ARK Innovation ETF (NYSEARCA: One we see listed and tracked is the ARKK ($ARKK) which is the most popular exchange traded fund from ARK Invest focusing on disruptive innovative companies across all sectors. The fund has a portfolio of 34 holdings and primarily invests in high growth industries like technology, healthcare and advanced industrial applications. As of January 3, 2025, stock has assets under management of $6.18 billion, with expense ratio of 0.75%, and price to earnings (P/E) ratio 54.91. From its inception on October 31, 2014, the stock has enjoyed a reputation for high beta of 1.75, indicating significant market volatility, and potentially sharp price swings.

The Innovation ETF (ARKK) is an ETF that invests almost all of its assets in stocks that reflect a certain theme. Offered as an actively managed fund, the fund aims to generate long term capital growth from companies with global exposure to or attached to, disruptive innovation. Stock was issued by ARK on Oct 31, 2014 and launched on the same day.

Asset ClassEquity

CategoryMid-Cap Growth

Stock ExchangeNYSEARCA

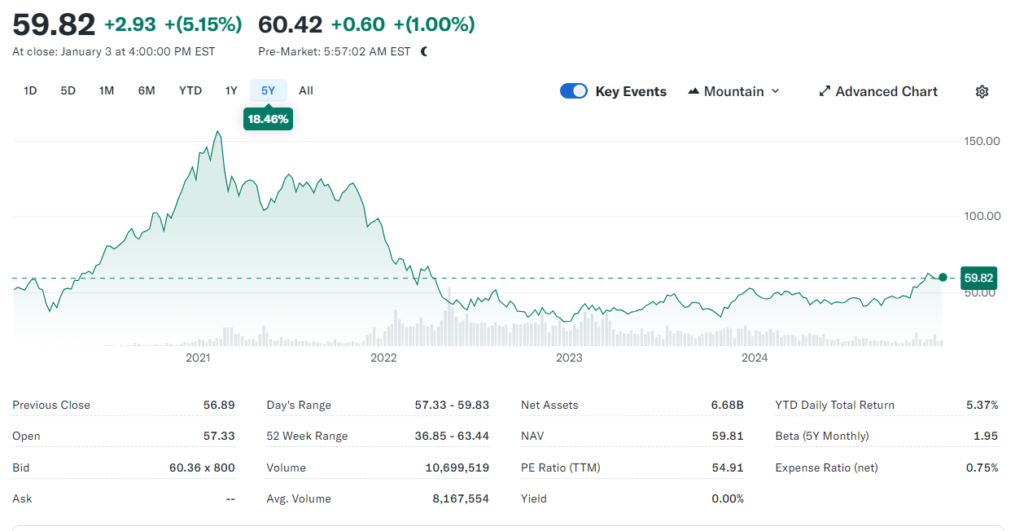

Recent Share Price and 6-Month Analysis

On January 3, 2025 the stock ended at $59.82, up 5.15% in a day. For the past six months, Stock price has seen massive fluctuation, between its 52 week low of $36.85 and its high of $63.44. Significant trends include:

- August to September 2024: Broad market sell offs coupled with woes for the technology sector hammered ARKK. Concerns about the global economy was bad news for investor sentiment.

- October to December 2024: There was a resurgence of a recovery phase, backed up by good earnings from major portfolio companies as well as renewed enthusiasm in the growth stocks.

- December 2024 to January 2025: As investor confidence bolstered by rising technological optimism and economic indicators continued upward momentum, the optimism was coupled with the success of innovative markets.

Dividend History

| Ex-Dividend Date | Cash Amount | Declaration Date | Record Date | Pay Date |

|---|---|---|---|---|

| Dec 29, 2021 | $0.78257 | Dec 28, 2021 | Dec 30, 2021 | Dec 31, 2021 |

| Dec 29, 2020 | $1.62774 | Dec 28, 2020 | Dec 30, 2020 | Dec 31, 2020 |

| Dec 27, 2019 | $0.19063 | Dec 26, 2019 | Dec 30, 2019 | Dec 31, 2019 |

| Dec 27, 2018 | $1.16844 | Dec 26, 2018 | Dec 28, 2018 | Dec 31, 2018 |

| Dec 27, 2017 | $0.48761 | Dec 26, 2017 | Dec 28, 2017 | Dec 29, 2017 |

| Dec 24, 2015 | $0.4651 | Dec 23, 2015 | Dec 29, 2015 | Dec 31, 2015 |

* Dividend amounts are adjusted for stock splits when applicable.

Key Factors Influencing Price Movements

- Macroeconomic Conditions: Growth oriented investments are influenced by interest rate change, inflation trend, and overall stability of the economy.

