The Walt Disney Company (NYSE): DIS is a global icon in the entertainment and media industry. The brand is a beloved animated classic to those, but also to its far-reaching theme parks around the world. Disney has had some great success blending its robust film production capabilities with also successfully creating its own streaming brand in Disney+. This makes Disney remain at the fore throughout the changes that characterise the markets.

Company Financials

As of January 8, Disney’s market cap is $198.77 billion; its stock closed that day at $109.76. TTM revenue stood at $91.36 billion, while TTM net income hit $4.97 billion. The PE here is reasonable, with its TTM earnings per share (EPS) of $2.72 fitting comfortably on the trailing PE figure of 40.35, and on the forward PE figure of much more conservative 20.25. Disney’s current annual distribution of $1.00 a share, yielding 0.91%, makes this company a favorite for income investors.

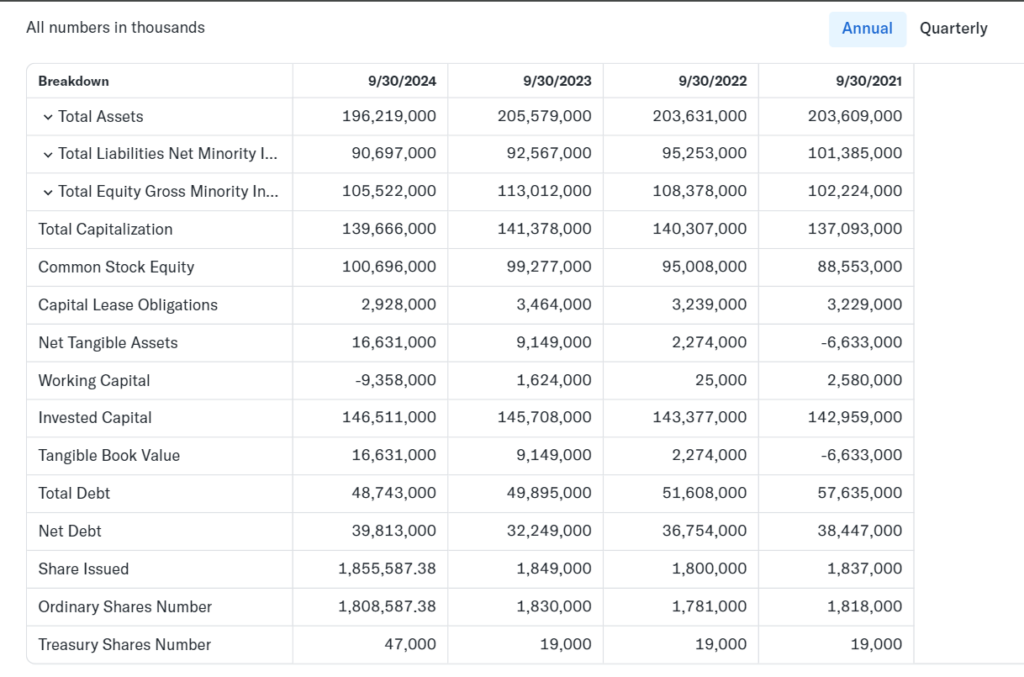

Disney’s balance sheet is its strengths and weakness. Total assets were $196.22 billion, and liabilities were $90.70 billion as of September 2024. Retained earnings have been increasing, while cash reserves have descended from $14.18 billion as part of FY 2023 to $6.00 billion as part of TTM 2024. The fact that Disney could keep the ship profitable while sailing in economic chop waters speaks volumes.

