The Boeing Company makes planes for commercial travel, military protection, space travel, and security. Boeing started running their business in 1916 from a main office in Chicago, IL, and currently trades shares on the NYSE as BA. Boeing makes high-quality planes (737 and 787) but has now added space and defense solutions to its range of products.

Though it is known for developing innovative solutions, their business has struggled throughout recent years due to production issues, product safety concerns, and problems making enough money.

Company Financials

With $131.29 billion market capitalization, Boeing shares were $175.41 starting January 2025. In the past 12 months, Boeing’s shares have moved between $137.03 apiece and $217.59. Its stock value keeps changing. The company made $73.29 billion in sales over the last year, but lost $7.98 billion in total, giving its investors returns of -$12.99 per share.

Stock is in financial trouble because its whole list of debts ($161.26 billion) is larger than its total amount of assets ($137.69 billion). The firm’s balance sheet shows two key figures: $57.65 billion in debts and -$47.20 billion in net cash.

Short-Term Analysis (2024–2030)

Stock price trends in the next few years are expected to reflect both the company’s efforts to stabilize operations and external factors impacting the aerospace industry. Below is a year-by-year analysis of Boeing’s stock price predictions:

2024: Its share price will likely continue facing issues in 2024 because production problems won’t go away and suppliers are still recovering from supply chain disruptions. The average price forecast shows a 12.77% jump to $197.89 by next year, according to analyst estimates.

Getting more 737 MAX planes into production and meeting delivery deadlines on their backlog orders should help the company do better.

2025: Boeing’s results for 2025 will grow at a typical rate as people travel more between countries after the COVID-19 pandemic ended. The stock could reach $210 in January 2025 when the company releases its earnings report, assuming simpler shipping processes and better financial management.

The stock shows a strong bounce, but it is very unpredictable and might make you feel like you’re on a turbulent plane flight.

2026: When stock rolls out brand-new planes and improves aviation fuel efficiency in 2026, investors may be willing to back the company more strongly. Boeing will likely jump to $230 if they succeed in lowering their debt and making their business work better.

Political tensions and economic hard times may keep the share price growth from reaching its full potential.

2027: Boeing should gain back all travel demand worldwide by 2027. Experts predict Boeing’s shares will rise from $240 to $250 when it grows its 5,000 aircraft block of orders.

Better profit and higher returns to shareholders will help keep the upward trajectory moving.

2028: Whether Boeing does well or poorly in 2028 will depend largely on how competently it deals with more opponents coming from Airbus and new aerospace industry players.

2029: Boeing hopes to get through 2029 without continued losses in its business. Investors stand to earn predictable income in 2029 if Boeing improves its production quality and running processes successfully.

With market success, Boeing’s stock could climb to $260. Boeing’s growth comes from two main sources: it will build more military planes, and will increase investments to develop space technologies.

2030: Experts believe Boeing’s plans for a better future will help them reach important goals before 2030. We can expect Boeing’s stock to reach between $290 and $310 if it improves its financial strength and seizes new business opportunities in urban air transportation and self-flying airplanes.

Long-Term Analysis (2030–2050)

Boeing will likely succeed in the future, but there are possible dangers they need to watch out for. The company plans to become a leader in aerospace technology with two major projects in mind:

Building airplanes using hydrogen fuel and developing better manufacturing approaches. From 2030 to 2050, Boeing’s stock could see exponential growth, driven by the following factors:

- Sustainability Initiatives: As countries worldwide work to become carbon neutral, Boeing’s money spent on making planes that use less fuel will be very important. By working together with governments and universities, Boeing can show they’re ahead of other companies in developing clean flying technology.

- Space Exploration: Boeing’s part in NASA’s Artemis mission and other space programs can lead to important income opportunities. With their satellites and space launch expertise, Boeing has no problem meeting market demand.

- Emerging Markets: More middle-class people in developing nations will make more flights go from point A to point B. Just meeting customers’ needs and low cost sales to various markets is what Boeing must do excellently.

