Hims & Hers Health, Inc. (NYSE): A pioneer in the telehealth sector, HIMS has gained popularity on the healthcare market with its accessible online platform. That company has completely changed how consumers think about personal health, from prescription medicines to wellness products.

Using a combination of an innovative business model, strong financial numbers and the potential for growth we will analyze the stock price forecast and forecast for the future for the years 2025 to 2030.

Company Overview

Hims & Hers Health, Inc, is a telehealth platform that founded its services in 2017. Rather, it serves as an online platform and mobile application, which connects consumers with licensed healthcare professionals. During those years, it has grown its portfolio to include prescription medications, over the counter products and cosmetic care.

HIMS is a key player in the consumer staples sector under the household and personal products industry and is a market player that has conquered the healthcare accessibility challenge. Recent company performance speaks volumes of growth and innovation.

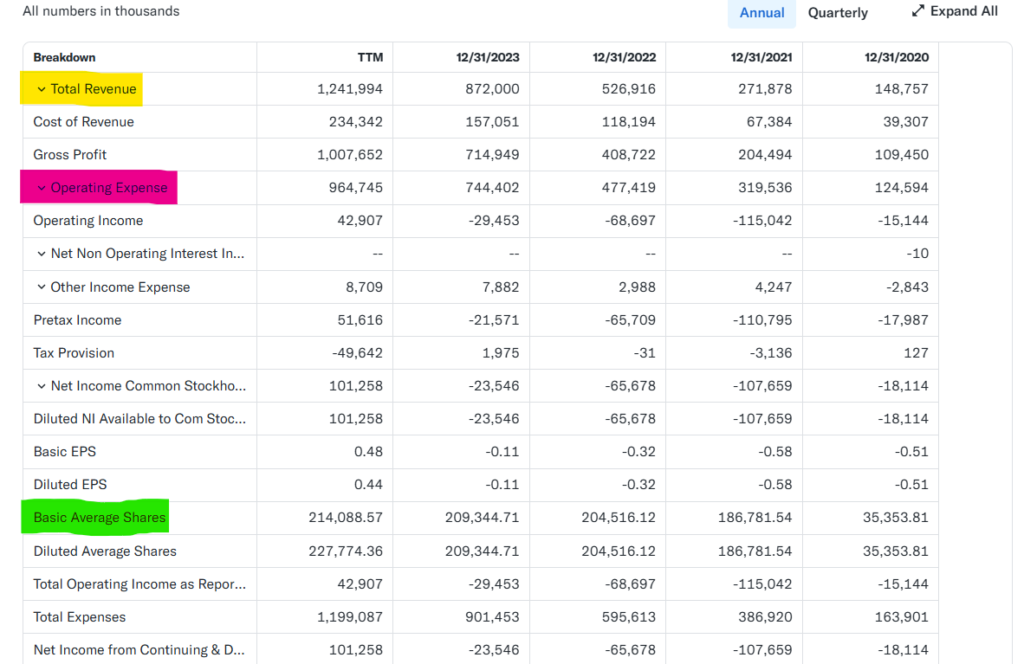

Company Financials

In recent years Hims & Hers has seen explosive growth, both in revenue and profitability.

1. Revenue Growth

From 2022 to 2024, revenue has increased from $526.92 million to $1.24 billion at a compound annual growth rate (CAGR) of 57%. The company’s growth has been driven by:

- Increased customer acquisition through its telehealth platform.

- Expanding its product portfolio, including prescription and non prescription offerings.

- Entry into new markets, both domestically and internationally.

Revenue Growth Highlights:

2020-2024 CAGR: 93.81% (from $148.76 million in 2020).

Externally, the company has had consistently gross profit margins above 75% which are very indicative of strong pricing power and cost control.

2. Profitability Metrics

Hims & Hers operates on the back of profitability, a major milestone in the company’s growth.

- Net Income (TTM): $101.26 million

- Gross Profit Margin: 81.13%

- High margin is a result of efficiency of its business model, where the proportion of operating cost to revenue is lower than the revenue itself.