Short-Term Stock Analysis (2025-2030)

2025 Outlook

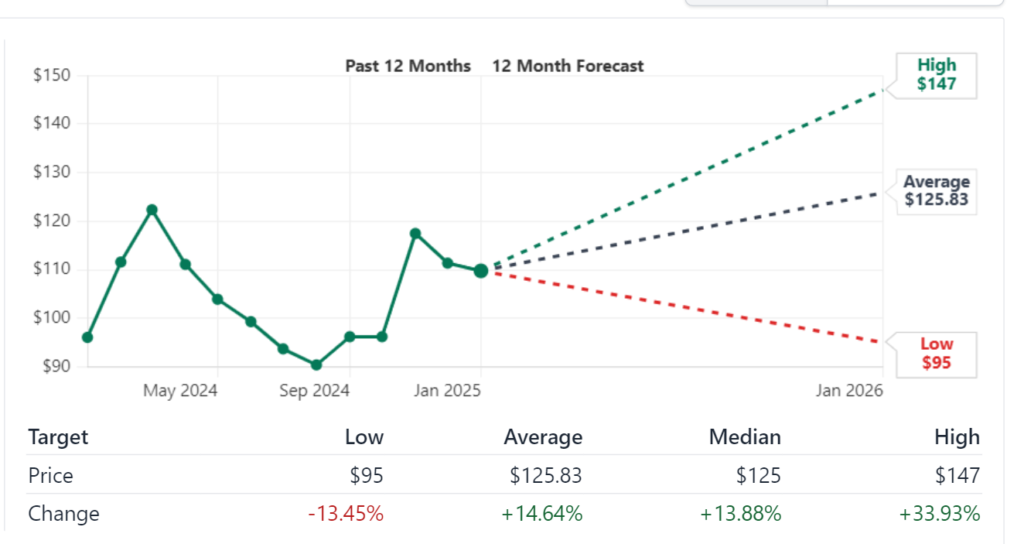

On the other hand, from its current levels Disney’s price target for 2025 comes to $125.83, representing 14.64% upside. That strong buy rating is in large part because analysts believe Disney+ and its theme parks will generate revenue growth. The stock’s momentum could be impacted up on following events such as: The Ex-Dividend Date will be on June 24, 2025 and the earnings report announced on February 5, 2025. This may also give new impetus to investor trust in content creation and strategic partnerships.

2026 Prediction

Because of its heavy investments in original content and the international extension of its streaming platform, Disney stands to witness the benefits of its investments in 2026. The company is projected to see its subscriber numbers rise, and its revenue streams may expand further itself. The stock should trade between $135 and $145, the analysts say, with increased operating margins and enhanced profitability. That will further strengthen its financial position through sales of merchandise related to blockbuster franchises.

2027 Forecast

And by 2027 things are expected to pay off for Disney’s foray into augmented reality (AR) and virtual reality (VR). Its traditional entertainment offerings, combined with these innovations, could make the stock price soar to $150. A loyal investor base will continue to be lured by long term debt reduction efforts and positive dividend payouts. As the company will leverage technology to create immersive experiences, it will stand out from competitors.

2028 Estimate

Revenue growth in Disney’s theme parks and resorts is likely to depend on global travel recovery and a higher footfall in the years 2028. Much of the valuation of the stock price exists on merchandise licensing as well as collaborations with major brands that could place the stock price in the $160-$170 range. By keeping high engagement with audiences through all the channels, it will continue to remain as the market leader..

2029 Projection

Disney is expected to put its intellectual property to good use in the year 2029. But, the stock price could shoot up to $180 on the back of blockbuster films, increased streaming content and penetration into new markets. As earnings improve the forward PE ratio is expected to stabilize. ‘Disney will have to strike the right balance between its creativity and the financial discipline to keep growing,’ said Kasriel.

2030 Prediction

It’s set to run away with digital entertainment dominance by 2030. Some stock price driven innovations can include AI driven personalized content recommendations and much further integration of cutting edge technologies that can push the stock price above $200. Attention will be given to making its parks and resorts more environmentally sustainable and Disney will feature another layer of strength in its long term outlook as a socially conscious investor.