By 2050, Boeing’s stock price could potentially exceed $500, assuming it successfully navigates industry challenges and macroeconomic uncertainties.

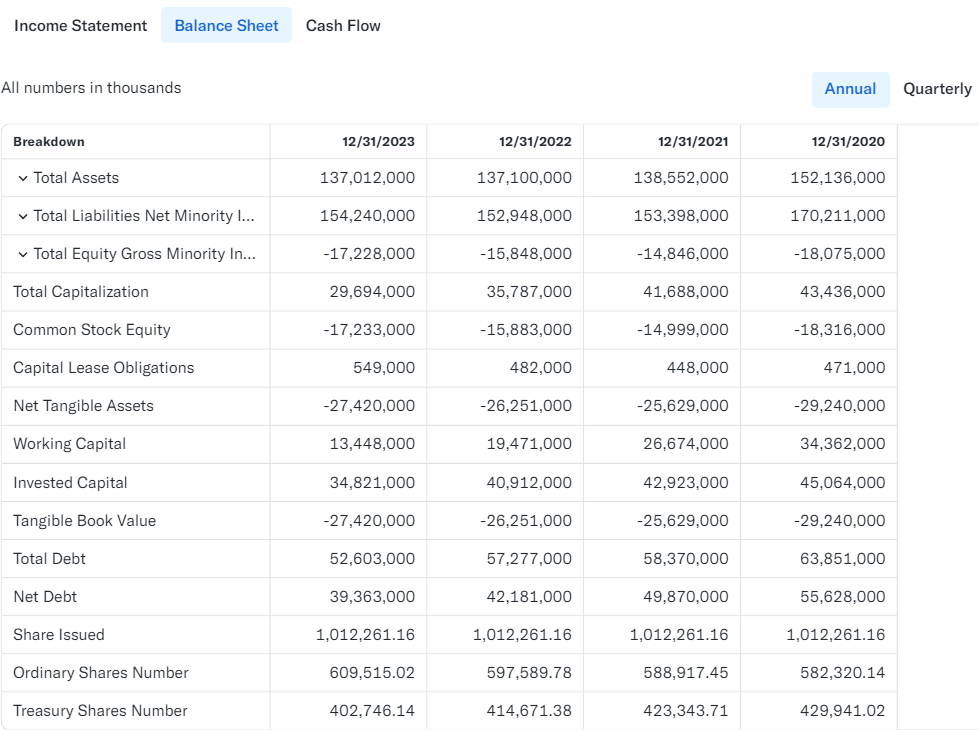

Stock Balance Sheet Analysis

The information in Boeing’s financial records tells us how well they stand with money versus debts. Despite having $137.69 billion total assets, Boeing’s overall debt of $161.26 billion leaves the company with -$23.56 billion in value for shareholders. The big debt and low cash situation show that Boeing must take action right now to fix its money problems. Key components of the balance sheet include:

- Cash & Short-Term Investments: From $13.36 billion last year to $10.45 billion now, Boeing’s cash reserves shrank by 21.74%. Boeing’s lost cash makes clear how much it needs to borrow from other sources to keep running.

- Inventory: Boeing has kept its $83.34 billion inventory level stable because clients continue to order planes that haven’t been delivered yet. Checking inventory is key to bringing cash more easily into our business.

- Debt: Boeing faces severe financial struggles because it owes so much money – $57.65 billion. Saving money on our core operations and building trusting connections with other companies is what we must do to stay strong in the near future.

- Working Capital: Boeing can handle its short-term debts more easily thanks to the $12.14 billion in working capital it has. However, Boeing’s negative net worth of -$33.68 billion shows we must fix deep structural problems before we can improve.

Market Cap History and Analysis of the Last 10 Years

Over the past decade, The Boeing Company (NYSE: The Boeing Company’s (NYSE: BA) market value went up and down based on three things: how well the economy was doing, global airlines’ demand for planes, and problems from outside. When financial markets reviewed Boeing in 2014, they put a market value of $91 billion on the company. During 2018, Boeing’s value hit its highest point at $207 billion thanks to high demand for aircraft and profitable business.

