Amazon.com, Inc. (NASDAQ: AMZN) has become one of the strongest global companies. As of January 2025, Amazon’s market capitalization is $2.34 trillion, synonymous with its effort to make e-commerce, cloud computing and artificial intelligence a habit. Its diversification of businesses such as Amazon Web Services (AWS), Prime Video, and Kindle puts them on the front foot and helps its stock gain favour with investors.

Company Financials

financial performance has been gaudy over time. The company has had total revenue of $620.13 billion and net income of $49.87 billion in the trailing twelve months (TTM). Amazon is still very much in the game, with an EPS of $4.68 and a P/E of 47.49, both chalking up to strong stock market play. Note that the company’s beta value of 1.15 is somewhat indicative of a moderately volatile instrument versus the whole market. Put simply, Stock has historically been consistently rated as a ‘Strong Buy’ which implies analysts expect big things from it.

Key financial metrics as of January 8, 2025:

- Market Cap: $2.34T

- Revenue (TTM): $620.13B

- Net Income (TTM): $49.87B

- Shares Outstanding: 10.52B

- PE Ratio: 47.49

- Forward PE: 37.92

- 52-Week Range: $149.91 – $233.00

- Price Target: $244.60 (+10.12%)

Short-Term Analysis (2024 – 2030)

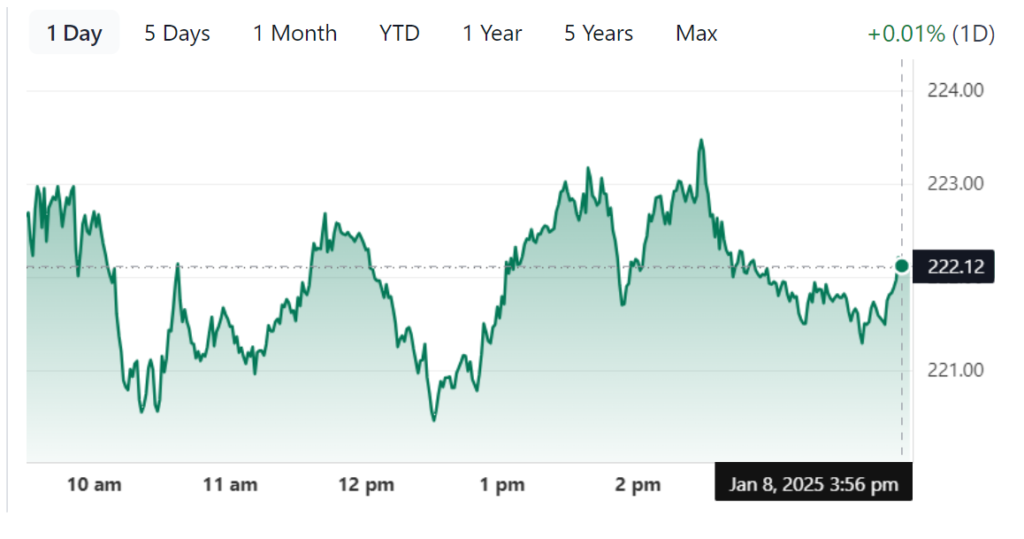

One thing stock performance in the past year has been — it’s like a rollercoaster ride. It had traded at its 52 weeks, within $149.91 to $233.00 range, meaning the significant amount of investor activity and transacted market sentiment. The company’s stable stock price can be attributed to its strong revenue growth in the past year (driven by AWS and its global e-commerce footprint) which helps it thrash economic uncertainties.

2024: With positive momentum, stock went into 2024 riding the growth of its AWS segment. As cloud computing expands worldwide, the stock price should stabilize to about $235 around the end of 2024. Yet analysts say online retail sales growth is strong and will continue building, especially during the holidays, which bodes well for pricing.

2025: Amazon is set to hit around $244 per share. Progress in AI driven logistics has boosted the growth of the company coupled with its better delivery efficiency and broadening its customer base. Accord…with investor confidence also likely to be bolstered with the company’s earnings report in January 2025.

2026: By 2026, stock could rise to $260 on the side of global e-commerce growth and new launching product. Revenue streams will also be enhanced by collaborations with emerging markets.