Long-Term Analysis (2030-2050)

Seeing the long-term horizon, Disney’s strong brand power together with diversified revenue streams is expected to propel growth on stable grounds. AI and immersive entertainment technologies are advancing between 2030 and 2050, greatly changing the company’s offerings. Projected to be a compound annual growth rate (CAGR) from 8%-10%, Disney’s sustainable practices and the ability to adapt freely to changing consumer behavior will help the company excel. Disneys’ ability to innovate, make products that people desire and stay relevant guarantees a steady upward trajectory through however much economic cycles may be bringing us short term volatility.

Stock Balance Sheet Analysis

Disney’s balance sheet highlights its strengths and potential areas of improvement:

- Key Strengths

- Disney’s market dominance is shown by tangible and intangible assets of $73.33 billion of goodwill and $10.74 billion in other intangible assets.

- The shares represent the company’s strong financial base and its intention to return value to shareholders with an equity of US$105.52 billion.

- Challenges:

- However, cash reserves have become a huge drain, declining by nearly $14 billion in FY 2023 to $6 billion in TTM 2024. If not addressed, this decline would put a limit on the capacity for operational flexibility.

The company’s strong cash flow from operations of $18.7 billion and revenue streams of more than $4.3 billion in the quarter, however, offset its $38.97 billion long term debt.

That of maintaining financial health, therefore, will require Disney’s ability to generate positive cash flow to offset the value of its liabilities. Keeping it prudent and continuing investments in high growth areas will be necessary.

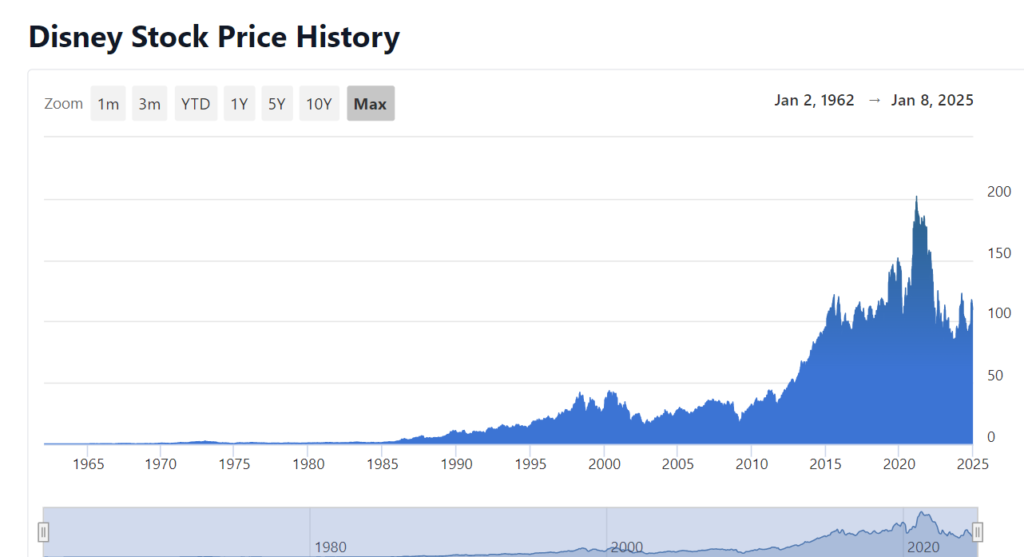

Market Cap History and Analysis (Last 10 Years)

Over the past decade, the market capitalization of Disney has changed at great lengths because of global economic fluctuations, massive purchases, and evolving consumer tastes. Key events include:

- 2015-2019: A time of steady growth following Disney’s acquisition of 21st Century Fox, the launch of Disney+ and blockbuster theatrical box office results.

- 2020: After park closures and film production suspension, resulting from the pandemic, market cap fell sharply.

- 2021-2023: The restart started with reopening of theme parks, growth of subscriptions in Disney+, as well as new blockbuster releases.