The 737 MAX grounding and COVID-19 hit Boeing’s value hard, bringing down its stock worth from $207 billion to $88 billion. In January 2025, the company’s share price has improved enough to make its market value $131.21 billion. Sales numbers have improved thanks to a better market for aircraft and solving past problems.

Last 10-Year History and Analysis (with Table)

| Year | Market Cap (USD Billion) | Revenue (USD Billion) | Net Income (USD Billion) |

|---|---|---|---|

| 2014 | 91 | 90.76 | 5.45 |

| 2015 | 97 | 96.11 | 5.18 |

| 2018 | 207 | 101.13 | 10.46 |

| 2020 | 88 | 58.16 | -11.94 |

| 2023 | 115 | 72.20 | -4.91 |

| Jan 2025 | 131.21 | 73.29 | -7.98 |

Comparison with Other Stocks

Among its competitors, Boeing’s results have both good and bad parts. For example:

- Airbus (Euronext): Due to regulatory limitations fixed by the EU, Airbus hasn’t faced drastic growth variations like some competitors while keeping an array of products flying.

- Lockheed Martin (NYSE): Lockheed Martin stays free of industry ups and downs since they rely heavily on doing business with the government.

| Company | Market Cap (USD Billion) | 2024 Revenue (Est.) | 2024 Net Income (Est.) |

|---|---|---|---|

| Boeing | 131.21 | 73.29 | -7.98 |

| Airbus | 140.50 | 78.00 | 4.90 |

| Lockheed Martin | 115.00 | 67.20 | 6.80 |

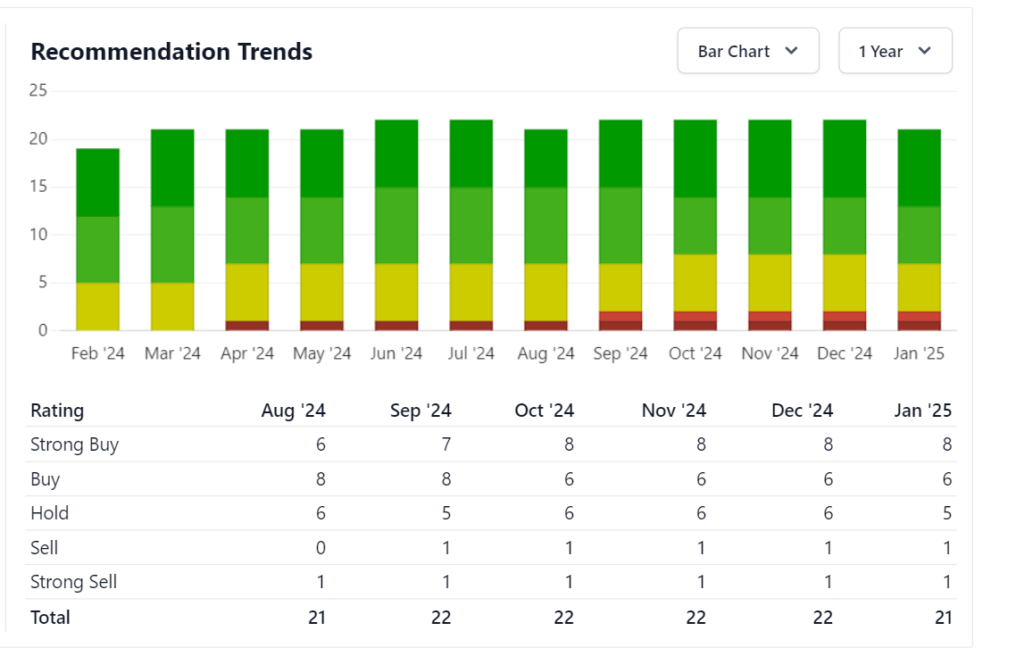

Stock Recommendation of Analysts (with Table)

Boeing’s stock movements draw different opinions among analysts because its recovery path is uncertain. Most stock analysts say you should buy Boeing’s shares because of the company’s potential to grow, yet some note its high debt problem as a cause for concern.

| Analyst | Rating | Price Target (USD) | Recommendation |

|---|---|---|---|

| Morgan Stanley | Overweight | 210 | Buy |

| Goldman Sachs | Neutral | 190 | Hold |

| JP Morgan | Overweight | 205 | Buy |

Indicator-Based Stock Analysis

- 52-Week Range: Share price fell almost $80 dollars during the last 12 months.

