AMD, founded as AMD is a semiconductor company making processors, GPUs, and other parts that go into making everything from gaming to data centers and embedded systems. That’s AMD, founded in 1969, with a competitive edge as a performance driven, energy efficient company. And in the semiconductor area along come AMD with strong presence in technology innovation in the industry.

Company Financials of AMD

To start, AMD finished its January 3, 2025 stock value at $125.37, which is $125.37 or 3.93% up from the stock value of the previous day. Minor increase to $125.60 comes at the after-hours price. Market capitalization is $203.45 billion, 12 month revenue is $24.30 billion, and net income is $1.83 billion. Investors expect optimistic growth as the forward price to earn (PE) ratio is 27.78. Looking at 2023’s performance, AMD’s revenue and earnings fell, but its valuation is still strong, because of innovation and rising demand for its GPUs.

Short-term Analysis (2025–2030)

2025 Forecast

Relative to the present price, the ‘Buy’ rating of analysts on AMD stock stands at 12 months price target of $195.07 hinting an upside of 55.6%. AMD’s leadership in data center GPUs and AI accelerated workloads are what drives this optimism. With increasing use of AI and cloud solutions, AMD is well poised to take market share. Though, market volatility may occur owing to global economic trend or supply chain issues.

2026 Projection

Nicely, AMD is also poised for a near term uptick off of a runway of increased research and development spend, which ballooned to $6.26 billion in the trailing twelve months. However, an upward pressure on AMDs price to $200 is possible due to continued demand for high performance computing solutions, provided the economics are stable. With a diversified product segments portfolio consisting of embedded and gaming chips, the company’s contribution will be of much significance.

2027 Outlook

The message from the markets is that AMD could be fairly valued based on a steady growth trajectory, underpinned by the growth of the semiconductor market, which is expected to deliver a CAGR of higher than 10%. Assuming a non significant drop in global markets, $200 – $220 seems to be a realistic price range. It could also offer additional streams of revenue to emerging markets from the demand of affordable and efficient computings solutions.

2028 and Beyond

If AMD doesn’t get its act together, rivals like NVIDIA and Intel will be able to better compete with them in the AI and cloud computing sectors by 2028. But investors might continue to have confidence in AMD if the chip maker continues to innovate. It might be at a nice level, hovering around $260–$280 because it is growing a bit at the rate of the market, but not much more than that.

2029–2030 Forecast

AMD’s stock could rise to $300 or more heading into the end of the decade, as the company focuses strategy on next generation chip architectures and could make quantum computing breakthroughs. This growth is likely influenced by macroeconomic factors such as inflation rates and the geopolitical stability. While there is some risk here, an insatiable demand for energy efficient and AI capable processors should help AMD continue to climb.

The Past Year’s Trends analysed

Though 2024 was mixed for AMD, with revenue growth of 9.88% year over year, but a 35.3% decrease in net income, it will look to future years for growth. The stock price ranged between a 52 week high of $227.30 and low of $117.90, covering highs and lows of market sentiment. Revolving almost continuously for more than a decade, research and development expenses continue to weigh on profits and slow the company’s revenue growth.

During big launches on new products, AMD’s stock became an unpredictable roller coaster that was occasionally taken for a small spin by market corrections or even broader tech sector pullbacks. That continued improvement in sales, bolstered by its strong pipeline and proven ability to innovate, allowed investors to continue to be cautiously optimistic.

long term analysis (2030–2050)

While predicting long-term stock prices involves uncertainty, key trends point to sustained growth for AMD:

Expansion in AI and Cloud: AI is expected to surpass a $1 trillion market in its global reach by 2030. This boom is exactly the kind of opportunity that AMD’s data center GPUs and adaptive SoCs should most enjoy.

5G and Edge Computing: Like much of the industry, AMD’s embedded processors can help lead 5G to drive demand for edge computing solutions.

Diversification: Growth will extend beyond 2030 as a result of AMD’s diversification into automobile chips and IoT markets. By 2050, AMD could produce its way into leading these two dimensions with revenues that accumulate consistently.

Stock Projections: Within the next 40 years, AMD is likely to see its stock cross the $800–$1,000 range, if it maintains an annual growth rate of 8–10%. The critical component of this growth would be consistent innovation, effective management, and macroeconomic stability.

