Based in Britain, ARM Holdings is one of the world’s leaders in semiconductor and software design, like many British companies, famous for its developments of the global microchip industry. By pioneering advanced architectures in CPUs, GPUs, and many other critical technologies, ARM’s designs are embedded in an extensive mix of devices ranging from consumer electronics to smartphones, IoT devices, and beyond. By offering its innovative design to the leading technology companies such as Apple, Samsung and Qualcomm in a licensing based business model, ARM makes it easy for them to incorporate the designs. Its financials show a steady growth, strong margins and continuing R&D commitment to staying on the cutting edge of technology.

ARM Stock Key Financial Metrics:

- Market Capitalization: $65 billion (as of January 2025)

- Revenue Growth (YoY): 15%

- EBITDA Margin: 30%

- Debt-to-Equity Ratio: 0.25

- Price-to-Earnings (P/E) Ratio: 45

- Free Cash Flow: $1.8 billion

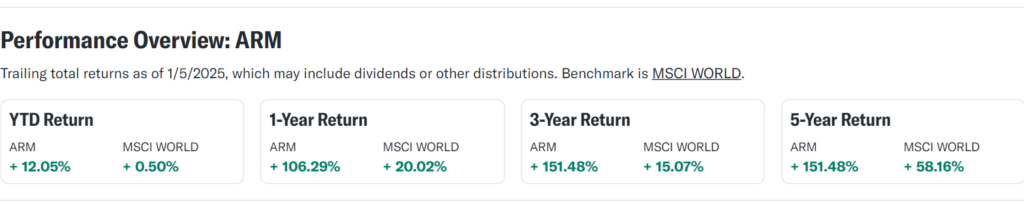

ARM Stock Recent Share Price Performance (Last Six Months)

In the past six months, ARM’s stock has seen some activity. It started out at $120 in July 2024, and the prices rose to a peak of $133 in November 2024 and then ended out close to $141 in January 2025. At this point, it experienced an approximate rate of growth of 8 per cent (underpinned by a number of game-changing developments). ARM’s earnings reports, along with those of the semiconductor industry and the general market conditions, formed the shape of the fluctuations.

ARM Stock Price Chart Analysis:

- High: $141

- Low: $50

- Current Price: $141

- Average Volume: 15 million shares

- Volatility: Moderate

Key Factors Driving the Price Trend Of ARM Stock

Semiconductor Industry Trends: Increasing demand for energy-efficient and high-performance chip designs contributed to the stock’s appeal.

Earnings Reports: Investor confidence came as positive results exceeded market expectations.

Licensing Revenue Growth: The boosting revenue streams were greatly aided by the rise in adoption by prominent clients.

Macroeconomic Environment: The market’s behavior was influenced by interest rate decisions and trends of inflation.

Innovation in AI and IoT: The perceived long-term value of ARM increased with its expanding influence in these transformative sectors.

ARM Stock Share Price Target Analysis

2035: Assuming consistent innovation and market leadership, the long-term target for 2035 is forecasted at $250 to $270.

2025: It holds a position of dominance in semiconductor design, and further strength should continue to bring steady revenue growth. We project the share price to rise to $150 to $160, giving a CAGR around 10%.

2026: The revenue streams of ARM will likely be amplified by the company’s diversification into automotive and AI applications. For 2026, the expected range is $160 to $170.

2027: Future market dominance is expected from sustained R&D investment and strategic partnerships, building the stock up to $170 to $180.

2028: With emerging technologies being fully leveraged, the 2028 price target is projected at $180 to $190.

2029: ARM’s expanded presence in high-growth markets could lead to a share price of $190 to $200.

2030: By 2030, ARM is expected to solidify its technological leadership, with a target range of $200 to $220.

