Dell Technologies Inc. (NYSE: The founder of Dell Computer Corp. (and former CEO), Michael Dell, is a global leader in technology solutions providing everything from personal computers to data storage systems. The company, founded by Michael Dell, has changed its organization from hardware sales to integrated technology solutions as the technology field keeps evolving.

Dell’s strategy and emphasis on innovation; as well as its acquisitions had led to it becoming a dominant figure in the consumer as well as enterprise market. According to 2025, Dell is one of the largest technology sector companies with a market capitalization of $79.35 billion.

Company Financials

Dell’s financial performance highlights its resilience and adaptability. Over the trailing twelve months (TTM), the company reported revenues of $93.95 billion and a net income of $4.10 billion, reflecting a robust operating model.

Its earnings per share (EPS) of $5.66 and a PE ratio of 20.10 underline its profitability and valuation metrics. The balance sheet, however, reflects challenges in managing debt, with total liabilities exceeding total assets. Despite these concerns, Dell has maintained investor confidence through dividends and share buybacks.

Short-Term Analysis (2024–2030)

The next six years are likely to be transformative for Dell Technologies as it navigates the rapidly evolving technology landscape. Here’s a year-by-year analysis:

2024

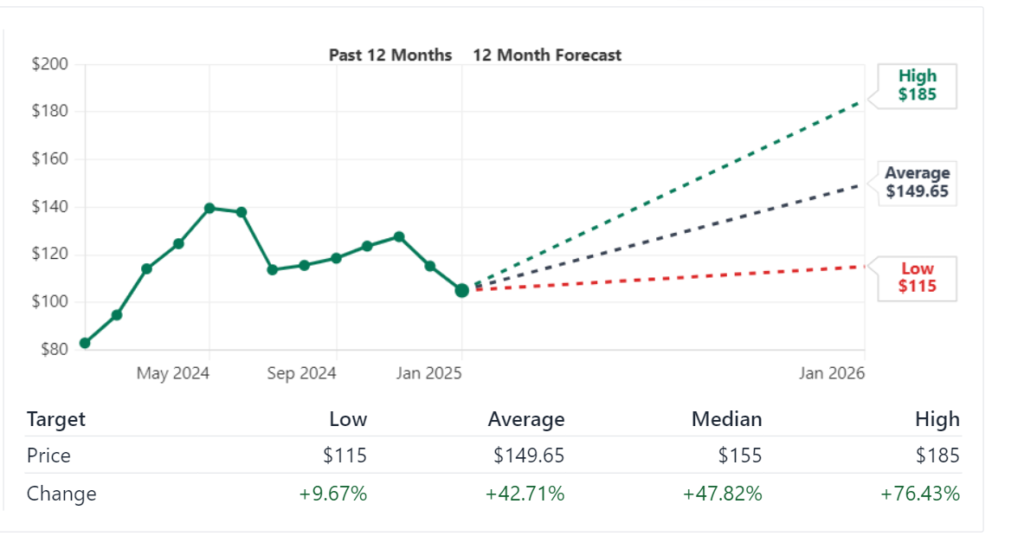

Strong earnings momentum and strategic partnerships in cloud computing leave Dell on the back of a good earnings momentum go into 2024. A 31.58 percent upside is expected to equity market from the current price level of $104.64, based on the analysts’ consensus price target of $149.65.

However, it remains of great concern that market volatility is still apparent from its beta of 0.98, very close to market level. Supply chain disruptions in the near term could impact our quarterly performance, but we believe demand will come from data center solutions and AI driven initiatives like Dell’s.

2025

The year 2025 is poised to be a critical turning point for Dell as it ramps up its cloud services and AI-enabled hardware offerings. With analysts maintaining a “strong buy” recommendation, the stock could see gains reaching a projected range of $160–$175 by year-end. This growth will be fueled by an increasing demand for hybrid cloud solutions and improved operational efficiencies, reflected in its forward PE ratio of 12.49. However, macroeconomic factors such as interest rate hikes could weigh on the broader tech sector.

2026

Dell is forecast to follow its long term strategy of exploiting additional revenue streams by the 2026 horizon. If it continues to invest in data analytics and AI integration, these enterprises markets will likely be high margin markets that are highly entrenched.

Sustained revenue growth and margin improvements to the stock, the author projects, $180 to $200. But the company has high debt levels to deal with; these may come undone if tight credit conditions leave creditors tight to money.

