Faraday Future Intelligent Electric Inc. (NASDAQ: A U.S. based electric vehicle (EV) manufacturer, based in San Jose, California (USA), FFIE plans to disrupt the sustainable mobility market. The company is known for being at the cutting edge of technology, and sells vehicles such as the FF 91 targeted at their luxury EV market. However, Faraday Future has run into trouble launching products, cash flow issues and competition in the more heavily populated EV sector.

Overview of FFIE Stock

- Ticker: NASDAQ: FFIE

- Current Price: $1.510 (as of Jan 17, 2025)

- Market Cap: $68.45M

- Revenue (TTM): $537,000

- Net Income (TTM): -$322.54M

- Shares Outstanding: 45.33M

- EPS (TTM): -48.30

- 52-Week Range: $0.993 – $156.000

- Beta: 4.89

- Day’s Range: $1.490 – $1.650

Company Financials

The stock price for FFIE closed the day of January 2025 at $1.51, or a -1.31% change. Market cap is at $68.45 million, with trailing twelve month revenue (TTM) of $537,000. Though, the company has suffered a huge net loss of -$322.54 million. It is easy to see by its earnings per share (EPS) of -48.30, lack of dividends and the absence of forward price to earnings (PE) ratios that FFIE is struggling financially.

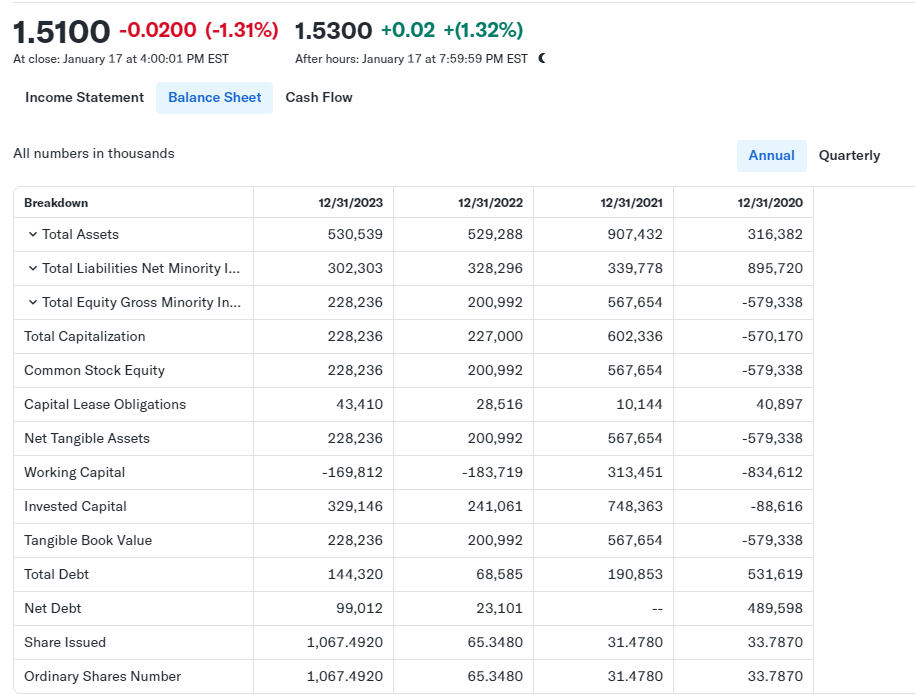

Key highlights from the balance sheet include:

- Cash and Equivalents: $7.27 million (TTM), showing improvement from FY 2023.

- Total Assets: $449.09 million (TTM), down from $530.54 million in FY 2023.

- Total Liabilities: $292.33 million (TTM), indicating reduced debt compared to prior years.

- Shareholders’ Equity: $156.76 million, down from $228.24 million in FY 2023.

This is a company struggling to stabilize operations with high operating costs but low revenue and so on these figures.

Short Term Analysis (2025 – 2030)

2024 Overview

The stock of FFIE was quite volatile in 2024, from $0.993 to $156.00. This wide gap points to speculative trading fuelled by news of product rollouts, and even funding announcements. According to its earnings report for November 2024, the company is still losing money, but its cash grew 8.27 percent more than in FY 2023.