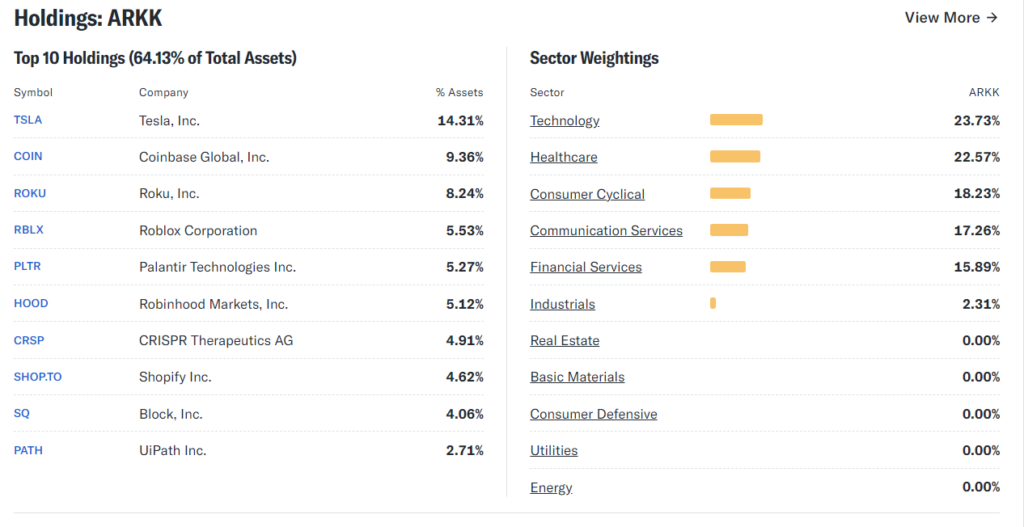

- Top Holding Performance: Pouring significant weight in ARKK’s valuation are companies like Tesla, Roku, and CRISPR Therapeutics, which behind the scenes drive much of the headline grabbing action in stock.

- Innovation Trends: While price volatility is aided by emerging sectors like artificial intelligence (AI), genomics and blockchain, it’s been these areas that have played a major role in maintaining investor interest.

Share Price Targets

| Year | Target Price (USD) | Growth Expectations |

|---|---|---|

| 2025 | $70 – $75 | Moderate recovery, reflecting stabilization. |

| 2026 | $85 – $90 | Growth fueled by AI advancements and tech demand. |

| 2027 | $95 – $100 | Significant expansion in genomics and AI. |

| 2028 | $110 – $115 | Continued gains from disruptive technologies. |

| 2029 | $120 – $125 | Stable upward trajectory amid market maturity. |

| 2030 | $135 – $140 | Projected peak within the innovation cycle. |

| 2035 | $200+ | Long-term compounding of innovation trends. |

ARK Invest Financial Status and Overview

ETF Invest is a global asset management firm dedicated to innovation-oriented investment strategies. ARK is founded in 2014 by Cathie Wood and focuses on disruptive technology with actively managed ETFs catering to forward thinking investors. And what makes the firm truly unique is that it combines research on technological breakthroughs with thematic investing across the sectors of genomics, robotics, artificial intelligence, and blockchain.

Key Financial Metrics (As of January 2025)

| Metric | Value |

|---|---|

| Assets Under Management (AUM) | $23.4 billion |

| Number of ETFs | 9 |

| Average Expense Ratio | 0.72% |

| Revenue (2024) | $950 million |

| Net Income (2024) | $210 million |

| Active Fund Holdings | 150+ |

Performance of Core ETFs

Innovation ETF

- AUM: $6.18 billion

- 1-Year Return: +18.46%

- Expense Ratio: 0.75%

- Sector Focus: Disruptive innovation in technology and healthcare.

Genomic Revolution ETF

- AUM: $4.32 billion

- 1-Year Return: +14.20%

- Expense Ratio: 0.72%

- Sector Focus: Genomics and biotech innovations.

Next Generation Internet ETF

- AUM: $3.89 billion

- 1-Year Return: +16.80%

- Expense Ratio: 0.79%

- Sector Focus: AI, blockchain, and digital media.

Revenue Streams

Invest derives revenue primarily from:

- Management Fees: Average fees of 0.72% from actively managed ETFs.

- Licensing: Collaborations with other financial institutions for investment products.

- Advisory Services: Consultation on innovation-driven investment strategies.

Growth Trends and Financial Highlights

- Rapid AUM Growth: AUM increased by 15% in 2024, driven by renewed investor interest in high-growth sectors.

- Expanded Product Lineup: Launch of two new ETFs focusing on clean energy and space exploration in late 2024.

- Profitability: Net income grew by 12% year-over-year due to operational efficiencies and higher fee income.

Challenges :

- Market Volatility: ARK’s innovation-focused ETFs exhibit high beta values, making them susceptible to market downturns.

- Competition: Increasing competition from other thematic ETF providers.

- Concentration Risk: Significant exposure to a limited number of high-growth stocks.

Financial Outlook (2025–2030)

| Year | Projected AUM (USD) | Revenue (USD) | Net Income (USD) |

|---|---|---|---|

| 2025 | $26.5 billion | $1.05 billion | $230 million |

| 2026 | $30.2 billion | $1.22 billion | $265 million |

| 2027 | $34.0 billion | $1.38 billion | $305 million |

| 2028 | $38.5 billion | $1.55 billion | $350 million |

| 2029 | $43.2 billion | $1.73 billion | $400 million |

| 2030 | $48.0 billion | $1.92 billion | $460 million |

Positioned as a leader of the ETF space based on focus on disruptive innovation, it is given more attention by investors. But given challenges it has a diversified revenue streams, a robust product lineup and a strategic focus on emerging technologies laying a strong base for future growth. ARK has high sensitivity to macroeconomic and sector specific trends which investors should closely monitor.