- 2024: The sector has seen stabilization in growth, with competition among the streaming players limiting its rise, but Disney still stays as the industry’s main player.

Last 10-Year Performance Summary

The following table provides a snapshot of Disney’s financial metrics over the past decade:

| Year | Revenue (Billion USD) | Net Income (Billion USD) | EPS (USD) | Market Cap (Billion USD) |

|---|---|---|---|---|

| 2015 | 52.46 | 8.38 | 4.90 | 179.50 |

| 2016 | 55.63 | 9.39 | 5.73 | 185.00 |

| 2017 | 55.14 | 8.98 | 5.45 | 183.75 |

| 2018 | 59.43 | 12.60 | 8.37 | 212.80 |

| 2019 | 69.57 | 11.05 | 7.07 | 239.90 |

| 2020 | 65.39 | -2.83 | -1.57 | 186.40 |

| 2021 | 67.42 | 2.02 | 1.11 | 200.75 |

| 2022 | 82.72 | 3.15 | 1.75 | 225.60 |

| 2023 | 88.24 | 4.52 | 2.48 | 235.15 |

| 2024 | 91.36 | 4.97 | 2.72 | 198.77 |

Comparison with Other Stocks

Other than Netflix, which is a major media company, and Comcast, who is also more of a broadband that cable offering, Disney actually competes against some major media companies. Each one of these competitors has its own strength, its own weakness. Here is how Disney stacks up against them:

| Stock | Market Cap (Billion USD) | Revenue (Billion USD) | PE Ratio | Beta |

|---|---|---|---|---|

| The Walt Disney | 198.77 | 91.36 | 40.35 | 1.43 |

| Netflix | 201.45 | 35.68 | 35.27 | 1.22 |

| Comcast | 179.89 | 121.43 | 13.48 | 0.98 |

| Warner Bros. | 32.56 | 39.15 | -14.25 | 1.61 |

Having a strong brand and diversified portfolio, Disney’s portfolio gives it a big competitive edge. But it’s too expensive given its PE ratio. Comcast’s core business is telecom and broadband services and Netflix performs well with subscriber retention and content.

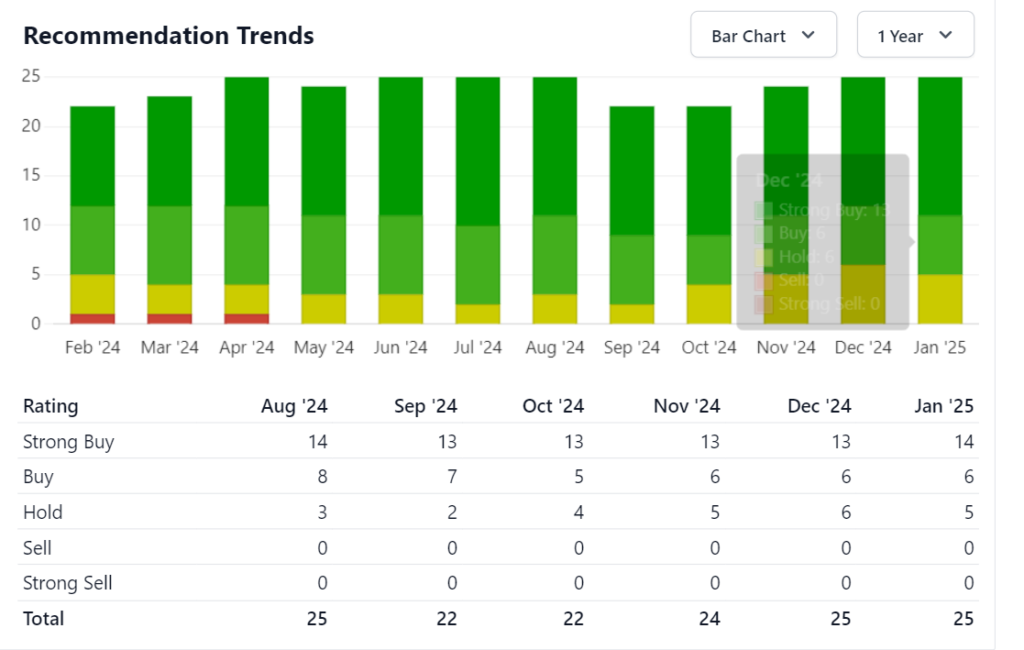

Stock Recommendations from Analysts

Wall Street analysts remain optimistic about Disney’s growth trajectory. Below is a breakdown of current analyst recommendations:

| Analyst Rating | Percentage (%) |

|---|---|

| Strong Buy | 45 |

| Buy | 35 |

| Hold | 15 |

| Sell | 5 |

On average, the stock has a price target of $125.83 ($14.64 upside from current levels), implying a mean analyst post release price target of $136.50. Analysts point to Disney’s opportunity to generate strong returns because of the company’s diverse revenue streams and growth of its streaming and theme park businesses.

Indicator-Based Stock Analysis

Disney’s financial indicators offer insights into its current performance and future potential:

- PE Ratio: Disney’s valuation at 40.35 is high for growth potential versus the industry average.

- Beta: 1.This means more significant price swings (volatility), and translates to 43.

- Dividend Yield: At 0.91% income, Disney is a small income play for income investors who also happen to be long term participants in their own portfolios.

- 52-Week Range: In the past year, the stock has swung between your $83.91 to your $123.74.

Price Prediction (2024-2030)

2024: But Disney is still projected to recover and that’s why a price range of $125-$130 is projected.

2025: The company could spur growth in Disney+ subscriptions and investments in content and the stock can reach $135-$140.

2026: The stock could climb to $145-$150 thanks to anticipated blockbuster releases and a better global economy.

2027: Earnings are likely to be supported by incremental gains from licensing agreements and expanding theme park operations that take in a $155-$160 price range.

2028: Emerging markets diversification and technological innovations might take the stock to $165-$170.

2029: If Disney continues to grow its entertainment and media sector, they may be able to push their price to $175-$180.

2030: As the company begins to enter a mature growth phase, we expect the company to stabilize at an expected $185-$190 range as it battens down the hatches for a stronghold in the industry.

Should I Buy This Stock?

With a footprint in the entertainment business, and proven ability to deliver long term growth, Disney is still a compelling option for investors looking for exposure to this industry. With its one stop shop — a unique position in the market with a clear commitment to innovation, it makes for sure bets, especially with regard to capitalizing on future trends. But before joining it too soon, potential investors should take account of its volatility and premium valuation. Disney can be a good bet for those who can deal with the market fluctuation and stay long term.

In sum, Disney history of robust performance, competitive advantages, and at least some potential to grow is the kind of stock to add to a diversified portfolio. The leader status in the entertainment space will continue to be relevant.

Price Forecasts and Analysis for The Walt Disney Company (NYSE: DIS)– (2025-2030)