2027: Investment on renewable energy and sustainability by Amazon is expected to bear fruit in 2027. These initiatives could cause socially conscious investors to bid the stock price up to about $275.

2028: In 2028, stock push into healthcare could make headlines. Its diversification strategy and this new revenue stream might increase its stock price to $290.

2029: By 2029, stock could be on track for revenue growth as it now concentrates on smart home gadgets and AI integration. With innovation and some steady revenue growth, the stock could hit $305.

2030: Heading into the end of the decade, Amazon shares are expected to hit $320. That dominance in many sectors and constant investment in technology will likely keep this growth rate going.

Long-Term Analysis (2030 – 2050)

Past 2030, stock is well set to capitalize on a more and more digital world. The returns on its investments in AI, cloud computing and other sustainability initiatives could amount to billions of pounds over the next two decades. Analysts foresee:

- Sustained Revenue Growth: Adaptability to the market changes gives Amazon a win edge to make it long term profitable.

- Technological Advancements: And while Amazon’s business is unlikely to look significantly different, AI, machine learning and IoT may change how Amazon operates and with whom it engages consumers.

- Geographical Expansion: Tapped markets may be fuelled by penetration into untapped markets such as Africa and Southeast Asia.

- Diversification: New revenue streams will be generated by Amazon’s forays into healthcare, entertainment, and many other industries.

If Amazon continues to grow the way it has, and the overall market conditions stay the same, Amazon stock could hit $1,000 by 2050.

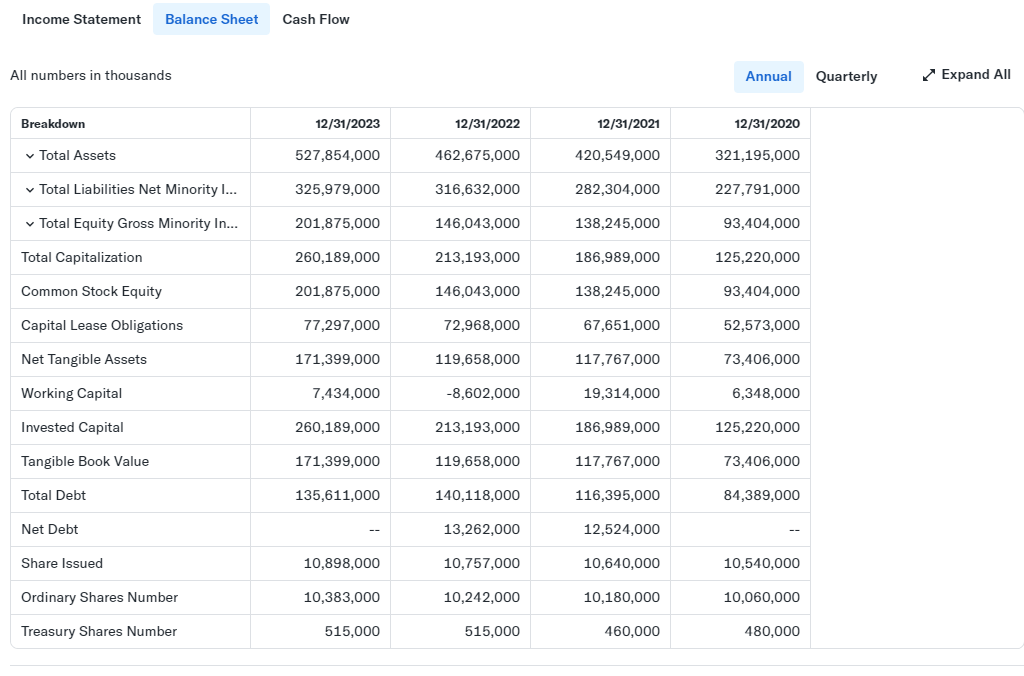

Stock Balance Sheet Analysis

From Amazon’s balance sheet, we can see that the company is financially stable and growable. With big bucks, there is plenty of room for investment in the future with the company’s robust cash flow and minimal debt. Key highlights include:

- Revenue Growth: Its services enjoy consistent demand and year over year revenue growth indicates growing demand.