- Operating Income (TTM): $46.04 million

- The higher revenue contribution per unit sold and good cost management have led to better operating income.

- EPS (TTM): $0.44

- The improving EPS shows that the company can increase value to shareholders as it scales.

- Profitability Trends:

- The Company’s improved Operating Margin from – 39.33% in 2021 to 3.71% in 2024 is attributable to the Company’s increased operational efficiency.

- Net Profit Margin: 8.15% in 2024, a significant turnaround from negative figures in prior years.

3. Cash Flow Analysis

Hims & Hers’ growth strategy is dependent on cash flow.

- Free Cash Flow (TTM): $160.92 million

- This is a major step up from earlier years allowing the company to reinvest in R&D, marketing and infrastructure.

- Free Cash Flow Margin: 12.96%

- Financial stability is evidenced by the ability to generate free cash flow consistently.

4. Investment in R&D and Marketing

Hims & Hers has strategically invested in growth drivers to secure its position in the telehealth market:

Marketing Expenses: The substantial marketing outlay continues to be vital in driving costs yet played a vital role in Hims & Hers customer acquisition and retention programs. This supports robust market expansion for the future.

R&D Spend (TTM): $68.48 million

When companies prioritize innovation their product and service development process maintains a constant flow.

Short-term Analysis (2025 to 2030)

2025: A Year of Stabilized Growth

2025 will bring consolidation with revenue projected to balloon to $2.08 billion and an EPS of $0.55. HIMS is expected to grow at a moderated pace vs. past growth levels with the business model maturing and additional competition. But its forward P/E ratio of 56.14 indicates investors’ strong confidence maintained.

Prediction for 2025: Stock price would lie between $28 and $34, with change in the stock price dependent on the quarterly performance and macro economies.

| Month | Minimum Price ($) | Maximum Price ($) | % Change from Now |

|---|---|---|---|

| January | 28.00 | 30.00 | -9.3% to -2.9% |

| February | 28.50 | 30.50 | -7.7% to -1.3% |

| March | 29.00 | 31.00 | -6.1% to +0.3% |

| April | 29.50 | 32.00 | -4.5% to +3.6% |

| May | 30.00 | 33.00 | -2.9% to +6.8% |

| June | 30.50 | 33.50 | -1.3% to +8.4% |

| July | 31.00 | 34.00 | +0.3% to +10.2% |

| August | 30.50 | 33.50 | -1.3% to +8.4% |

| September | 30.00 | 33.00 | -2.9% to +6.8% |

| October | 29.50 | 32.50 | -4.5% to +5.2% |

| November | 29.00 | 31.50 | -6.1% to +3.6% |

| December | 28.50 | 30.50 | -7.7% to -1.3% |

2026: Scaling Innovations

By next year (2026), growth should continue in Hims & Hers due to leveraging its technological advancements and strategic partnerships. Operational streamlining is forecasted to support the EPS to reach $0.73. The $2.44 billion revenue projection is a result of the company successfully penetrating deeper into international markets.

Prediction for 2026: This should spell good news for HIMS stock valuation, which should grow to anywhere between $35 to $40, given the improving fundamentals and increased interest in the stock.

| Month | Minimum Price ($) | Maximum Price ($) | % Change from Now |

|---|---|---|---|

| January | 35.00 | 37.00 | +13.3% to +19.8% |

| February | 35.50 | 38.00 | +15.0% to +23.1% |

| March | 36.00 | 39.00 | +16.6% to +26.3% |

| April | 36.50 | 40.00 | +18.2% to +29.5% |

| May | 37.00 | 39.50 | +19.8% to +27.9% |

| June | 36.50 | 39.00 | +18.2% to +26.3% |

| July | 36.00 | 38.50 | +16.6% to +24.7% |

| August | 35.50 | 38.00 | +15.0% to +23.1% |

| September | 35.00 | 37.50 | +13.3% to +21.5% |

| October | 34.50 | 37.00 | +11.6% to +19.8% |

| November | 34.00 | 36.50 | +10.0% to +18.2% |

| December | 34.50 | 37.00 | +11.6% to +19.8% |

2027: Competitive Positioning

As the telehealth market becomes more and more competitive, he expects Hims & Hers to differentiate itself. It is expected to generate more than $2.8 billion from new product launches with improved customer experience. EPS growth may or may not stabilize but the company’s innovation pipeline will help ensure positive sentiment.