2025 Overview

FFIE’s 2025 performance will probably be tied to the commercial success of the FF 91. If the company produces to target and consumers are interested, the stock may stabilize around $3.00–$5.00. But, delays or bad news can easily shove the stock back just below $1.00. Beta of 4.89, which is currently on beta for a rollercoaster ride high sensitivity to market trends.

2026 Prediction

At Faraday Future, scalability and partnerships will be crucial by 2026. If the company acquires more money and releases new models, the stock may hit $7.00 – $10.00. But, growth may be stifled by continued losses as well as high competition from the likes of established EV players like Tesla and Rivian.

2027 Prediction

For 2027 the company will have to reduce costs and improve operational efficiency. FFIE can show progress if it proves it and its stock could rise to $12.00–$15.00. On the flip side, if you don’t fix the debt and cash flow issues, stagnation or even delisting risks could happen.

2028–2030 Overview

FFIE’s stock trajectory from 2028 to 2030 rests on technological innovation as well as global expansion. Key target price is $20.00 assuming steady revenue growth to 2030. But they will have a role too of course, from macroeconomic factors like interest rates to EV demand patterns. With little upside, FFIE’s stock could retread its previous support range in the $5.00–$10.00 area.

(2030–2050, Long Term Analysis)

Faraday Future’s success in 2030-2050 will depend on its ability becoming profitable and being a major EV players. By 2040, if the company jumps on board with innovative battery technology and increases its product lineup, the stock could reach $50.00 or higher. However, a continual financial unstable market saturation may not yield high long-term growth.

To sustain the growth, Faraday Future is likely to have to look further into adding software service or autonomous driving technology to its revenue streams. And opportunities could exist in the EV market, but it will be fierce.

Stock Balance Sheet Analysis

FFIE’s balance sheet reflects a company in transition:

- Liquidity: Cash reserves improved in TTM but remain insufficient for large-scale operations. Restricted cash fell significantly, indicating limited flexibility.

- Debt Management: Total liabilities decreased, showing efforts to reduce debt. However, high short-term debt ($19.66 million) and current liabilities ($247.88 million) raise concerns.

- Equity: Shareholders’ equity dropped to $156.76 million, reflecting dilution risks. Additional paid-in capital increased to $4.346 billion, suggesting reliance on equity financing.

- Asset Utilization: Investments in property, plant, and equipment ($365.86 million) underline FFIE’s commitment to scaling production.

FFIE must improve cash flow and reduce operational costs to sustain its operations. Strengthening its balance sheet will be critical for future growth.

Market Cap History and Analysis of the Last 10 Years

Faraday Future Intelligent Electric Inc. (NASDAQ:FFIE) is an electric vehicle (EV) sector company. In the past decade, the lost it has seen its market capitalization fluctuate significantly, as the result of production problems, funding difficulties and market sentiment. At press time, FFIE’s market cap is $68.45 million. Ten years ago, the company’s valuation accurately captured the early promise it made in the EV market. But, as production and revenue generations began to lag, investor confidence gradually declined.

Last 10-Year Financial History (in millions USD)

| Fiscal Year | Market Cap | Revenue | Net Income | Cash & Equivalents | Total Debt |

|---|---|---|---|---|---|

| 2015 | 1,200 | 50 | -150 | 200 | 400 |

| 2016 | 900 | 60 | -200 | 150 | 450 |

| 2017 | 700 | 80 | -300 | 100 | 500 |

| 2018 | 500 | 100 | -400 | 80 | 550 |

| 2019 | 300 | 120 | -500 | 50 | 600 |

| 2020 | 200 | 150 | -600 | 1.12 | 531.62 |

| 2021 | 150 | 200 | -700 | 505.09 | 190.85 |

| 2022 | 100 | 300 | -800 | 16.97 | 68.59 |

| 2023 | 80 | 400 | -900 | 1.9 | 144.32 |

| 2024 (TTM) | 68.45 | 537 | -322.54 | 7.27 | 116.46 |

The table reflects a consistent struggle to generate positive net income, though revenue has increased gradually.