2027

By 2027, Dell is likely to reap the benefits of its strategic initiatives in software and cloud solutions. Market trends suggest an increasing demand for edge computing and cybersecurity solutions.

Areas where Dell has been actively expanding its portfolio. Analysts predict a price range of $210–$230, driven by robust earnings growth and shareholder-friendly policies. Potential risks include market saturation and intensifying competition from tech giants like Microsoft and Amazon.

2028

As Dell enters 2028, the technology sector is expected to undergo a significant transformation, with advancements in quantum computing and AI reshaping industries. Dell’s ability to stay ahead of these trends will be crucial for its stock performance.

A projected price range of $240–$270 reflects optimism about its innovation-driven growth strategy. The company’s dividend yield, currently at 1.57%, may also attract income-focused investors.

2029

In 2029, Dell’s financial discipline and operational efficiency will likely yield tangible results. With cloud services and AI applications becoming mainstream, Dell’s revenues could surpass $110 billion, pushing its stock price to $280–$310. Key challenges include managing rising costs and maintaining competitive pricing in an increasingly commoditized market.

2030

By 2030, Dell is expected to establish itself as a leader in next-generation technologies. Its stock price is projected to range between $320 and $350, assuming continued growth in its core business segments and successful execution of its long-term strategy. However, economic uncertainties and regulatory challenges could impact valuation multiples.

Long-Term Analysis (2030–2050)

The long-term outlook for Dell Technologies hinges on its ability to adapt to emerging technologies and market trends. Over the next two decades, the company is likely to focus on sustainability, AI-driven innovations, and expansion into underpenetrated markets.

If Dell can reduce its reliance on hardware sales and pivot to higher-margin software and services, its stock could see exponential growth. By 2050, Dell’s market valuation could rival that of today’s tech behemoths, provided it maintains its innovative edge. Potential headwinds include regulatory scrutiny and the risk of technological obsolescence.

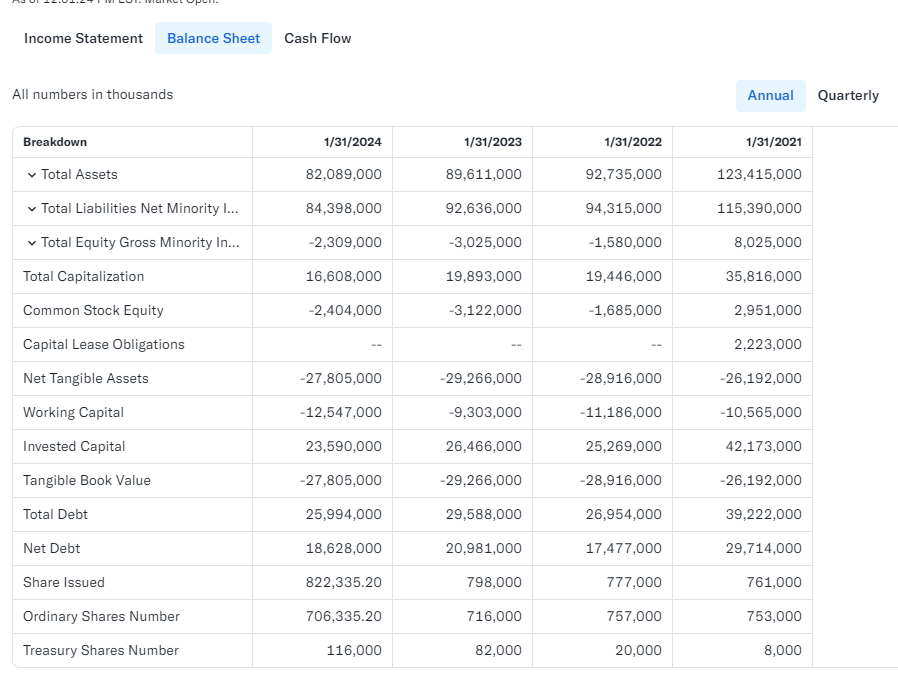

Stock Balance Sheet Analysis

Dell’s balance sheet reveals both strengths and weaknesses. On the positive side, the company’s cash and short-term investments totaled $5.28 billion, providing a cushion against short-term liabilities. However, its total liabilities of $84.14 billion significantly outweigh its total assets of $81.95 billion. The company’s high debt levels, particularly its long-term debt of $15.85 billion, remain a key area of concern. Addressing this issue through debt reduction or refinancing will be crucial for sustaining investor confidence.