Comparison with Similar ETFs

When compared with other ETFs focused on innovation, this stock offers distinctive benefits and risks:

- Invesco QQQ: Offers less volatility, more stable returns than direct exposure to emerging sectors but provides lower volatility, and less stable returns.

- Global X Future Tech ETF: It shares a similar focus on innovation but operates from a smaller asset base and even smaller scope.

The fund will invest under normal circumstances primarily (at least 65% of its assets) in domestic and foreign equity securities of companies that are relevant to the fund’s investment theme of disruptive innovation, will be an actively managed exchange traded fund (“ETF”), and will impose an(Inca) restructuring fee of 1% per calendar quarter. Its investments in foreign equity will be in both developed and emerging markets. The fund may invest in securities issued or traded abroad as well as ADRs and GDRs and in the securities of foreign or U.S. issuers located abroad. The fund is non-diversified.

Should I Buy the Stock?

Technical and Financial Metrics

- 1-Year Return: Market headwinds notwithstanding, this represents solid performance (+18.46%) for the year.

- Volume: There is robust liquidity with an average daily trading volume more than 10 million.

- Expense Ratio: Its 0.75% actively managed and sector specializeing fee is higher than some ETFs but is more than justified by its active management and sector specialisation.n.

Bullish Case

- Exposure to high growth transformative sectors.

- Experienced management team with expertise in disruptive innovation as a leader.

- Whether it is AI, genomics or renewable energy, recovery potential.

Bearish Case

- High volatility and high susceptibility to the economic and sector specific risks.

- The risks of concentration as a result of depending on a small number of holdings.

- Uniranulability to macroeconomic uncertainties, especially at the interest rate fluctuations.

Stock long term analysis (2025-2030)

Monthly Price Projections (2025)

| Month | Projected Price (USD) |

|---|---|

| January | $59.82 |

| February | $61.00 |

| March | $62.20 |

| April | $63.45 |

| May | $64.70 |

| June | $66.00 |

| July | $67.30 |

| August | $68.65 |

| September | $70.00 |

| October | $71.40 |

| November | $72.80 |

| December | $74.25 |

Monthly Price Projections (2026)

| Month | Projected Price (USD) |

| January | $75.70 |

| February | $77.20 |

| March | $78.75 |

| April | $80.30 |

| May | $81.90 |

| June | $83.50 |

| July | $85.15 |

| August | $86.80 |

| September | $88.50 |

| October | $90.20 |

| November | $91.95 |

| December | $93.70 |

Monthly Price Projections (2027)

| Month | Projected Price (USD) |

| January | $95.50 |

| February | $97.30 |

| March | $99.15 |

| April | $101.00 |

| May | $102.90 |

| June | $104.80 |

| July | $106.75 |

| August | $108.70 |

| September | $110.70 |

| October | $112.70 |

| November | $114.75 |

| December | $116.80 |

Monthly Price Projections (2028)

| Month | Projected Price (USD) |

| January | $118.90 |

| February | $121.00 |

| March | $123.15 |

| April | $125.30 |

| May | $127.50 |

| June | $129.70 |

| July | $131.95 |

| August | $134.20 |

| September | $136.50 |

| October | $138.80 |

| November | $141.15 |

| December | $143.50 |

Monthly Price Projections (2029)

| Month | Projected Price (USD) |

| January | $145.90 |

| February | $148.30 |

| March | $150.75 |

| April | $153.20 |

| May | $155.70 |

| June | $158.20 |

| July | $160.75 |

| August | $163.30 |

| September | $165.90 |

| October | $168.50 |

| November | $171.15 |

| December | $173.80 |

Monthly Price Projections (2030)

| Month | Projected Price (USD) |

| January | $176.50 |

| February | $179.20 |

| March | $182.00 |

| April | $184.80 |

| May | $187.60 |

| June | $190.50 |

| July | $193.40 |

| August | $196.35 |

| September | $199.30 |

| October | $202.30 |

| November | $205.30 |

| December | $208.35 |

Additional Metrics Table

| Metric | Value |

|---|---|

| Assets Under Management (AUM) | $6.18B |

| Holdings | 34 |

| Dividend Yield | N/A |

| 52-Week Range | $36.85 – $63.44 |

| Beta | 1.75 |

Final Recommendation

The stock is for risk tolerant investors looking to get exposure to cutting edge innovation. The fund offers a diversified way to play high growth sectors but it’s highly sensitive to macro trends. ARKK is only viable as an investment option for investors with very long time horizons, low risk tolerance and high tolerance for market conditions.

Potential investors learn by understanding what factors influence ARKK and can make informed decisions as to whether or not it should be part of their portfolio.