Prediction for 2027: Prices will vary between $38 and $44, and the stock may have higher volatility.

| Month | Minimum Price ($) | Maximum Price ($) | % Change from Now |

|---|---|---|---|

| January | 38.00 | 40.00 | +23.1% to +29.5% |

| February | 38.50 | 41.00 | +24.7% to +32.7% |

| March | 39.00 | 42.00 | +26.3% to +36.0% |

| April | 39.50 | 43.00 | +27.9% to +39.2% |

| May | 40.00 | 44.00 | +29.5% to +42.4% |

| June | 40.50 | 44.50 | +31.1% to +43.9% |

| July | 41.00 | 45.00 | +32.7% to +45.7% |

| August | 41.50 | 45.50 | +34.3% to +47.3% |

| September | 41.00 | 45.00 | +32.7% to +45.7% |

| October | 40.50 | 44.50 | +31.1% to +43.9% |

| November | 40.00 | 44.00 | +29.5% to +42.4% |

| December | 39.50 | 43.50 | +27.9% to +40.8% |

2028: Global Expansion

By 2028 Hims & Hers could become the leader in global telehealth with acquisitions and strategic investment. There might be a slowdown in revenue growth to 17% YoY to around $3.2 billion, but it’s predicted to be profitability and EPS of $1.08.

Prediction for 2028: HIMS stock could trade in a band of $45 to $50 on the basis of its established market dominance.

| Month | Minimum Price ($) | Maximum Price ($) | % Change from Now |

|---|---|---|---|

| January | 45.00 | 47.00 | +45.7% to +52.1% |

| February | 45.50 | 48.00 | +47.3% to +55.5% |

| March | 46.00 | 49.00 | +48.9% to +58.7% |

| April | 46.50 | 50.00 | +50.5% to +61.9% |

| May | 47.00 | 50.50 | +52.1% to +63.5% |

| June | 47.50 | 51.00 | +53.7% to +65.1% |

| July | 48.00 | 51.50 | +55.3% to +66.7% |

| August | 48.50 | 52.00 | +56.9% to +68.3% |

| September | 48.00 | 51.50 | +55.3% to +66.7% |

| October | 47.50 | 51.00 | +53.7% to +65.1% |

| November | 47.00 | 50.50 | +52.1% to +63.5% |

| December | 46.50 | 50.00 | +50.5% to +61.9% |

2029: Market Leadership

Projected revenue for 2029 is $3.6 billion and the year is set to be profitable. Other competitive advantages can be provided by innovation in AI driven healthcare solutions.

Prediction for 2029: With stable investor confidence, the stock price is expected to stabilise at $50 – $55.

| Month | Minimum Price ($) | Maximum Price ($) | % Change from Now |

|---|---|---|---|

| January | 50.00 | 52.00 | +61.9% to +68.3% |

| February | 50.50 | 53.00 | +63.5% to +71.6% |

| March | 51.00 | 54.00 | +65.1% to +74.8% |

| April | 51.50 | 55.00 | +66.7% to +78.0% |

| May | 52.00 | 55.50 | +68.3% to +79.6% |

| June | 52.50 | 56.00 | +69.9% to +81.2% |

| July | 53.00 | 56.50 | +71.6% to +82.8% |

| August | 53.50 | 57.00 | +73.2% to +84.4% |

| September | 53.00 | 56.50 | +71.6% to +82.8% |

| October | 52.50 | 56.00 | +69.9% to +81.2% |

| November | 52.00 | 55.50 | +68.3% to +79.6% |

| December | 51.50 | 55.00 | +66.7% to +78.0% |

2030: Transitioning to Long-Term Sustainability

Hims & Hers is realistically bound to be the cornerstone of the healthcare sector by 2030. The company will therefore focus on sustainable growth and shareholder value within diversified revenue streams with strong cash flow.