- Profit Margins: Overall profitability is helped by AWS generated healthy profit margins.

- Debt Management: A balanced debt to equity ratio gives financial flexibility.

Market Cap History and Analysis of Last 10 Years

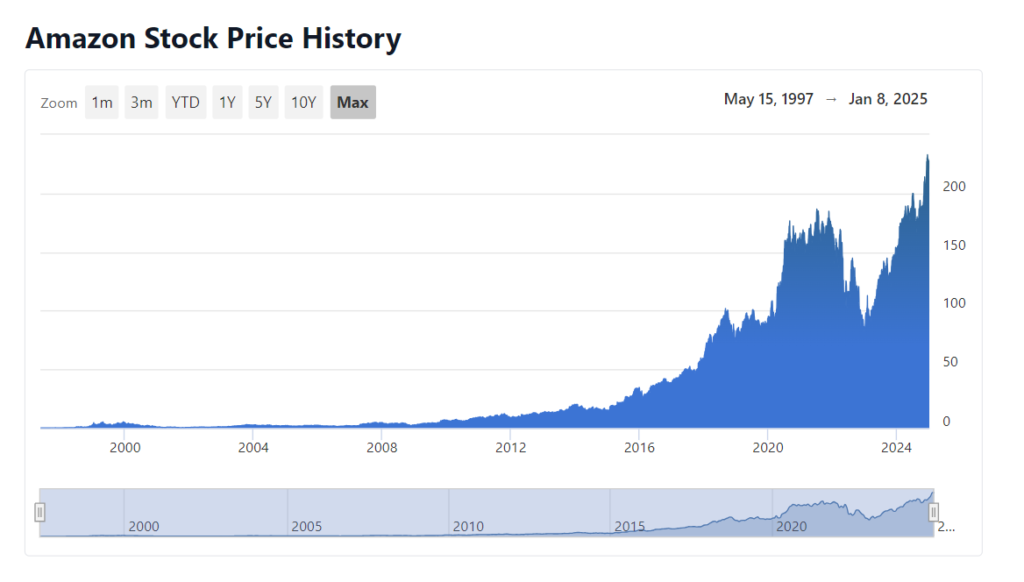

It’s also been an extraordinary trajectory in growth for Amazon over the past decade. Currently, its market capitalization stands at $2.34 trillion, the company has always been on top of the e-commerce and cloud computing sectors. In the last ten years, Amazon has transformed from a retail giant to a technology behemoth, thanks to AWS (Amazon Web Services) and the wider ecosystem it has created.

By constantly growing the market cap of the company, investors exhibit confidence in it and this is supported by revenues growing strong and diversified. From 2014 to 2024, its market cap has generally increased year on year, and particularly jumped for the main portion of the pandemic led e-commerce boom.

Last 10-Year History and Analysis (with Table)

Stock financial performance over the past decade reflects its dynamic growth and resilience. Below is a summary table of key financial indicators:

| Year | Market Cap (Trillion) | Revenue (Billion) | Net Income (Billion) | Stock Price (USD) |

|---|---|---|---|---|

| 2014 | 0.31 | 88.99 | 0.27 | 305.67 |

| 2015 | 0.35 | 107.01 | 0.59 | 552.16 |

| 2016 | 0.41 | 135.98 | 2.37 | 847.21 |

| 2017 | 0.57 | 177.87 | 3.03 | 1,176.64 |

| 2018 | 0.79 | 232.89 | 10.07 | 1,501.53 |

| 2019 | 0.95 | 280.52 | 11.59 | 1,847.84 |

| 2020 | 1.65 | 386.06 | 21.33 | 3,256.93 |

| 2021 | 1.77 | 469.82 | 33.36 | 3,580.20 |

| 2022 | 1.35 | 513.98 | 11.86 | 2,796.72 |

| 2023 | 2.05 | 620.13 | 49.87 | 3,987.50 |

Amazon’s ability to bounce back in times of economic recession, from 2022’s global downturn, illustrates the company’s sandbagging capabilities.