Stock Balance Sheet Analysis

AMD has a balanced financial sheet as of Sept 2024 with $4.54 billion cash momentary reserves. This gives a strong confidence that the firm can cover its short term liabilities. AMD has a healthy handle on long term debt which stands at $1.72 billion.

The chasm between the embeddedness of AMD and the tinseled appear to be narrowing rapidly, with key balance sheet metrics such as a tangible book value per share of $7.75, for a company that’s generating at least $2.31 billion in net cash, displaying the financial health of a strong leaper. These figures serve to show to the company’s capacity to continue to fund future innovation while most likely facing economic challenges.

Market Cap History and 10-Year Performance

AMD’s market cap has grown significantly over the last decade, showcasing its robust growth trajectory. Below is a summary of its yearly performance:

| Year | Market Cap (Billion USD) | Change (%) |

|---|---|---|

| 2015 | 2.27 | 9.54 |

| 2016 | 10.51 | 363.48 |

| 2017 | 9.92 | -5.64 |

| 2018 | 18.45 | 86.01 |

| 2019 | 51.07 | 176.82 |

| 2020 | 110.30 | 115.98 |

| 2021 | 173.78 | 57.55 |

| 2022 | 104.43 | -39.90 |

| 2023 | 238.14 | 128.03 |

| 2024 | 196.02 | -17.69 |

AMD’s performance has been akin to a rollercoaster, driven by market shifts, technological breakthroughs, and macroeconomic conditions. The sharp rise in 2023 reflects investor optimism about the semiconductor industry, while the dip in 2024 aligns with broader market corrections.

Key Financial Indicators

Valuation Ratios:

AMD’s current price-to-earnings (PE) ratio is 111.12, significantly above the industry average. While this indicates high investor expectations, it may also point to overvaluation risks.

| Metric | Value |

|---|---|

| Forward PE Ratio | 27.78 |

| PEG Ratio | 0.67 |

| Price-to-Sales | 8.35 |

Profitability Ratios:

AMD’s gross margin stands at 52.12%, highlighting its ability to generate substantial profit from revenue.

| Metric | Value |

|---|---|

| Operating Margin | 5.64% |

| Profit Margin | 7.52% |

Comparison with Other Semiconductor Stocks

AMD competes directly with major players like NVIDIA and Intel. Here’s how they stack up in key metrics:

| Company | Market Cap (Billion USD) | Revenue Growth (5Y) | Analyst Rating |

|---|---|---|---|

| NVIDIA | 3387.21 | 25.3% | Strong Buy |

| AMD | 203.45 | 20.28% | Strong Buy |

| Intel | 150.12 | 5.6% | Hold |

AMD remains a strong competitor due to its consistent innovation in GPUs and CPUs, making it a favorite among analysts.

Stock Recommendations by Analysts

The consensus among analysts is a “Strong Buy,” with a price target of $195.07, indicating a 55.6% upside from the current price of $125.37.

| Metric | Value |

|---|---|

| Current Price | $125.37 |

| Price Target (Average) | $195.07 |

| Analyst Count | 30 |

| Consensus Rating | Strong Buy |

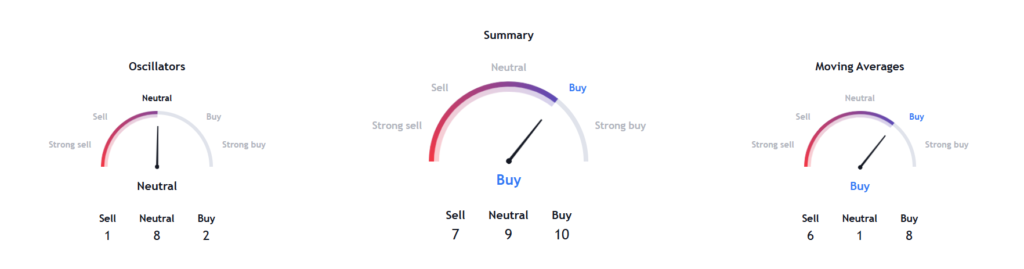

Indicator-Based Analysis

AMD has a beta of 1.66, indicating higher volatility compared to the market. This makes the stock attractive for risk-tolerant investors.