Prediction for 2030: Signifying maturity as a market leader, the stock could trade between $55 and $65.

| Month | Minimum Price ($) | Maximum Price ($) | % Change from Now |

|---|---|---|---|

| January | 55.00 | 60.00 | +78.0% to +94.2% |

| February | 55.50 | 61.00 | +79.6% to +97.5% |

| March | 56.00 | 62.00 | +81.2% to +100.7% |

| April | 56.50 | 63.00 | +82.8% to +103.9% |

| May | 57.00 | 64.00 | +84.4% to +107.1% |

| June | 57.50 | 65.00 | +86.1% to +110.3% |

| July | 58.00 | 65.50 | +87.7% to +111.9% |

| August | 58.50 | 66.00 | +89.3% to +113.5% |

| September | 58.00 | 65.50 | +87.7% to +111.9% |

| October | 57.50 | 65.00 | +86.1% to +110.3% |

| November | 57.00 | 64.50 | +84.4% to +108.7% |

| December | 56.50 | 64.00 | +82.8% to +107.1% |

(2030 – 2050) Long-Term Analysis

During the course of the next two decades, trends such as digital health adoption, increasing populations, and personalized medicine will begin to materialize to benefit Hims & Hers.

The company’s long term will rest in how it adapts to new technologies and customer preferences. In an emerging market – investments in R&D and strategic acquisitions, the company would remain competitive.

Hims & Hers could become a dividend paying stock by 2050, and attract a wider investor base. This will yield multiples in excess of $10 billion in revenue and the growth in EPS will sustain shareholder value.

Stock Balance Sheet Analysis

A snapshot of Hims & Hers’ financial status is their balance sheet, which displays what they have for assets, what they owe to others (liabilities) and what is left (shareholders’ equity). Here’s a detailed breakdown:

1. Assets

Over time, Hims & Hers has consistently reported a doubling of total assets, a keen indicator that they have been able to fully reinvest these assets in growth and maintain a healthy balance sheet.

- Total Assets: $602.26 million (TTM)

- Cash & Cash Equivalents: $165.52 million

- Short-Term Investments: $88.55 million

- Property, Plant & Equipment: $63.03 million

- Goodwill and Intangible Assets: $157.55 million

The large cash and equivalents, together with substantial short term investments further demonstrate that the company is well capitalized, and able to fund its future growth. Its property and equipment investments signal its ability to add to its operational capabilities.

Key Ratios Derived from Assets:

- Current Ratio (Current Assets / Current Liabilities): 2.14

- The strong liquidity here means that Hims & Hers has more than twice what it would need in current assets to pay off its short term liabilities.

- Asset Turnover Ratio (Revenue / Total Assets): Approximately 2.06

- From this figure, we can see that assets have been used efficiently to generate revenue.

2. Liabilities

Hims & Hers has a lower debt leverage and uses a conservative manner in such areas which lead to a low-liability structure.

- Total Liabilities: $162.21 million

- Current Liabilities: $152.65 million

- Long-Term Liabilities: $9.57 million

The majority of the company’s liabilities virtually always include accounts payable and accrued expenses with little to no reliance on debt financing.

- Debt-to-Equity Ratio: 0.03

- This ultra low ratio shows the company incurred very little debt compared to its equity, cutting down the financial risk and interest to pay.

3. Shareholders’ Equity

Hims & Hers is well capitalized and demonstrates through their equity position the confidence of investors.

- Total Shareholders’ Equity: $440.05 million

- Book Value Per Share: $2.02

- This metric gives us a baseline for the intrinsic value on each share, allowing us to know what is the stock worth its value compared to its assets.

Key Points from the Balance Sheet:

- Asset Growth: Continuing investments into innovation and market expansion are evident in the continued increase in tangible and intangible assets.

- Liquidity: Hims & Hers has a healthy cash position and current ratio to meet short term liabilities without hand.