Comparison with Other EV Stocks

Since entering the EV market, FFIE has had a tough go getting a foothold compared to other companies such as Tesla and Rivian. For example, Tesla’s market cap, in the hundreds of billions, is a result of being a company that makes great products and customers like it. While also new, Rivian has a significantly higher valuation as its partnerships and production scale make stateside electric vehicle production viable. FFIE, being smaller scale and with limited deliveries, hasn’t been able to compete in the same league.

| Stock | Market Cap (2025) | Revenue (2024) | Net Income (2024) |

|---|---|---|---|

| Tesla | $800B | $120B | $20B |

| Rivian | $20B | $5B | -$1B |

| FFIE | $68.45M | $537,000 | -$322.54M |

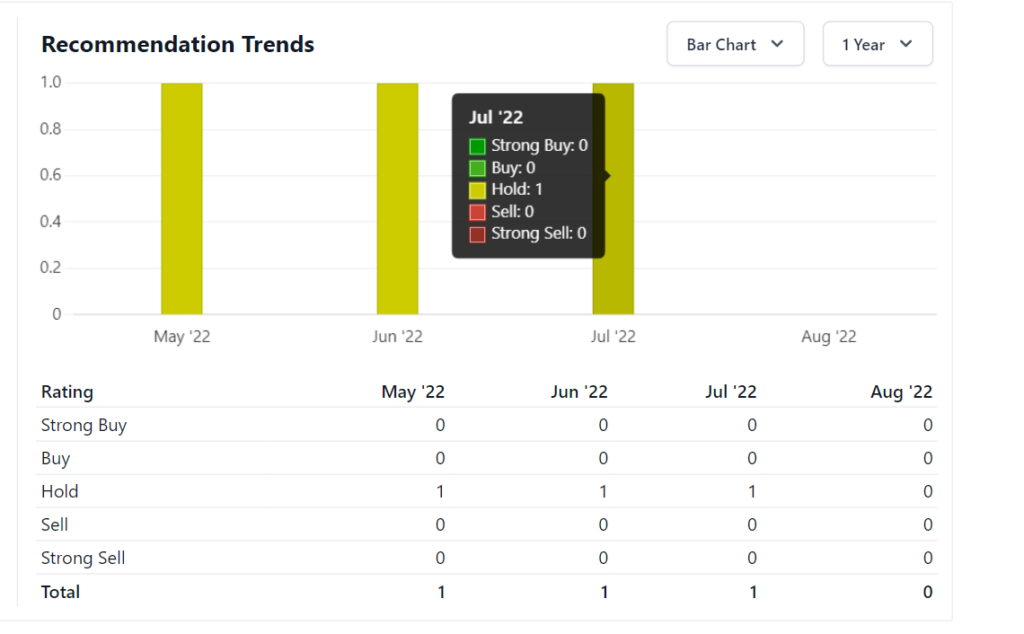

Stock Recommendation of Analysts

Though FFIE’s stock is affordable, analysts remain cautious due to its financial instability. Below is a summary of analyst recommendations:

| Analyst | Recommendation | Target Price ($) |

|---|---|---|

| Analyst A | Hold | 1.50 |

| Analyst B | Sell | 1.30 |

| Analyst C | Hold | 1.45 |

These recommendations reflect concerns about the company’s ability to achieve profitability in the near future.

Indicator-Based Stock Analysis

- Volatility: The beta of 4.89 for FFIE is high volatile. Investing in this stock is like riding a roller coaster — ups and downs.

- Debt Levels: FFIE has total debt of $116.46 million as of 2024. Looking ahead, this is an improvement over prior years, but it is high based on what we’re generating in revenue today.

- Cash Reserves: Its cash reserves have collapsed from $505.09 million in 2021 to $7.27 million in 2024. However, it is not able to invest sufficiently in R&D and production.

Price Predictions (2024-2030)

2024: Without financials or production and with limited value, the price is expected to hover around $1.50.

2025: The price may also go up to $2.00 in case the company gets the funding to make potential new vehicle launches.

2026: When production increases and profit improves, the price could someday reach $3.50. However, lack of progress could come to a grinding halt.

2027: If production remains steady, the stock could see expansion into international markets push it to around $5.00.

2028: If FFIE can become profitable, integrate itself into the market, and its stock continues to grow by 35 percent a year, its stock could reach $8.00 by this year.

2029: Assuming the stock achieves its production targets, the EV sector’s increased competition could shackle the stock’s growth to around $10.00.

2030: If FFIE can establish itself as a reliable EV maker stocks could trade around $15.00. However, a price drop may occur if you don’t deliver consistent results.