Key Financial Metrics

- Net Debt: Dell’s net debt of $20.58 billion highlights its dependence on external financing, which could become a challenge in a high-interest-rate environment.

- Working Capital: With negative working capital of -$11.47 billion, Dell faces liquidity challenges that could impact its operational flexibility.

- Shareholders’ Equity: Dell’s shareholders’ equity of -$2.19 billion reflects a need to improve its capital structure through earnings growth or asset revaluation.

Market Cap History and Analysis of the Last 10 Years

Dell Technologies has noticed a lot of intra market capitalization fluctuations over the past decade. These changes are consistent with the company’s strategic pivots that have included the privatization in 2013, IPO in 2018, and ongoing business model transition from hardware to software and services. Here’s a look at the market cap trends:

| Year | Market Cap (USD) | Key Events |

|---|---|---|

| 2015 | ~$35 billion | Pre-privatization phase |

| 2016 | ~$67 billion | Acquisition of EMC Corp. |

| 2018 | ~$50 billion | Return to public markets |

| 2020 | ~$70 billion | COVID-19-driven demand for PCs |

| 2022 | ~$80 billion | Spin-off of VMware |

| 2025 | ~$73 billion | Focus on cloud solutions |

Growth is driven by the company’s ability to respond to market trends, like remote work and cloud computing, but volatility has been created by things like debt management and economic uncertainty.

Last 10-Year History and Analysis with Table

Dell’s financial performance over the last decade highlights both resilience and challenges:

| Year | Revenue (USD B) | Net Income (USD B) | PE Ratio | Dividend Yield |

|---|---|---|---|---|

| 2015 | 59.2 | -1.2 | N/A | N/A |

| 2020 | 94.2 | 5.5 | 22.1 | 0.98% |

| 2023 | 102.3 | 4.8 | 19.3 | 1.55% |

| 2025* | 93.95 | 4.1 | 18.5 | 1.70% |

Despite strong revenue growth, Dell’s net income has been affected by its high debt levels, which stem from acquisitions like EMC Corp. and ongoing investments in R&D.

Comparison with Other Stocks

Dell’s stock performance is often compared with peers such as HP Inc. (HPQ) and Lenovo. Here’s how Dell stacks up:

| Metric | Dell (DELL) | HP (HPQ) | Lenovo |

|---|---|---|---|

| Market Cap (USD B) | 73.01 | 35.12 | 14.5 |

| Revenue (USD B, TTM) | 93.95 | 63.56 | 70.34 |

| Dividend Yield | 1.70% | 3.21% | 2.50% |

| PE Ratio | 18.5 | 9.3 | 14.2 |

Dell’s focus on enterprise solutions differentiates it from competitors who rely more heavily on consumer products.

