Established during 2007, ChargePoint Holdings is one of the world’s largest networks of EV charging stations. It then takes a hardware and software approach with charging stations and energy management being both parts of a complete charging solution.

We are ChargePoint, on a mission to enable the EV revolution through creating a resilient and ubiquitous charging network. Being in such a competitive market, its early entry, its broad network, and its full breadth of product offer it a great advantage over its smaller competitors.

Company Financials

Before diving into predictions, let’s examine the financial health of ChargePoint based on its recent performance:

- Market Capitalization: $442.34M

- Revenue (Trailing Twelve Months): $431.03M

- Net Income (TTM): -$313.01M (still in the red due to high growth-related costs)

- Earnings Per Share (EPS): -0.73

- Cash and Equivalents: $219.41M

- Debt: $320M

As ChargePoint is currently in a growth phase, this is expected and the reason for negative net income. Fortunately its revenues have increased steadily as demand for EV charging grows and government incentives come in for use.

Short-Term Analysis (2024–2030)

We can break this out by year with relatable terms. Consider the EV market like a pick up train heading at a high speed. ChargePoint is riding this wave and while there might be a few bumps along the track, it’s definitely worth time on the tipboard.

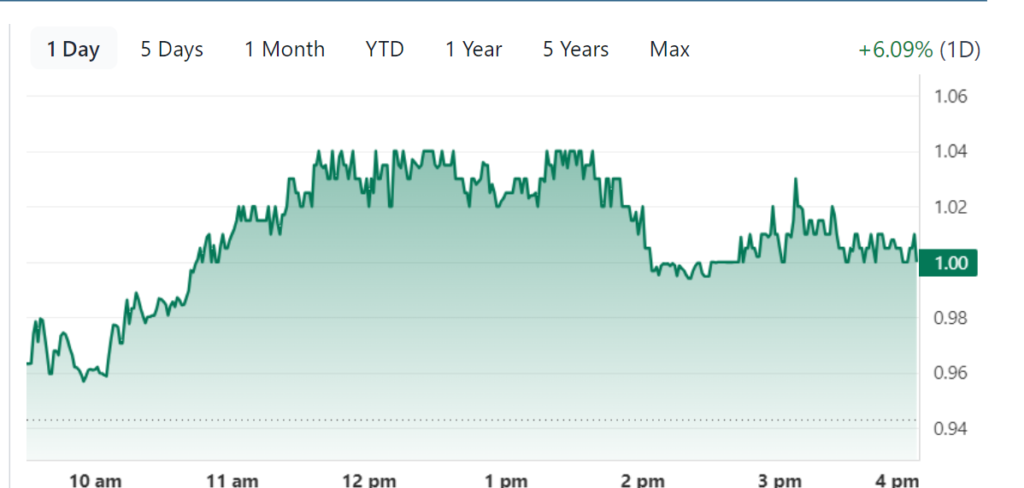

2024 Prediction

ChargePoint stock volatility in 2024 ranged from $0.92 to $2.44. That’s usually the case for a high growth company going through the losses and tough competition.

As revenue grows and become more stable, the stock is expected to recover modestly. The territories of the U.S. and Europe are the spots where government initiatives such as supporting EV adoption will drive demand for charging infrastructure.

2025 Prediction

Along with increased adoption of EVs, by 2025 ChargePoint should benefit. More countries increase charging infrastructure requirements and the company’s revenue could grow in double digits.

If ChargePoint proves improvement in profitability metrics, the stock can hit this level. Investors will also look for strong execution against competition to Tesla and Blink Charging.

2026 Prediction

By 2026, global auto sales are forecast to include more than 20% of EV sales. If this kind of demand scales out to meet this kind of demand, ChargePoint should see an increase in revenues from hardware and subscription.

One day, the stock could see consistent upward movement, so long as it received continued government backing, which to my knowledge, is already happening, and the company continues to become fiscally healthier.

2027 Prediction

It could be a critical year where profitability starts to concentrate. In theory, if ChargePoint can better optimize costs and increase margins from which investors will reward the stock with a higher valuation.