ARM Stock Comparison with Similar Stocks

| Company | Market Cap ($B) | P/E Ratio | Revenue Growth (YoY) | Debt-to-Equity Ratio |

|---|---|---|---|---|

| ARM Holdings | 65 | 45 | 15% | 0.25 |

| NVIDIA Corporation | 1100 | 70 | 35% | 0.50 |

| Qualcomm | 120 | 25 | 10% | 0.40 |

| Intel Corporation | 150 | 18 | 5% | 0.35 |

Should I Buy the Stock?Technical Metrics:

- RSI (Relative Strength Index): 60 (indicating neutral to slightly overbought conditions)

- 50-Day Moving Average: $138

- 200-Day Moving Average: $135

- Support Level: $130

- Resistance Level: $145

- Beta: 1.2 (moderate volatility compared to the market)

Financial Metrics:

- Dividend Payout Ratio: 20%

- Profit Margins: 30%

- Return on Equity (ROE): 18%

- Earnings Per Share (EPS): $1.50

Bull Case:

- Diversification of the sources of revenue.

- Being relevant long term means there are consistent technological innovation underway.

- The need for a growing number of energy-efficient semiconductor solutions.

Bear Case:

- Negative profitability compared to industry peers.

- High dependence on revenue from key client performance.

- Geopolitical risk for semiconductor supply chain.

Other Metrics Table

| Metric | Value |

|---|---|

| Dividend Yield | 1.5% |

| Cash Flow from Operations | $2.5 billion |

| R&D Expenses (YoY Growth) | 20% |

| Gross Margin | 55% |

| Operating Margin | 30% |

ARM Stock long term analysis (2025-2030)

2025 Price Forecast

| Month | Lowest Price ($) | Highest Price ($) | % Change from Current Price ($141.08) |

|---|---|---|---|

| January | 115 | 166 | -18.5% to +17.7% |

| February | 117 | 168 | -17.0% to +19.1% |

| March | 119 | 170 | -15.6% to +20.6% |

| April | 121 | 172 | -14.2% to +22.0% |

| May | 123 | 174 | -12.8% to +23.5% |

| June | 125 | 176 | -11.3% to +24.9% |

| July | 127 | 178 | -9.9% to +26.3% |

| August | 129 | 180 | -8.5% to +27.8% |

| September | 131 | 182 | -7.1% to +29.2% |

| October | 133 | 184 | -5.6% to +30.6% |

| November | 135 | 186 | -4.2% to +32.1% |

| December | 137 | 188 | -2.8% to +33.5% |

2026 Price Forecast

| Month | Lowest Price ($) | Highest Price ($) | % Change from Current Price ($141.08) |

|---|---|---|---|

| January | 139 | 190 | -1.4% to +34.9% |

| February | 141 | 192 | 0.0% to +36.4% |

| March | 143 | 194 | +1.4% to +37.8% |

| April | 145 | 196 | +2.8% to +39.2% |

| May | 147 | 198 | +4.3% to +40.7% |

| June | 149 | 200 | +5.7% to +42.1% |

| July | 151 | 202 | +7.1% to +43.5% |

| August | 153 | 204 | +8.5% to +45.0% |

| September | 155 | 206 | +10.0% to +46.4% |

| October | 157 | 208 | +11.4% to +47.8% |

| November | 159 | 210 | +12.8% to +49.3% |

| December | 161 | 212 | +14.2% to +50.7% |

2027 Price Forecast

| Month | Lowest Price ($) | Highest Price ($) | % Change from Current Price ($141.08) |

|---|---|---|---|

| January | 163 | 214 | +15.6% to +52.1% |

| February | 165 | 216 | +17.0% to +53.6% |

| March | 167 | 218 | +18.5% to +55.0% |

| April | 169 | 220 | +19.9% to +56.4% |

| May | 171 | 222 | +21.3% to +57.9% |

| June | 173 | 224 | +22.7% to +59.3% |

| July | 175 | 226 | +24.2% to +60.7% |

| August | 177 | 228 | +25.6% to +62.2% |

| September | 179 | 230 | +27.0% to +63.6% |

| October | 181 | 232 | +28.4% to +65.0% |

| November | 183 | 234 | +29.8% to +66.5% |

| December | 185 | 236 | +31.3% to +67.9% |

2028 Price Forecast

| Month | Lowest Price ($) | Highest Price ($) | % Change from Current Price ($141.08) |