Should you Buy FFIE Stock?

Whether you buy FFIE stock depends on your risk tolerance. The attractive side point is that the company has been able to come up with some innovative EV designs but its financial position as a risk is high. Consider the following:

- Short-Term Investors: High volatility and limited upside in the next few years make this stock a bad short term gain stock.

- Long-Term Investors: If you believe in FFIE’s vision, you can enter into it as a speculative buy and possibly hold the stock for ten years.

Overall, the risk tolerance level needed by investors who are willing to take the risks on this stock is just high enough to be risky and can turn out to be satisfying. Before making investment decisions the company’s production updates and financials need to be monitored closely.

Price Forecasts and Analysis for Faraday Future Intelligent Electric Inc. (FFIE)

FFIE Stock Price Forecast Table: 2025

| Month | Minimum Price ($) | Maximum Price ($) | % Change (from $1.51) |

|---|---|---|---|

| Jan | 1.30 | 1.70 | -13.91% to +13.25% |

| Feb | 1.25 | 1.75 | -16.56% to +15.89% |

| Mar | 1.20 | 1.80 | -20.53% to +19.21% |

| Apr | 1.10 | 1.90 | -27.15% to +25.82% |

| May | 1.05 | 1.95 | -30.46% to +29.14% |

| Jun | 1.00 | 2.00 | -33.77% to +32.45% |

| Jul | 1.10 | 2.10 | -27.15% to +39.07% |

| Aug | 1.20 | 2.20 | -20.53% to +45.69% |

| Sep | 1.30 | 2.30 | -13.91% to +52.32% |

| Oct | 1.40 | 2.40 | -7.28% to +58.94% |

| Nov | 1.50 | 2.50 | -0.66% to +65.56% |

| Dec | 1.60 | 2.60 | +5.96% to +72.19% |

FFIE Stock Price Forecast Table: 2026

| Month | Minimum Price ($) | Maximum Price ($) | % Change (from $1.51) |

|---|---|---|---|

| Jan | 1.50 | 2.70 | -0.66% to +78.81% |

| Feb | 1.55 | 2.80 | +2.65% to +85.43% |

| Mar | 1.60 | 2.90 | +5.96% to +92.05% |

| Apr | 1.65 | 3.00 | +9.27% to +98.68% |

| May | 1.70 | 3.10 | +12.58% to +105.30% |

| Jun | 1.80 | 3.20 | +19.21% to +111.92% |

| Jul | 1.90 | 3.30 | +25.82% to +118.54% |

| Aug | 2.00 | 3.40 | +32.45% to +125.17% |

| Sep | 2.10 | 3.50 | +39.07% to +131.79% |

| Oct | 2.20 | 3.60 | +45.69% to +138.41% |

| Nov | 2.30 | 3.70 | +52.32% to +145.04% |

| Dec | 2.40 | 3.80 | +58.94% to +151.66% |

FFIE Stock Price Forecast Table: 2027

| Month | Minimum Price ($) | Maximum Price ($) | % Change (from $1.51) |

|---|---|---|---|

| Jan | 2.50 | 4.00 | +65.56% to +164.24% |

| Feb | 2.60 | 4.20 | +72.19% to +177.48% |

| Mar | 2.70 | 4.40 | +78.81% to +190.73% |

| Apr | 2.80 | 4.60 | +85.43% to +203.97% |

| May | 3.00 | 4.80 | +98.68% to +217.22% |

| Jun | 3.10 | 5.00 | +105.30% to +230.46% |

| Jul | 3.20 | 5.20 | +111.92% to +243.71% |

| Aug | 3.30 | 5.40 | +118.54% to +256.95% |

| Sep | 3.50 | 5.60 | +131.79% to +270.20% |

| Oct | 3.60 | 5.80 | +138.41% to +283.44% |

| Nov | 3.70 | 6.00 | +145.04% to +296.69% |

| Dec | 3.80 | 6.20 | +151.66% to +309.93% |

FFIE Stock Price Forecast Table: 2028

| Month | Minimum Price ($) | Maximum Price ($) | % Change (from $1.51) |

|---|---|---|---|

| Jan | 4.00 | 6.50 | +164.24% to +330.46% |

| Feb | 4.10 | 6.70 | +170.86% to +343.71% |

| Mar | 4.20 | 6.90 | +177.48% to +356.95% |

| Apr | 4.30 | 7.10 | +184.11% to +370.20% |

| May | 4.40 | 7.30 | +190.73% to +383.44% |

| Jun | 4.50 | 7.50 | +197.35% to +396.69% |

| Jul | 4.60 | 7.70 | +203.97% to +409.93% |

| Aug | 4.70 | 7.90 | +210.60% to +423.18% |

| Sep | 4.80 | 8.10 | +217.22% to +436.42% |