- Beta (1.53): Shows higher risk compared to other stocks in the market, but creates possibility for bigger earnings.

- Price-to-Earnings (PE) Ratio: Since stock lost money, investors are focused on how well it will get back into profits and how it plans to pay down its debts.

- Debt Levels: Boeing has a large debt of $57.65 billion that keeps it from making significant financial decisions.

Should you Buy This Stock?

Whether you should invest in stock shares depends on two things: your comfort with risk and what you hope to achieve from your investment. Here’s a breakdown:

Reasons to Consider Buying:

- Increased travel around the world has created solid orders for Boeing, which should generate higher sales.

- Analysts calculate that the stock will increase by 12.84%, hitting $197.89 soon.

- While the industry keeps track of growing fuel-efficient plane orders.

Reasons for Caution:

- The company is struggling with too much debt and has been losing money during recent years.

- The trouble of earning a profit right away is what worries some analysts & investors.

Conclusion: Stock can be added to your portfolio if you invest for the long term and can accept price drops along the way. People who need quick returns will most likely search for other investments.

Boeing (NYSE: BA) Stock Price Forecast (2025-2030)

2025 Price Forecast

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Current Price |

|---|---|---|---|

| January | 180.00 | 185.00 | +2.69% |

| February | 182.00 | 188.00 | +4.97% |

| March | 184.00 | 190.00 | +6.71% |

| April | 186.00 | 192.00 | +8.46% |

| May | 188.00 | 195.00 | +10.57% |

| June | 190.00 | 197.00 | +12.42% |

| July | 192.00 | 200.00 | +14.57% |

| August | 194.00 | 202.00 | +16.17% |

| September | 195.00 | 205.00 | +17.83% |

| October | 197.00 | 208.00 | +19.71% |

| November | 198.00 | 210.00 | +21.40% |

| December | 200.00 | 215.00 | +23.71% |

2026 Price Forecast

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Current Price |

|---|---|---|---|

| January | 202.00 | 217.00 | +25.47% |

| February | 204.00 | 220.00 | +27.49% |

| March | 206.00 | 223.00 | +29.60% |

| April | 208.00 | 225.00 | +31.42% |

| May | 210.00 | 230.00 | +33.70% |

| June | 212.00 | 233.00 | +35.71% |

| July | 214.00 | 236.00 | +37.83% |

| August | 216.00 | 240.00 | +40.20% |

| September | 218.00 | 245.00 | +43.02% |

| October | 220.00 | 250.00 | +46.12% |

| November | 222.00 | 255.00 | +49.17% |

| December | 224.00 | 260.00 | +52.42% |

2027 Price Forecast

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Current Price |

|---|---|---|---|

| January | 226.00 | 265.00 | +55.90% |

| February | 228.00 | 270.00 | +59.50% |

| March | 230.00 | 275.00 | +63.14% |

| April | 232.00 | 280.00 | +66.80% |

| May | 234.00 | 285.00 | +70.47% |

| June | 236.00 | 290.00 | +74.19% |

| July | 238.00 | 295.00 | +77.90% |

| August | 240.00 | 300.00 | +81.59% |

| September | 242.00 | 305.00 | +85.31% |

| October | 244.00 | 310.00 | +89.04% |

| November | 246.00 | 315.00 | +92.82% |

| December | 248.00 | 320.00 | +96.57% |

2028 Price Forecast

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Current Price |

|---|---|---|---|

| January | 250.00 | 325.00 | +100.45% |

| February | 252.00 | 330.00 | +104.44% |

| March | 254.00 | 335.00 | +108.41% |

| April | 256.00 | 340.00 | +112.42% |

| May | 258.00 | 345.00 | +116.40% |

| June | 260.00 | 350.00 | +120.43% |

| July | 262.00 | 355.00 | +124.45% |

| August | 264.00 | 360.00 | +128.47% |

| September | 266.00 | 365.00 | +132.49% |

| October | 268.00 | 370.00 | +136.52% |

| November | 270.00 | 375.00 | +140.56% |

| December | 272.00 | 380.00 | +144.59% |