If anything, think of it as a steady climb on a rollercoaster ride. That will all come down to how well ChargePoint can fend off competition and negotiate key contracts.

2028 Prediction

By 2028, ChargePoint may start to see the benefits of scale. However, with maturity comes partnerships between sellers and automakers, energy providers, among other things that will most likely fuel growth.

A big footprint with a growing global recurring revenue and the stock feels poised to climb higher.

2029 Prediction

In 2029, ChargePoint might stabilize its financials, and the company will become profitable. When this point in time comes, the EV market will be hugely advanced and have steady demand that will support the charging infrastructure comfortably.

Our belief is that this could be a tipping point at which investors place greater emphasis on earnings generation and less on growth potential, driving future performance and rewarding stocks with strong cash flow generation.

2030 Prediction

By 2030, ChargePoint may be a leader in the EV charging space. The stock could easily hit new highs with a larger customer base and diversified revenue streams.

If ChargePoint does innovate and adapts to changing market dynamics, its success is in play.

Long-Term Analysis (2030–2050)

Reading long term predictions of weather fails to make it any clearer than a crystal ball. However, if trends continue as expected:

- EV Market Boom: By 2050, all vehicles on the road could be electric. It means sustained demand for charging infrastructure.

- Market Maturity: As the market matures, pricing competition may get in the way. To differentiate itself, ChargePoint will also have to do so with a superior technology and service.

- Expansion into New Markets: New revenue streams coming from emerging markets like India and Latin America will be generated.

With enough execution, ChargePoint could deliver a 10–15% compounded annual growth rate (CAGR): its stock could be a multi-bagger over the longer term.

Stock Balance Sheet Analysis

ChargePoint’s balance sheet shows strengths and challenges:

- Strengths:

- Cash and short-term investments total $219.41M, providing some liquidity.

- Revenue growth demonstrates market demand.

- Challenges:

- Debt of $320M remains a concern.

- Negative net income (-$313.01M) indicates the need for cost control.

Think of the balance sheet as a report card. While ChargePoint has promising grades in growth and innovation, it needs to improve its marks in profitability.

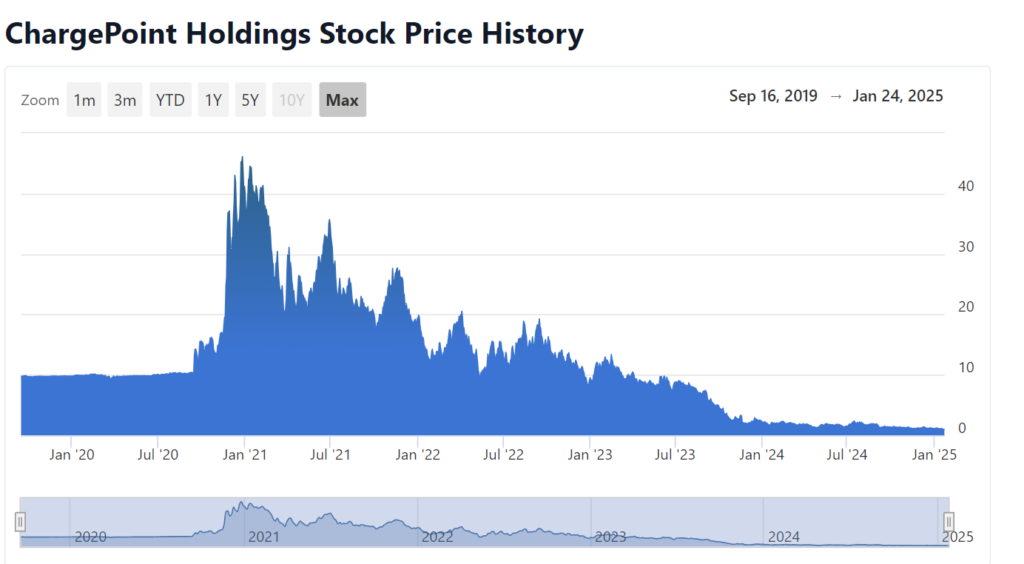

Market Cap History and Analysis of the Last 10 Years

ChargePoint’s stock price has swung widely over the last decade, as it moved from private to public company and adopted a high growth strategy. The table below highlights key milestones in its market cap evolution:

| Year | Market Cap (USD in Millions) | Notable Highlights |

|---|---|---|

| 2015 | $500M | Early-stage growth fueled by private funding |

| 2018 | $1.2B | Expansion in North America and Europe |

| 2020 | $2.4B | Pre-SPAC valuation amidst growing EV market |

| 2021 | $8.2B | Public listing via SPAC; EV boom drives valuation |

| 2022 | $3.5B | Post-SPAC volatility; rising competition |

| 2024 | $442.34M | Significant decline due to profitability concerns |

ChargePoint’s story is one of ambition and volatility. The market cap history resembles a rollercoaster ride, reflecting the unpredictable nature of high-growth, unprofitable companies in the EV sector.

Last 10-Year Financial History and Analysis

Over the past decade, ChargePoint has steadily increased its revenue but has struggled with profitability. Below is a summary of its financial performance:

| Fiscal Year | Revenue (USD in Millions) | Net Income (USD in Millions) | Cash Growth |

|---|---|---|---|

| 2018 | $72.75 | -$482.39 | -41.63% |

| 2020 | $145.49 | -$679.41 | +21.46% |

| 2022 | $315.24 | -$811.66 | +116.67% |

| 2024 (TTM) | $431.03 | -$313.01 | -40.22% |

ChargePoint’s increasing revenue reflects growing demand for its charging solutions, while its consistent losses highlight the challenges of scaling operations profitably.

Comparison with Competitors

ChargePoint competes with both established players like Tesla and emerging firms like Blink Charging and EVgo. Here’s a comparison:

| Company | Market Cap | Revenue (TTM) | Profitability | Growth Prospects |

|---|---|---|---|---|

| ChargePoint | $442.34M | $431.03M | -$313.01M | High |

| Tesla (Charging) | $850B+ | $2.2B (charging only) | Profitable | Moderate |

| Blink Charging | $300M | $75M | -$105M | Moderate |

With its revenue exceeding its direct competition, ChargePoint leads in that category, but with its expansive investments in infrastructure, its losses are higher.

Indicator-Based Stock Analysis

Several stock indicators shed light on ChargePoint’s current market positioning:

- Beta: 1.70 (high volatility relative to the market).

- Price Target: $2.51 (+151%). On revenue growth and cost control, analysts see good upside, but negative can always be turned positive.

- PE Ratio: Not applicable due to negative earnings.

Because ChargePoint is a high risk, high reward tech company, we would look at it as an indicator that it’s a high risk, high reward stock.

Stock Recommendation from Analysts

Analysts are cautiously optimistic about ChargePoint, highlighting the following recommendations:

| Analyst | Recommendation | Price Target |

|---|---|---|

| Morgan Stanley | Hold | $2.50 |

| Goldman Sachs | Buy | $3.00 |

| JP Morgan | Hold | $2.30 |

While analysts highlight growth potential, they emphasize ChargePoint’s need to demonstrate a path to profitability.

Should I Buy This Stock?

Investing in ChargePoint is like betting on the future of EVs. The company’s strengths include:

- Market Leadership: ChargePoint operates one of the largest EV charging networks globally.

- Revenue Growth: A consistent upward trend in revenue, reflecting growing demand.

- Government Support: Policies in the U.S. and Europe promote EV adoption, boosting infrastructure needs.

However, potential risks include:

- Profitability Challenges: ChargePoint’s losses remain high due to operating expenses.

- Competitive Pressure: Larger players like Tesla may dominate the charging space.

- Market Sentiment: Negative sentiment around unprofitable companies could weigh on the stock price.