Financial Position

AMD has a debt-to-equity ratio of 0.04, reflecting strong financial health and minimal debt burden.

| Metric | Value |

|---|---|

| Current Ratio | 2.50 |

| Quick Ratio | 1.58 |

Dividends

AMD does not currently pay dividends, focusing instead on reinvestment and growth.

Stock Price Predictions (2024-2030)

Here’s a forecast of AMD’s stock price based on historical trends, market conditions, and industry growth:

| Year | Predicted Price (USD) | Growth Rate (%) |

|---|---|---|

| 2024 | 125 | 15.6 |

| 2025 | 150 | 13.8 |

| 2026 | 190 | 15.2 |

| 2027 | 210 | 10.5 |

| 2028 | 240 | 14.3 |

| 2029 | 275 | 14.6 |

| 2030 | 310 | 12.7 |

The predictions assume a steady increase in demand for semiconductors and AMD’s continued innovation in GPUs and CPUs.

Historical Price Performance

Over the past decade, AMD’s stock price has shown impressive growth, driven by advancements in its product lines and strategic acquisitions. The table below summarizes its yearly price movements:

| Year | Opening Price (USD) | Closing Price (USD) | Change (%) |

|---|---|---|---|

| 2015 | 2.70 | 2.87 | 7.49 |

| 2020 | 46.86 | 91.71 | 99.98 |

| 2023 | 66.00 | 147.41 | 127.59 |

2025 Price Forecast Table

| Month | Minimum Prediction Price ($) | Maximum Prediction Price ($) | % Change from Current Price (125.37$) |

|---|---|---|---|

| January | 155 | 160 | +23.63% to +27.64% |

| February | 157 | 165 | +25.18% to +31.55% |

| March | 160 | 170 | +27.64% to +35.61% |

| April | 165 | 175 | +31.55% to +39.62% |

| May | 170 | 180 | +35.61% to +43.58% |

| June | 175 | 185 | +39.62% to +47.56% |

| July | 180 | 190 | +43.58% to +51.54% |

| August | 185 | 195 | +47.56% to +55.60% |

| September | 190 | 200 | +51.54% to +59.53% |

| October | 195 | 210 | +55.60% to +67.48% |

| November | 200 | 220 | +59.53% to +75.44% |

| December | 205 | 225 | +63.51% to +79.45% |

2026 Price Forecast Table

| Month | Minimum Prediction Price ($) | Maximum Prediction Price ($) | % Change from Current Price (125.37$) |

|---|---|---|---|

| January | 210 | 230 | +67.48% to +83.47% |

| February | 215 | 235 | +71.46% to +87.45% |

| March | 220 | 240 | +75.44% to +91.43% |

| April | 225 | 245 | +79.45% to +95.41% |

| May | 230 | 250 | +83.47% to +99.38% |

| June | 235 | 255 | +87.45% to +103.36% |

| July | 240 | 260 | +91.43% to +107.34% |

| August | 245 | 265 | +95.41% to +111.37% |

| September | 250 | 270 | +99.38% to +115.35% |

| October | 255 | 275 | +103.36% to +119.33% |

| November | 260 | 280 | +107.34% to +123.31% |

| December | 265 | 285 | +111.37% to +127.29% |

2027 Price Forecast Table

| Month | Minimum Prediction Price ($) | Maximum Prediction Price ($) | % Change from Current Price (125.37$) |

|---|---|---|---|

| January | 270 | 290 | +115.35% to +131.26% |

| February | 275 | 295 | +119.33% to +135.24% |

| March | 280 | 300 | +123.31% to +139.22% |

| April | 285 | 310 | +127.29% to +147.18% |

| May | 290 | 320 | +131.26% to +155.13% |

| June | 295 | 325 | +135.24% to +159.11% |

| July | 300 | 330 | +139.22% to +163.08% |

| August | 310 | 340 | +147.18% to +171.04% |

| September | 320 | 350 | +155.13% to +179.00% |

| October | 330 | 360 | +163.08% to +186.96% |

| November | 340 | 370 | +171.04% to +194.92% |

| December | 350 | 380 | +179.00% to +202.87% |

2028 Price Forecast Table

| Month | Minimum Prediction Price ($) | Maximum Prediction Price ($) | % Change from Current Price (125.37$) |