- Financial Flexibility: The company has very little debt and has enough room to invest in new projects or spend on new investments, which won’t threaten the company’s financial stability.

Market Cap History Analysis

Growth in Hims & Hers market capitalization has also been explosive and indicates investor confidence and expansion of the business. From as of January 23, 2025, the company has an market cap of $6.75 billion, up by 281.26% from their position one year ago. The company’s market cap is up more than 85.33% compound annual growth rate (CAGR) over the past five years, growing from $246.53 million in 2019.

The company has room to scale its operations, it innovates within the space of telehealth and has been able to consistently grow revenue. As its share in the burgeoning market continues, the company’s revenue in 2024 soared from $526.92 million to $1.24 billion.

It has been instrumental in driving its market valuation as HIMS’ ability to keep its profitability while expanding its services.

Last 10-Year History and Analysis

To understand the trajectory of Hims & Hers, it’s essential to look at its historical data:

| Year | Market Cap | Change | Growth Rate |

|---|---|---|---|

| 2019 | $246.53M | N/A | N/A |

| 2020 | $367.28M | +$120.75M | 47.47% |

| 2021 | $1.34B | +$972.72M | 263.65% |

| 2022 | $1.33B | -$10M | -0.30% |

| 2023 | $1.89B | +$560M | 41.69% |

| 2024 | $5.28B | +$3.39B | 180.00% |

| 2025 | $6.75B | +$1.47B | 22.91% |

It shows the company’s resilience and adaptability, especially after the pandemic drove the demand for telehealth services even faster. Strong operational efficiency and market positioning testify that it is able to weather volatility in 2022 and stage a strong rebound in years thereafter.

Comparison with Other Stocks

The reason to evaluate Hims & Hers is that it should compare its metrics to other consumer staples and telehealth companies.

| Company | Market Cap | Revenue (2024) | PE Ratio | Growth Rate (2024) |

|---|---|---|---|---|

| Hims & Hers Health | $6.75B | $1.24B | 69.49 | 56.7% |

| Teladoc Health, Inc. | $12.8B | $2.6B | N/A | 35.0% |

| Walmart | $747.55B | $673.82B | 24.3 | 6.7% |

| The Procter & Gamble Co. | $389.75B | $84.35B | 26.7 | 5.4% |

As an operation on a smaller scale than giants like Walmart or Procter & Gamble, Hims & Hers still boasts a much faster growth rate than many traditional players. Being a high growth stock, it is priced as such with a forward PE of 57.66.

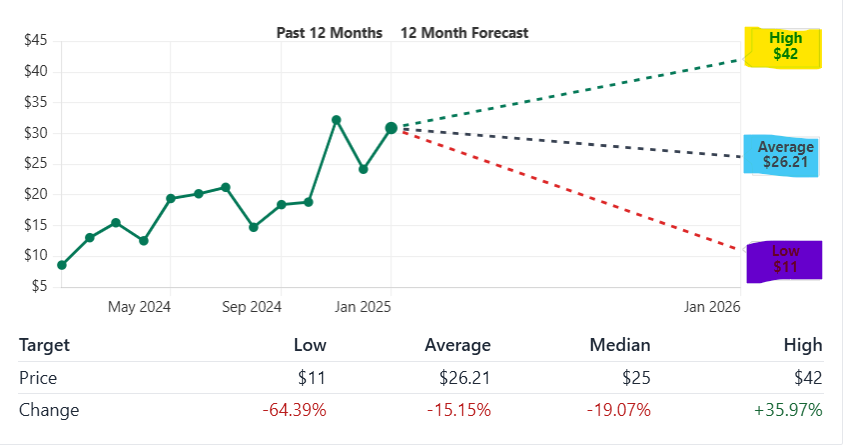

Stock Recommendation by Analysts

Most analysts have a “Buy” on Hims & Hers Health and have attracted attention. The group of analysts polled estimated that the stock might fall, giving it a consensus price target of $26.21, which is almost 15 percent below the $30.89 at which the stock is currently trading. Yet analyst targets vary greatly (from $11 to $42), so the extent to which investor sentiment changes with earnings, or market trends, is not yet clear.