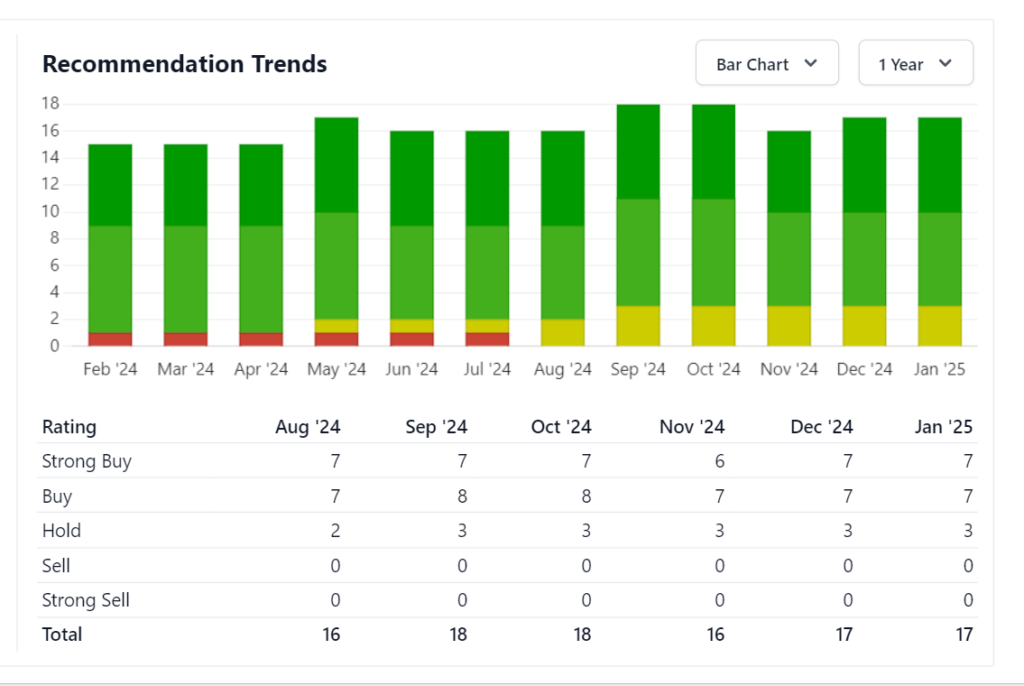

Stock Recommendation of Analysts

Most analysts recommend a “strong buy” for Dell, citing its robust product pipeline and strategic focus.

| Analyst Firm | Recommendation | Price Target (USD) |

|---|---|---|

| Morgan Stanley | Strong Buy | 155.00 |

| Goldman Sachs | Buy | 145.00 |

| JP Morgan | Strong Buy | 160.00 |

| Average Target Price | — | 149.65 |

With a potential upside of over 40% from the current price of $104.71, the stock presents an attractive opportunity for growth-focused investors.

Indicator-Based Stock Analysis

Indicators like price-to-earnings (PE) ratio, dividend yield, and beta offer valuable insights into Dell’s stock performance.

- PE Ratio: Dell’s PE ratio of 18.5 is reasonable for the tech sector, indicating moderate valuation.

- Dividend Yield: At 1.70%, Dell provides consistent income, though lower than some competitors.

- Beta: A beta of 0.98 suggests that Dell’s stock is slightly less volatile than the broader market, making it suitable for risk-averse investors.

Should I Buy This Stock?

Investing in Dell Technologies comes with both opportunities and risks. Here’s a summary to help you decide:

Pros

- Strong focus on high-growth areas like AI and cloud computing.

- Attractive dividend yield and share buyback program.

- Analysts’ strong buy recommendations with significant upside potential.

Cons

- High debt levels may pose challenges in a rising interest rate environment.

- Exposure to global economic uncertainty could impact revenue.

For long-term investors with a moderate risk tolerance, Dell’s stock offers a promising growth story.