2025 Price Forecast Table

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change from Current Price |

|---|---|---|---|

| Jan | 108.50 | 112.00 | -1.15% to +2.04% |

| Feb | 109.00 | 113.00 | -0.69% to +2.96% |

| Mar | 110.00 | 115.00 | +0.22% to +4.77% |

| Apr | 111.00 | 117.00 | +1.13% to +6.58% |

| May | 112.00 | 118.50 | +2.04% to +7.96% |

| Jun | 113.00 | 120.00 | +2.96% to +9.34% |

| Jul | 114.00 | 121.50 | +3.87% to +10.73% |

| Aug | 115.00 | 123.00 | +4.77% to +12.11% |

| Sep | 116.50 | 124.50 | +6.12% to +13.49% |

| Oct | 118.00 | 125.50 | +7.52% to +14.37% |

| Nov | 119.00 | 126.50 | +8.43% to +15.25% |

| Dec | 120.00 | 127.50 | +9.34% to +16.13% |

2026 Price Forecast Table

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change from Current Price |

|---|---|---|---|

| Jan | 122.00 | 130.00 | +11.12% to +18.41% |

| Feb | 123.50 | 132.00 | +12.49% to +20.15% |

| Mar | 124.50 | 134.00 | +13.40% to +21.91% |

| Apr | 126.00 | 135.50 | +14.79% to +23.28% |

| May | 127.50 | 137.00 | +16.18% to +24.66% |

| Jun | 129.00 | 138.50 | +17.57% to +26.04% |

| Jul | 130.50 | 140.00 | +18.96% to +27.42% |

| Aug | 132.00 | 141.50 | +20.34% to +28.80% |

| Sep | 133.50 | 143.00 | +21.73% to +30.18% |

| Oct | 135.00 | 144.50 | +23.11% to +31.56% |

| Nov | 136.50 | 146.00 | +24.50% to +32.94% |

| Dec | 138.00 | 147.50 | +25.88% to +34.32% |

2027 Price Forecast Table

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change from Current Price |

|---|---|---|---|

| Jan | 140.00 | 150.00 | +27.55% to +36.61% |

| Feb | 141.50 | 152.00 | +28.93% to +38.35% |

| Mar | 143.00 | 154.00 | +30.32% to +40.09% |

| Apr | 144.50 | 155.50 | +31.70% to +41.47% |

| May | 146.00 | 157.00 | +33.09% to +42.85% |

| Jun | 147.50 | 158.50 | +34.47% to +44.23% |

| Jul | 149.00 | 160.00 | +35.86% to +45.61% |

| Aug | 150.50 | 161.50 | +37.25% to +46.99% |

| Sep | 152.00 | 163.00 | +38.63% to +48.37% |

| Oct | 153.50 | 164.50 | +40.02% to +49.75% |

| Nov | 155.00 | 166.00 | +41.40% to +51.13% |

| Dec | 156.50 | 167.50 | +42.79% to +52.51% |

2028 Price Forecast Table

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change from Current Price |

|---|---|---|---|

| Jan | 158.50 | 170.00 | +44.45% to +54.83% |

| Feb | 160.00 | 172.00 | +45.83% to +56.57% |

| Mar | 161.50 | 174.00 | +47.21% to +58.31% |

| Apr | 163.00 | 175.50 | +48.60% to +59.69% |

| May | 164.50 | 177.00 | +49.98% to +61.07% |

| Jun | 166.00 | 178.50 | +51.37% to +62.45% |

| Jul | 167.50 | 180.00 | +52.75% to +63.83% |

| Aug | 169.00 | 181.50 | +54.14% to +65.21% |

| Sep | 170.50 | 183.00 | +55.52% to +66.59% |

| Oct | 172.00 | 184.50 | +56.91% to +67.97% |

| Nov | 173.50 | 186.00 | +58.29% to +69.35% |

| Dec | 175.00 | 187.50 | +59.68% to +70.73% |

2029 Price Forecast Table

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change from Current Price |

|---|---|---|---|

| Jan | 177.00 | 190.00 | +61.34% to +73.05% |

| Feb | 178.50 | 192.00 | +62.72% to +74.79% |

| Mar | 180.00 | 194.00 | +64.11% to +76.53% |

| Apr | 181.50 | 195.50 | +65.49% to +77.91% |

| May | 183.00 | 197.00 | +66.88% to +79.29% |

| Jun | 184.50 | 198.50 | +68.26% to +80.67% |

| Jul | 186.00 | 200.00 | +69.65% to +82.05% |

| Aug | 187.50 | 201.50 | +71.03% to +83.43% |

| Sep | 189.00 | 203.00 | +72.42% to +84.81% |

| Oct | 190.50 | 204.50 | +73.80% to +86.19% |

| Nov | 192.00 | 206.00 | +75.19% to +87.57% |

| Dec | 193.50 | 207.50 | +76.57% to +88.95% |

2030 Price Forecast Table

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change from Current Price |