| Analyst | Rating | Price Target | Upside/Downside |

|---|---|---|---|

| David Larsen (BTIG) | Strong Buy | $35 | +13.31% |

| Korinne Wolfmeyer (Piper) | Hold | $24 | -22.30% |

| Craig Hettenbach (Morgan) | Buy | $42 | +35.97% |

| Daniel Grosslight (Citi) | Strong Sell | $25 | -19.07% |

It is indicative of the uncertainty in the telehealth sector. And the stock will almost certainly react to how Hims & Hers manages to meet or beat earnings expectations.

Indicator-Based Stock Analysis

Hims & Hers’ stock performance is made more tangible using technical indicators. Presently the Relative Strength Index (RSI) of 62.15 shows that the stock is near overbought levels; yet still in a bullish region. At $27.80, the 50 day moving average is pointing towards a strong upward trend, and the 200 day moving average sits at $20.44.

Other key indicators:

- Beta (1.30): HIMS is more volatile than the market average, and that would make for big price swings.

- Short Interest (23.86%): Short interest is so high that short squeeze may occur during high levels of buying pressure.

- Momentum: MACD and Momentum technical indicators still indicate bullish near term sentiment.

Should I Buy This Stock?

A good growth story, but its potential must be weighed against risks associated with the same. The company’s sector is growing very rapidly and benefits from many tailwinds, including an increased adoption of telehealth as well as an increasing demand for personalized health care solutions. It successfully shows its financial metrics like revenue growth, profitability which indicates an operational efficiency and a scalability.

But there is also risk: high valuation metrics, reliance on continuing revenue growth, sharp competition in telehealth. The current PE ratio of 69.49 looks optimistic for future growth but as you can see there is very little room for error. Furthermore, just over 24 percent suggest bearish sentiment from some investors.

HIMS has potential upside for growth oriented investors OK with a bit of market volatility, provided it doesn’t disappoint. For risk averse investors, it might be best if they waited for a pullback or some more clarity on long term performance.

Conclusion

Hims & Hers Health, Inc. is a telehealth trailblazer leveraging innovation and customer centric solutions to grow. There appears to be a good future for the company from its financial performance and strategic vision. While stock price may vary over a short time period, the long term prognosis is positive. Its ability to continue to grow into a mature market leader as HIMS transitions will be hampered by a) FBOS, b) FACE costs, c) FBOS and FACE costs, and d) FACE costs.novate and adapt will determine its success.

Disclaimer

This analysis is for informational purposes only and does not constitute financial advice. Always consult a financial advisor before making investment decisions.

Frequently Asked Questions

What is the future price prediction for Hims & Hers Health (HIMS) stock?

Based on ongoing revenue growth, the HIMS stock price predictions are between $28 and $34 in 2025 and $55 and $65 in 2030, depending on the market expansion, expected profitability improvements. These numbers are projections based on market conditions, company performance and such.

Is Hims & Hers Health a good investment?

Because its financial performance, innovation in telehealth, and expansion potential make it a high growth stock, Hims & Hers Health is considered a high growth stock. Nevertheless, its valuation figures like a high P/E ratio imply that these people are ready to take some risk and seek for longer term profits.

What are the risks of investing in Hims & Hers stock?

Some risks include:

High valuation metrics, such as a forward P/E ratio of 57.66.

Increased competition in the telehealth sector.

Dependence on customer acquisition for revenue growth.

Volatility might be on the way if higher short interest (23.86%) is involved.

Will Hims & Hers pay dividends in the future?

Hims & Hers doesn’t pay dividends as of yet. High growth firms are used to reinvesting their profits into growth initiatives. The company may be matured and stabilized its cash flow and then dividend payouts may be considered.

What is the projected revenue growth for Hims & Hers Health?

With artificial intelligence accelerating the market and product innovation, Hims & Hers’ revenue is expected to increase from $2.08 billion in 2025 to more than $3.6 billion in 2029.