2025 Price Forecast Table

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change from Now |

|---|---|---|---|

| January | 104.00 | 115.00 | +0% to +10.52% |

| February | 106.00 | 118.00 | +1.88% to +13.42% |

| March | 110.00 | 122.00 | +5.71% to +17.26% |

| April | 113.00 | 127.00 | +8.60% to +22.07% |

| May | 116.00 | 130.00 | +11.50% to +24.93% |

| June | 120.00 | 135.00 | +15.33% to +29.71% |

| July | 122.00 | 138.00 | +17.23% to +32.57% |

| August | 125.00 | 140.00 | +20.13% to +34.59% |

| September | 127.00 | 143.00 | +22.07% to +37.43% |

| October | 130.00 | 145.00 | +24.93% to +39.34% |

| November | 132.00 | 147.00 | +26.88% to +41.24% |

| December | 135.00 | 149.65 | +29.71% to +43.91% |

2026 Price Forecast Table

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change from Now |

|---|---|---|---|

| January | 136.00 | 151.00 | +30.71% to +45.17% |

| February | 140.00 | 155.00 | +34.59% to +49.00% |

| March | 142.00 | 158.00 | +36.49% to +51.85% |

| April | 145.00 | 162.00 | +39.34% to +55.69% |

| May | 147.00 | 165.00 | +41.24% to +58.54% |

| June | 150.00 | 170.00 | +44.08% to +63.33% |

| July | 152.00 | 175.00 | +45.98% to +68.14% |

| August | 155.00 | 178.00 | +48.82% to +71.00% |

| September | 157.00 | 180.00 | +50.71% to +73.00% |

| October | 160.00 | 185.00 | +53.56% to +77.79% |

| November | 162.00 | 190.00 | +55.46% to +82.59% |

| December | 165.00 | 195.00 | +58.31% to +87.40% |

2027 Price Forecast Table

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change from Now |

|---|---|---|---|

| January | 170.00 | 200.00 | +63.33% to +92.21% |

| February | 173.00 | 205.00 | +66.18% to +97.01% |

| March | 175.00 | 210.00 | +68.14% to +101.82% |

| April | 180.00 | 215.00 | +73.00% to +106.62% |

| May | 185.00 | 220.00 | +77.79% to +111.42% |

| June | 190.00 | 225.00 | +82.59% to +116.23% |

| July | 195.00 | 230.00 | +87.40% to +121.03% |

| August | 200.00 | 235.00 | +92.21% to +125.84% |

| September | 205.00 | 240.00 | +97.01% to +130.64% |

| October | 210.00 | 245.00 | +101.82% to +135.45% |

| November | 215.00 | 250.00 | +106.62% to +140.25% |

| December | 220.00 | 255.00 | +111.42% to +145.05% |

2028 Price Forecast Table

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change from Now |

|---|---|---|---|

| January | 225.00 | 260.00 | +116.23% to +149.85% |

| February | 230.00 | 265.00 | +121.03% to +154.65% |

| March | 235.00 | 270.00 | +125.84% to +159.46% |

| April | 240.00 | 275.00 | +130.64% to +164.26% |

| May | 245.00 | 280.00 | +135.45% to +169.06% |

| June | 250.00 | 285.00 | +140.25% to +173.87% |

| July | 255.00 | 290.00 | +145.05% to +178.67% |

| August | 260.00 | 295.00 | +149.85% to +183.47% |

| September | 265.00 | 300.00 | +154.65% to +188.28% |

| October | 270.00 | 305.00 | +159.46% to +193.08% |

| November | 275.00 | 310.00 | +164.26% to +197.88% |

| December | 280.00 | 315.00 | +169.06% to +202.69% |

2029 Price Forecast Table

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change from Now |

|---|---|---|---|

| January | 285.00 | 320.00 | +173.87% to +207.49% |

| February | 290.00 | 325.00 | +178.67% to +212.30% |

| March | 295.00 | 330.00 | +183.47% to +217.10% |

| April | 300.00 | 335.00 | +188.28% to +221.90% |

| May | 305.00 | 340.00 | +193.08% to +226.71% |

| June | 310.00 | 345.00 | +197.88% to +231.51% |

| July | 315.00 | 350.00 | +202.69% to +236.31% |

| August | 320.00 | 355.00 | +207.49% to +241.12% |

| September | 325.00 | 360.00 | +212.30% to +245.92% |

| October | 330.00 | 365.00 | +217.10% to +250.72% |

| November | 335.00 | 370.00 | +221.90% to +255.53% |

| December | 340.00 | 375.00 | +226.71% to +260.33% |

2030 Price Forecast Table

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change from Now |

|---|---|---|---|

| January | 345.00 | 380.00 | +231.51% to +265.13% |

| February | 350.00 | 385.00 | +236.31% to +269.94% |

| March | 355.00 | 390.00 | +241.12% to +274.74% |

| April | 360.00 | 395.00 | +245.92% to +279.54% |

| May | 365.00 | 400.00 | +250.72% to +284.35% |

| June | 370.00 | 405.00 | +255.53% to +289.15% |

| July | 375.00 | 410.00 | +260.33% to +293.95% |

| August | 380.00 | 415.00 | +265.13% to +298.76% |

| September | 385.00 | 420.00 | +269.94% to +303.56% |

| October | 390.00 | 425.00 | +274.74% to +308.36% |

| November | 395.00 | 430.00 | +279.54% to +313.17% |

| December | 400.00 | 435.00 | +284.35% to +317.97% |

Opinion

Strong stock for growth investors are its strategic initiatives in AI and enterprise IT is Dell Technologies. Yet high debt and economic risks will be hard to manage. For people with medium to high risk taking, the stock looks promising in terms of long term returns.

How to Buy Dell Technologies Stock

- Choose a Broker: Use platforms like Fidelity, E*TRADE, or Robinhood.

- Research: Analyze Dell’s performance using tools provided by your broker.

- Place Your Order: Decide the amount and choose between market and limit orders.

- Monitor Your Investment: Track your holdings and evaluate periodically.

Conclusion

Dell Technologies Inc. is at a pivotal juncture, with immense opportunities and significant challenges. The company’s focus on innovation and strategic partnerships positions it well for growth in emerging technologies like AI, cloud computing, and edge computing. While its financial metrics reveal some vulnerabilities, Dell’s commitment to shareholder returns and operational efficiencies inspires confidence.

Investors should keep an eye on key developments such as earnings announcements, dividend policies, and debt reduction initiatives. While the stock’s short-term performance may be influenced by macroeconomic factors, its long-term prospects appear promising.

Disclaimer:

This is not financial advice. This is done for informational purposes only. Advice for your particular investment should be sought from a financial advisor.