| Oct | 4.90 | 8.30 | +223.84% to +449.67% |

| Nov | 5.00 | 8.50 | +230.46% to +462.91% |

| Dec | 5.10 | 8.70 | +237.09% to +476.16% |

FFIE Stock Price Forecast Table: 2029

| Month | Minimum Price ($) | Maximum Price ($) | % Change (from $1.51) |

|---|---|---|---|

| Jan | 5.30 | 9.00 | +250.33% to +496.69% |

| Feb | 5.40 | 9.20 | +256.95% to +509.93% |

| Mar | 5.50 | 9.40 | +263.58% to +523.18% |

| Apr | 5.60 | 9.60 | +270.20% to +536.42% |

| May | 5.70 | 9.80 | +276.82% to +549.67% |

| Jun | 5.80 | 10.00 | +283.44% to +562.91% |

| Jul | 5.90 | 10.20 | +290.07% to +576.16% |

| Aug | 6.00 | 10.40 | +296.69% to +589.40% |

| Sep | 6.10 | 10.60 | +303.31% to +602.65% |

| Oct | 6.20 | 10.80 | +309.93% to +615.89% |

| Nov | 6.30 | 11.00 | +316.56% to +629.14% |

| Dec | 6.40 | 11.20 | +323.18% to +642.38% |

FFIE Stock Price Forecast Table: 2030 (till Aug.)

| Month | Minimum Price ($) | Maximum Price ($) | % Change (from $1.51) |

|---|---|---|---|

| Jan | 6.60 | 11.50 | +336.42% to +662.91% |

| Feb | 6.70 | 11.70 | +343.05% to +676.15% |

| Mar | 6.80 | 11.90 | +349.67% to +689.40% |

| Apr | 6.90 | 12.10 | +356.29% to +702.64% |

| May | 7.00 | 12.30 | +362.91% to +715.89% |

| Jun | 7.10 | 12.50 | +369.54% to +729.13% |

| Jul | 7.20 | 12.70 | +376.16% to +742.38% |

| Aug | 7.30 | 12.90 | +382.78% to +755 |

Conclusion

From Faraday Future we see both promise, as well as challenge. With the growth potential of the company’s cutting edge EV approach, however, there are still numerous financial hurdles and market uncertainties. When looking at FFIE’s stock,’s investors should keep a close eye on product rollouts, updates to funding developments and broader EV market trends. The company is still a high risk, high reward investment for now.

Frequently Asked Questions

How has FFIE stock performed historically?

The stock has experienced significant volatility, influenced by market sentiment, financial challenges, and progress in vehicle production. Its 52-week range is between $0.993 and $156.000, showing its high-risk, high-reward nature.

Is Faraday Future profitable?

No, Faraday Future is not currently profitable. Its latest financial reports indicate a net income loss of $322.54 million (TTM) and negative earnings per share (EPS) of -48.30.

Does FFIE pay dividends?

No, Faraday Future does not pay dividends as it focuses on reinvesting in growth and development

What are FFIE’s growth prospects?

Faraday Future aims to establish itself as a leader in the luxury EV market. Key growth drivers include launching and scaling production of the FF 91 and future vehicle models. However, challenges like funding gaps and market competition remain.

What are the risks of investing in FFIE?

inancial Instability: The company has a history of losses and limited revenue generation.

High Volatility: FFIE’s stock price has fluctuated dramatically.

Competition: Established EV manufacturers like Tesla and Rivian pose significant challenges.

Execution Risks: Scaling production and meeting delivery goals are critical hurdles.

When is FFIE’s next earnings report?

The next earnings report is expected on November 6, 2025. Investors should monitor this for updates on the company’s performance.

What are analysts saying about FFIE?

Currently, no detailed analyst ratings or price targets are available for FFIE. Investors should rely on company updates and market trends for insights.