2029 Price Forecast

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Current Price |

|---|---|---|---|

| January | 275.00 | 385.00 | +148.97% |

| February | 278.00 | 390.00 | +153.41% |

| March | 281.00 | 395.00 | +157.85% |

| April | 284.00 | 400.00 | +162.28% |

| May | 287.00 | 405.00 | +166.73% |

| June | 290.00 | 410.00 | +171.17% |

| July | 293.00 | 415.00 | +175.61% |

| August | 296.00 | 420.00 | +180.05% |

| September | 299.00 | 425.00 | +184.49% |

| October | 302.00 | 430.00 | +188.94% |

| November | 305.00 | 435.00 | +193.38% |

| December | 308.00 | 440.00 | +197.82% |

2030 Price Forecast

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Current Price |

|---|---|---|---|

| January | 311.00 | 445.00 | +202.27% |

| February | 314.00 | 450.00 | +206.72% |

| March | 317.00 | 455.00 | +211.17% |

| April | 320.00 | 460.00 | +215.62% |

| May | 323.00 | 465.00 | +220.06% |

| June | 326.00 | 470.00 | +224.50% |

| July | 329.00 | 475.00 | +228.95% |

| August | 332.00 | 480.00 | +233.40% |

| September | 335.00 | 485.00 | +237.84% |

| October | 338.00 | 490.00 | +242.29% |

| November | 341.00 | 495.00 | +246.73% |

| December | 344.00 | 500.00 | +251.18% |

Opinion

Experts expect stock to quickly increase in value. Despite current struggles, fixing order delays and managing cash flow better could make Boeing’s stock jump by a lot in the next ten years. People who invest for the long run could find the company might do well, as the aerospace industry starts to recover.

How to Buy Boeing Stock (BA)

- Choose a Brokerage: Use a platform like E*TRADE, Robinhood, or Fidelity.

- Open an Account: Complete the account setup with your personal and banking details.

- Search for the Stock: Use the ticker symbol “BA” to find Boeing on the New York Stock Exchange.

- Analyze and Decide: Review Boeing’s performance, financials, and expert opinions.

- Place an Order: Choose the number of shares and order type (e.g., market or limit).

- Monitor Your Investment: Regularly check Boeing’s performance and industry trends.

Conclusion

Investors in it should consider both the chances they could get better and the danger of disappointments. Boeing’s growth strengths and coming back to profit look good, but its money problems and industry risk demand careful thinking for investors. Recent forecasts point to a slow improvement, but final results will rely on their planned strategies to be completed as intended. Watch Boeing’s financial announcements, check debt levels, and understand airplane orders to help you decide where to put your money.

Frequently Asked Questions

What does Boeing do?

It is one of the largest aerospace and defense companies globally. It designs, manufactures, and sells airplanes, rockets, satellites, telecommunications equipment, and military systems. The company also offers maintenance, repair, and support services for these products.

How is Boeing performing financially?

Its financial performance varies depending on the demand for airplanes, government defense budgets, and global economic factors. The company’s revenue and profitability were significantly affected by the 737 MAX grounding and the COVID-19 pandemic but are recovering as air travel demand increases.

What is Boeing’s current stock price and recent performance?

As of January 22, 2025 (12:34 PM EST), Boeing’s stock price is $175.28, reflecting a change of -0.16% during the trading session.

Does Boeing pay dividends?

Boeing suspended its dividend payments in 2020 due to financial difficulties caused by the pandemic. However, the company may resume dividends in the future depending on financial recovery.

Leave a Reply