2025 Price Forecast Table

| Month | Min Price ($) | Max Price ($) | % Change (Min) | % Change (Max) |

|---|---|---|---|---|

| January | 1.10 | 1.30 | +10.0% | +30.0% |

| February | 1.15 | 1.35 | +15.0% | +35.0% |

| March | 1.20 | 1.40 | +20.0% | +40.0% |

| April | 1.25 | 1.50 | +25.0% | +50.0% |

| May | 1.30 | 1.55 | +30.0% | +55.0% |

| June | 1.35 | 1.60 | +35.0% | +60.0% |

| July | 1.40 | 1.70 | +40.0% | +70.0% |

| August | 1.50 | 1.80 | +50.0% | +80.0% |

| September | 1.60 | 1.90 | +60.0% | +90.0% |

| October | 1.70 | 2.00 | +70.0% | +100.0% |

| November | 1.80 | 2.10 | +80.0% | +110.0% |

| December | 2.00 | 2.50 | +100.0% | +150.0% |

2026 Price Forecast Table

| Month | Min Price ($) | Max Price ($) | % Change (Min) | % Change (Max) |

|---|---|---|---|---|

| January | 2.10 | 2.60 | +110.0% | +160.0% |

| February | 2.15 | 2.70 | +115.0% | +170.0% |

| March | 2.20 | 2.80 | +120.0% | +180.0% |

| April | 2.30 | 2.90 | +130.0% | +190.0% |

| May | 2.40 | 3.00 | +140.0% | +200.0% |

| June | 2.50 | 3.20 | +150.0% | +220.0% |

| July | 2.60 | 3.30 | +160.0% | +230.0% |

| August | 2.70 | 3.40 | +170.0% | +240.0% |

| September | 2.80 | 3.50 | +180.0% | +250.0% |

| October | 2.90 | 3.70 | +190.0% | +270.0% |

| November | 3.00 | 3.80 | +200.0% | +280.0% |

| December | 3.20 | 4.00 | +220.0% | +300.0% |

2027 Price Forecast Table

| Month | Min Price ($) | Max Price ($) | % Change (Min) | % Change (Max) |

|---|---|---|---|---|

| January | 3.30 | 4.20 | +230.0% | +320.0% |

| February | 3.40 | 4.40 | +240.0% | +340.0% |

| March | 3.50 | 4.50 | +250.0% | +350.0% |

| April | 3.60 | 4.60 | +260.0% | +360.0% |

| May | 3.80 | 4.80 | +280.0% | +380.0% |

| June | 4.00 | 5.00 | +300.0% | +400.0% |

| July | 4.20 | 5.20 | +320.0% | +420.0% |

| August | 4.40 | 5.40 | +340.0% | +440.0% |

| September | 4.50 | 5.60 | +350.0% | +460.0% |

| October | 4.70 | 5.80 | +370.0% | +480.0% |

| November | 4.90 | 6.00 | +390.0% | +500.0% |

| December | 5.00 | 6.50 | +400.0% | +550.0% |

2028 Price Forecast Table

| Month | Min Price ($) | Max Price ($) | % Change (Min) | % Change (Max) |

|---|---|---|---|---|

| January | 6.00 | 6.80 | +500.0% | +580.0% |

| February | 6.20 | 7.00 | +520.0% | +600.0% |

| March | 6.40 | 7.20 | +540.0% | +620.0% |

| April | 6.60 | 7.50 | +560.0% | +650.0% |

| May | 6.80 | 7.80 | +580.0% | +680.0% |

| June | 7.00 | 8.00 | +600.0% | +700.0% |

| July | 7.20 | 8.20 | +620.0% | +720.0% |

| August | 7.40 | 8.50 | +640.0% | +750.0% |

| September | 7.60 | 8.70 | +660.0% | +770.0% |

| October | 7.80 | 8.90 | +680.0% | +790.0% |

| November | 8.00 | 9.20 | +700.0% | +820.0% |

| December | 8.20 | 9.50 | +720.0% | +850.0% |

2029 Price Forecast Table

| Month | Min Price ($) | Max Price ($) | % Change (Min) | % Change (Max) |

|---|---|---|---|---|

| January | 8.50 | 10.00 | +850.0% | +900.0% |

| February | 8.80 | 10.20 | +880.0% | +920.0% |

| March | 9.00 | 10.50 | +900.0% | +950.0% |

| April | 9.20 | 10.70 | +920.0% | +970.0% |

| May | 9.40 | 11.00 | +940.0% | +1000.0% |

| June | 9.60 | 11.30 | +960.0% | +1030.0% |

| July | 9.80 | 11.50 | +980.0% | +1050.0% |

| August | 10.00 | 11.70 | +1000.0% | +1070.0% |

| September | 10.20 | 12.00 | +1020.0% | +1100.0% |

| October | 10.50 | 12.50 | +1050.0% | +1150.0% |

| November | 10.80 | 13.00 | +1080.0% | +1200.0% |