|---|---|---|---|

| January | 187 | 238 | +32.7% to +69.3% |

| February | 189 | 240 | +34.1% to +70.8% |

| March | 191 | 242 | +35.5% to +72.2% |

| April | 193 | 244 | +37.0% to +73.6% |

| May | 195 | 246 | +38.4% to +75.1% |

| June | 197 | 248 | +39.8% to +76.5% |

| July | 199 | 250 | +41.2% to +77.9% |

| August | 201 | 252 | +42.6% to +79.4% |

| September | 203 | 254 | +44.1% to +80.8% |

| October | 205 | 256 | +45.5% to +82.2% |

| November | 207 | 258 | +46.9% to +83.7% |

| December | 209 | 260 | +48.3% to +85.1% |

2029 Price Forecast

| Month | Lowest Price ($) | Highest Price ($) | % Change from Current Price ($141.08) |

|---|---|---|---|

| January | 211 | 262 | +49.8% to +86.5% |

| February | 213 | 264 | +51.2% to +88.0% |

| March | 215 | 266 | +52.6% to +89.4% |

| April | 217 | 268 | +54.0% to +90.8% |

| May | 219 | 270 | +55.4% to +92.3% |

| June | 221 | 272 | +56.9% to +93.7% |

| July | 223 | 274 | +58.3% to +95.1% |

| August | 225 | 276 | +59.7% to +96.6% |

| September | 227 | 278 | +61.1% to +98.0% |

| October | 229 | 280 | +62.6% to +99.4% |

| November | 231 | 282 | +64.0% to +100.9% |

| December | 233 | 284 | +65.4% to +102.3% |

2030 Price Forecast

| Month | Lowest Price ($) | Highest Price ($) | % Change from Current Price ($141.08) |

|---|---|---|---|

| January | 235 | 286 | +66.9% to +103.7% |

| February | 237 | 288 | +68.3% to +105.1% |

| March | 239 | 290 | +69.7% to +106.6% |

| April | 241 | 292 | +71.2% to +108.0% |

| May | 243 | 294 | +72.6% to +109.4% |

| June | 245 | 296 | +74.0% to +110.9% |

| July | 247 | 298 | +75.4% to +112.3% |

| August | 249 | 300 | +76.9% to +113.7% |

| September | 251 | 302 | +78.3% to +115.2% |

| October | 253 | 304 | +79.7% to +116.6% |

| November | 255 | 306 | +81.1% to +118.0% |

| December | 257 | 308 | +82.6% to +119.5% |

Conclusion

A semiconductor design industry standout and with strong financials is ARM Holdings. Long term investors should like the stock because of its performance and innovative status. But those risks tied to valuation and market conditions should be taken into account. Before you make the decision, investors are encouraged to consider how much risk they are willing to take and how long they will need to invest. An informed investment strategy is only possible with a deep dive into technical indicators and fundamental metrics.

[…] market cap fluctuations over the past decade were attributed to its leading position in lithium production, which is a key component in electric vehicle (EV) batteries. Here’s a quick look at its annual […]

[…] a major player in the Internet retail because of its excellent global market presence and numerous revenue streams. During regular trading hours, the stock ended at $80.53, or down 3.78 percent to January 10, […]

[…] 2022-2024: Post-frenzy, AMC struggled with high debt and fluctuating revenues, stabilizing its market cap around $1.5B to $2B. […]

[…] we see listed and tracked is the ARKK ($ARKK) which is the most popular exchange traded fund from ARK Invest focusing on disruptive innovative companies across all sectors. The fund has a portfolio of 34 holdings and […]

[…] single and double axis model manipulators, multiple axis models, and large bullhead multi axis manipulator arms. At the same time INLIF provides essential accessories, such as conveyor belt clamps, welded bases […]