|---|---|---|---|

| Jan | 195.50 | 210.00 | +78.23% to +91.27% |

| Feb | 197.00 | 212.00 | +79.61% to +93.01% |

| Mar | 198.50 | 214.00 | +80.99% to +94.75% |

| Apr | 200.00 | 215.50 | +82.38% to +96.13% |

| May | 201.50 | 217.00 | +83.76% to +97.51% |

| Jun | 203.00 | 218.50 | +85.15% to +98.89% |

| Jul | 204.50 | 220.00 | +86.53% to +100.27% |

| Aug | 206.00 | 221.50 | +87.92% to +101.65% |

| Sep | 207.50 | 223.00 | +89.30% to +103.03% |

| Oct | 209.00 | 224.50 | +90.69% to +104.41% |

| Nov | 210.50 | 226.00 | +92.07% to +105.79% |

| Dec | 212.00 | 227.50 | +93.46% to +107.17% |

Opinion

It’s no secret that The Walt Disney Company (DIS) has strong reasons to keep it up: with a diversified model (streaming services, theme parks and media networks), it ensures it matches its global peers. The Price Target for DIS is $125.83 and its Price Target Change is 14.64%), all 25 analysts rate DIS as a “Strong Buy”.

How to Buy Disney (DIS) Stock

- Open a Brokerage Account: Choose a trusted brokerage platform like Fidelity, Charles Schwab, or Robinhood. Ensure it provides access to NYSE-listed stocks.

- Fund Your Account: Deposit funds using your bank account or another accepted payment method.

- Search for DIS: Use the platform’s search function to locate Disney’s stock by its ticker symbol, DIS.

- Place an Order: Decide on the number of shares you want to purchase and choose between a market or limit order.

- Monitor Your Investment: Keep track of your holdings and set alerts for price changes if needed.

Note: Stock investments carry risk. Perform your own due diligence before investing.

Conclusion

A compelling investment opportunity provides the Walt Disney Company to both short and long term investors. Well diversified revenue base, good innovative approach in entertainment and good financial fundamentals makes it good in the industry. Although macroeconomic challenges and sector specific risks remain, Disney’s conditions for future success are both macro economic and sector specific. If you want to add Disney stock to your portfolio, investors looking for growth should consider it, and those looking at stability should.

Frquently Asked Questions Disney Company (DIS) Stock

1.What is the current stock price of Disney (DIS)?

On January 8, 2025, the day the stock closed, Disney’s (DIS) stock closed at $109.76, down $1.63 (-1.46%.) The pre-market price as of January 10, 2025, at 8:The price was $110.07 (+0.31 or 0.28%) 20 AM EST.

2.Is Disney stock suitable for long-term investment?

A blue chip stock with a very strong brand and diversified revenue streams, Disney is. We’ll have to see if content performance, theme park recovery, and streaming platform expansion is going to be able to drive long term growth for its potential.

3.What is the analyst rating for Disney?

Disney has been rated a ‘Buy’ by analysts who assign it a price target of $125.83, which would imply an upside of 14.64% from the current price.

4.What is the stock symbol and exchange for Disney?

The stock symbol for Disney on the New York Stock Exchange (NYSE) trades under the ticker “DIS.”

Pingback: Amgen Inc. (AMGN) Stock Forecast, Price Prediction 2025, 2026, (2027 - 2030)

Pingback: Bank of America (BAC) Stock Forecast and Price Target 2025, 2026, 2027-2030

Pingback: Broadcom Inc. (AVGO) Stock Price Prediction and Price Target (2024-2030)

Pingback: Ameriprise Financial (AMP) Stock Price Forecast, Price Target (2024-2030)

Pingback: Albemarle Corporation (ALB) Stock Forecast, Price Target (2025 to 2030)