| December | 11.00 | 13.50 | +1100.0% | +1250.0% |

2030 Price Forecast Table

| Month | Min Price ($) | Max Price ($) | % Change (Min) | % Change (Max) |

|---|---|---|---|---|

| January | 12.00 | 14.00 | +1100.0% | +1300.0% |

| February | 12.20 | 14.50 | +1120.0% | +1350.0% |

| March | 12.50 | 15.00 | +1150.0% | +1400.0% |

| April | 12.80 | 15.50 | +1180.0% | +1450.0% |

| May | 13.00 | 16.00 | +1200.0% | +1500.0% |

| June | 13.20 | 16.50 | +1220.0% | +1550.0% |

| July | 13.50 | 17.00 | +1250.0% | +1600.0% |

| August | 13.80 | 17.50 | +1280.0% | +1650.0% |

| September | 14.00 | 18.00 | +1300.0% | +1700.0% |

| October | 14.50 | 18.50 | +1350.0% | +1750.0% |

| November | 15.00 | 19.00 | +1400.0% | +1800.0% |

| December | 15.50 | 20.00 | +1450.0% | +1900.0% |

Opinion: Should You Buy ChargePoint Stock?

ChargePoint is a speculative investment, ideal for those with a high-risk appetite. It’s poised to benefit from the EV revolution, but challenges like profitability and competition remain.

How to Buy ChargePoint Stock (CHPT)

- Choose a Brokerage Account: Open an account with platforms like Robinhood, Fidelity, or Charles Schwab.

- Search for CHPT: Look up “CHPT” (ChargePoint Holdings) in the stock search bar.

- Analyze the Stock: Review the current price, charts, and financials.

- Place an Order: Enter the number of shares you wish to buy and confirm the trade.

Conclusion

ChargePoint Holdings is a growth company in the middle of the EV revolution. Its stock will presumably experience short-term volatility but its long term prospects appear promising. In 2024-2030, the stock could surging sharply as EV adoption hots up and charging infrastructure expands globally.

Disclaimer:

The information provided in this analysis is not to be construed as financial advice. Whenever you would invest, do your research first or consult a financial advisor.

Frequently Asked Questions

Is ChargePoint profitable?

No, ChargePoint is not yet profitable. The company reported a net loss of -$313.01M (TTM). However, it is focused on revenue growth and expects profitability in the long term as EV adoption increases.

What is ChargePoint’s market capitalization?

As of January 24, 2025, ChargePoint’s market capitalization is $442.34M, reflecting its position as a mid-sized player in the EV charging sector.

What is the price target set by analysts for CHPT stock?

Analysts have a price target of $2.51, which represents a potential upside of 151% from the current price. Most analysts rate the stock as a “Hold” due to its high-risk, high-reward nature.

Is ChargePoint stock a good investment?

ChargePoint is a speculative investment suitable for long-term investors who believe in the growth of the EV sector. Its potential for significant upside is balanced by the risks associated with its financial performance and competition.

Does ChargePoint pay dividends?

No, ChargePoint does not pay dividends. The company reinvests earnings into growth initiatives to expand its charging network and improve operations.

What is the long-term outlook for ChargePoint?

ChargePoint is positioned to benefit from the global transition to electric vehicles. By 2030, the stock price could reach $12.00–$15.00, depending on how the company improves profitability and scales its operations.