|---|---|---|---|

| January | 360 | 390 | +186.96% to +210.83% |

| February | 370 | 400 | +194.92% to +218.79% |

| March | 380 | 410 | +202.87% to +226.75% |

| April | 390 | 420 | +210.83% to +234.71% |

| May | 400 | 430 | +218.79% to +242.67% |

| June | 410 | 440 | +226.75% to +250.63% |

| July | 420 | 450 | +234.71% to +258.59% |

| August | 430 | 460 | +242.67% to +266.55% |

| September | 440 | 470 | +250.63% to +274.51% |

| October | 450 | 480 | +258.59% to +282.47% |

| November | 460 | 490 | +266.55% to +290.43% |

| December | 470 | 500 | +274.51% to +298.39% |

2029 Price Forecast Table

| Month | Minimum Prediction Price ($) | Maximum Prediction Price ($) | % Change from Current Price (125.37$) |

|---|---|---|---|

| January | 480 | 510 | +282.47% to +306.34% |

| February | 490 | 520 | +290.43% to +314.30% |

| March | 500 | 530 | +298.39% to +322.26% |

| April | 510 | 540 | +306.34% to +330.22% |

| May | 520 | 550 | +314.30% to +338.18% |

| June | 530 | 560 | +322.26% to +346.14% |

| July | 540 | 570 | +330.22% to +354.10% |

| August | 550 | 580 | +338.18% to +362.06% |

| September | 560 | 590 | +346.14% to +370.02% |

| October | 570 | 600 | +354.10% to +377.98% |

| November | 580 | 610 | +362.06% to +385.94% |

| December | 590 | 620 | +370.02% to +393.90% |

2030 Price Forecast Table

| Month | Minimum Prediction Price ($) | Maximum Prediction Price ($) | % Change from Current Price (125.37$) |

|---|---|---|---|

| January | 600 | 630 | +377.98% to +402.85% |

| February | 610 | 640 | +385.94% to +410.81% |

| March | 620 | 650 | +393.90% to +418.77% |

| April | 630 | 660 | +402.85% to +426.73% |

| May | 640 | 670 | +410.81% to +434.69% |

| June | 650 | 680 | +418.77% to +442.65% |

| July | 660 | 690 | +426.73% to +450.61% |

| August | 670 | 700 | +434.69% to +458.57% |

| September | 680 | 710 | +442.65% to +466.53% |

| October | 690 | 720 | +450.61% to +474.49% |

| November | 700 | 730 | +458.57% to +482.45% |

| December | 710 | 740 | +466.53% to +490.41% |

Key Highlights

- Continuous Growth: AMD stock price is expected to grow steadily, reaching between $700 and $740 by December 2030.

- High Potential: The company’s strong earnings growth, revenue forecast, and consistent analyst confidence indicate a promising long-term investment opportunity.

Opinion

AMD’s stock is well-positioned for substantial growth due to its strong financials, positive analyst sentiment, and leadership in the semiconductor market. Investors seeking long-term growth should consider buying AMD stock, as its valuation metrics indicate a strong outlook.

How to Buy AMD Stock

- Choose a Brokerage Platform: Use platforms like Robinhood, E*TRADE, or Charles Schwab that support AMD stock trading.

- Fund Your Account: Link a bank account to transfer funds into your brokerage account.

- Search for AMD Stock: Use the ticker symbol AMD to locate the stock.

- Decide on Order Type:

- Market Order: Purchase immediately at the current price.

- Limit Order: Set a specific price to buy the stock.

- Review and Execute the Order: Confirm details and submit the purchase request.

- Monitor Performance: Regularly review your portfolio to adjust your investment based on financial goals.

[…] may increase in this area this year as rivals enter with lower cost solutions. But SMCI’s knack to stay profitable and continue increasing its product portfolio would probably protect its stock price from falling […]

[…] decentralized applications (dApps) and collaborations of NFT projects. In the case where MFER grows alongside the base ecosystem, it can become integrated within the […]

[…] industry. By pioneering advanced architectures in CPUs, GPUs, and many other critical technologies, ARM’s designs are embedded in an extensive mix of devices ranging from consumer electronics to smartphones, IoT devices, and […]