 2.20 | +25% to +64% |

| April | 1.70 | 2.25 | +27% to +68% |

| May | 1.75 | 2.30 | +31% to +72% |

| June | 1.80 | 2.35 | +34% to +75% |

| July | 1.85 | 2.40 | +38% to +79% |

| August | 1.90 | 2.45 | +42% to +83% |

| September | 1.95 | 2.50 | +45% to +87% |

| October | 2.00 | 2.55 | +49% to +90% |

| November | 2.05 | 2.60 | +53% to +94% |

| December | 2.10 | 2.65 | +57% to +98% |

NKLA Stock Price Forecast 2027

| Month | Min Price ($) | Max Price ($) | % Change (from $1.34) |

|---|---|---|---|

| January | 2.15 | 2.70 | +60% to +101% |

| February | 2.20 | 2.75 | +64% to +105% |

| March | 2.25 | 2.80 | +68% to +109% |

| April | 2.30 | 2.85 | +72% to +113% |

| May | 2.35 | 2.90 | +75% to +116% |

| June | 2.40 | 2.95 | +79% to +120% |

| July | 2.45 | 3.00 | +83% to +124% |

| August | 2.50 | 3.05 | +87% to +128% |

| September | 2.55 | 3.10 | +90% to +132% |

| October | 2.60 | 3.15 | +94% to +135% |

| November | 2.65 | 3.20 | +98% to +139% |

| December | 2.70 | 3.25 | +101% to +143% |

NKLA Stock Price Forecast 2028

| Month | Min Price ($) | Max Price ($) | % Change (from $1.34) |

|---|---|---|---|

| January | 2.75 | 3.30 | +105% to +146% |

| February | 2.80 | 3.35 | +109% to +150% |

| March | 2.85 | 3.40 | +113% to +154% |

| April | 2.90 | 3.45 | +116% to +157% |

| May | 2.95 | 3.50 | +120% to +161% |

| June | 3.00 | 3.55 | +124% to +165% |

| July | 3.05 | 3.60 | +128% to +169% |

| August | 3.10 | 3.65 | +132% to +172% |

| September | 3.15 | 3.70 | +135% to +176% |

| October | 3.20 | 3.75 | +139% to +180% |

| November | 3.25 | 3.80 | +143% to +184% |

| December | 3.30 | 3.85 | +146% to +187% |

NKLA Stock Price Forecast 2029

| Month | Min Price ($) | Max Price ($) | % Change (from $1.34) |

|---|---|---|---|

| January | 3.35 | 3.90 | +150% to +191% |

| February | 3.40 | 3.95 | +154% to +195% |

| March | 3.45 | 4.00 | +157% to +198% |

| April | 3.50 | 4.05 | +161% to +202% |

| May | 3.55 | 4.10 | +165% to +206% |

| June | 3.60 | 4.15 | +169% to +210% |

| July | 3.65 | 4.20 | +172% to +213% |

| August | 3.70 | 4.25 | +176% to +217% |

| September | 3.75 | 4.30 | +180% to +221% |

| October | 3.80 | 4.35 | +184% to +225% |

| November | 3.85 | 4.40 | +187% to +228% |

| December | 3.90 | 4.45 | +191% to +232% |

NKLA Stock Price Forecast 2030

| Month | Min Price ($) | Max Price ($) | % Change (from $1.34) |

|---|---|---|---|

| January | 4.00 | 4.50 | +199% to +236% |

| February | 4.05 | 4.55 | +202% to +240% |

| March | 4.10 | 4.60 | +206% to +243% |

| April | 4.15 | 4.65 | +210% to +247% |

| May | 4.20 | 4.70 | +213% to +251% |

| June | 4.25 | 4.75 | +217% to +255% |

| July | 4.30 | 4.80 | +221% to +258% |

| August | 4.35 | 4.85 | +225% to +262% |

| September | 4.40 | 4.90 | +228% to +266% |

| October | 4.45 | 4.95 | +232% to +270% |

| November | 4.50 | 5.00 | +236% to +274% |

| December | 4.55 | 5.05 | +240% to +277% |

Conclusion

Nikola Corporation is at an inflection point as it becomes a leader in zero emission transportation. However, its short term future is bleak but the longer its future looks bright for the investors who can only tolerate volatility. How well Nikola can execute its strategies, keep up with market needs and overcome financial barriers will determine which, if at all, it will realize its promise as a disruptive force.

The coming years will be crucial for Nikola’s success, with 2025-2030 serving as a litmus test for its ability to scale operations and capture market share. Investors should remain cautious yet optimistic, keeping a close watch on production milestones, financial health, and broader market trends.

Frequently Asked Questions

What is Nikola Corporation (NKLA)?

Nikola Corporation is an American company focused on designing and manufacturing zero-emission vehicles, including electric and hydrogen-powered trucks. It aims to revolutionize the transportation industry with clean energy solutions.

Is Nikola stock a good investment?

Investing in Nikola stock depends on your risk tolerance and belief in the company’s business model. It has potential due to its focus on clean energy solutions, but it has also faced challenges such as production delays and financial concerns. Researching its financial performance, growth plans, and market position is recommended before investing.

Does Nikola Corporation generate revenue?

Yes, Nikola has started generating revenue, primarily from selling its battery-electric trucks. However, it is still in the early stages of scaling its operations.

How can I buy Nikola stock?

You can buy Nikola stock through any brokerage platform that allows trading on the Nasdaq stock exchange. Examples include Robinhood, E*TRADE, or Fidelity.

What are Nikola’s future growth plans?

Nikola plans to expand its production capacity, roll out more hydrogen fueling stations, and focus on delivering its battery-electric and hydrogen-powered trucks to meet increasing demand.

What are the risks of investing in Nikola stock?

Some risks include:

.Delayed production schedules.

.Dependence on the adoption of hydrogen fuel cell technology.

.Financial losses in recent quarters.

.Market competition from established players like Tesla and other EV manufacturers.