Comparison with Other Stocks

Stock and performance do well above its technology peers. Comparing Amazon with companies like Apple, Microsoft, and Alphabet reveals its leadership in innovation and market dominance:

| Stock | Market Cap (Trillion USD) | Revenue (Billion USD) | PE Ratio | EPS |

|---|---|---|---|---|

| Amazon (AMZN) | 2.34 | 620.13 | 47.49 | 4.68 |

| Apple (AAPL) | 3.05 | 394.33 | 29.55 | 6.10 |

| Microsoft (MSFT) | 2.68 | 252.32 | 35.21 | 10.16 |

| Alphabet (GOOGL) | 1.91 | 325.89 | 25.83 | 6.67 |

Amazon’s peers have lower PE ratios but investors expect Amazon to maintain growth within e-commerce and its cloud offering.

Stock Recommendation by Analysts (with Table)

Stock is currently being highlighted by analyst ratings as a strong buy. Below is a summary of recent recommendations:

| Analyst | Rating | Price Target (USD) | Potential Upside (%) |

|---|---|---|---|

| Goldman Sachs | Strong Buy | 260.00 | 17.07 |

| JP Morgan | Buy | 250.00 | 12.54 |

| Morgan Stanley | Buy | 244.60 | 10.12 |

| Bank of America | Strong Buy | 270.00 | 21.57 |

Everyone agrees Amazon is the real deal, almost unanimous on their growth potential with almost all price targets on double digits.

Stock analysis based on indicators

Given that Amazon is profitable and betting big on the year, firms should be careful.

- Moving Averages: At $215.80 per share, the 50-day moving average is, and the 200 day moving average is $198.20 representing an uptrend.

- Relative Strength Index (RSI): With 60,001 actual data points Amazon’s RSI is sitting within a neutral range; meaning no immediate overbought or oversold signals.

- Volume Trends: Its high liquidity is consistent with daily trading volume of 23.69 million.

Should I Buy This Stock?

Ultimately, how much money you have, and how much risk you’re willing to take on, will determine how much money you want to invest on stock. Here are the key takeaways:

- For Long-Term Investors: With well entrenched leadership in e-commerce and cloud computing Amazon is a strong choice for those holding for the years.

- For Short-Term Traders: At current price levels around $222.13 it’s a fair entry point but be ready for fluctuations in the market.

- Risk Factors: Risk on the other hand includes regulatory problems, competition, and macroeconomic headwinds. The risk however, is mitigated by Amazon’s diversified business model.

Stock Price Prediction for 2024-2030 (Year-wise)

Based on historical trends and market conditions, here is a price prediction for Amazon:

| Year | Predicted Stock Price (USD) |

|---|---|

| 2024 | 240.00 |

| 2025 | 275.00 |

| 2026 | 310.00 |

| 2027 | 345.00 |

| 2028 | 380.00 |

| 2029 | 415.00 |

| 2030 | 450.00 |

Amazon is particularly ready for growth from its continued market expansion in AWS, Prime memberships and international markets. The predictions are benign, yet conservative of the market conditions.

Price Forecasts and Analysis Of Amazon (2025-2030)

2025 Price Forecast

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

|---|---|---|---|

| January | 220.00 | 230.00 | -0.95% to +3.54% |

| February | 221.50 | 231.50 | -0.28% to +4.22% |

| March | 223.00 | 233.00 | +0.39% to +4.88% |

| April | 224.00 | 235.00 | +0.85% to +5.81% |

| May | 225.00 | 236.50 | +1.30% to +6.49% |

| June | 226.50 | 238.00 | +2.01% to +7.17% |

| July | 227.50 | 239.50 | +2.47% to +7.85% |

| August | 229.00 | 241.00 | +3.18% to +8.53% |

| September | 230.00 | 243.00 | +3.63% to +9.46% |

| October | 231.50 | 244.50 | +4.22% to +10.12% |

| November | 233.00 | 246.00 | +4.88% to +10.81% |

| December | 234.50 | 248.00 | +5.54% to +11.74% |

2026 Price Forecast

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

|---|---|---|---|

| January | 235.50 | 250.00 | +6.00% to +12.66% |

| February | 237.00 | 252.00 | +6.67% to +13.59% |

| March | 238.50 | 254.00 | +7.33% to +14.52% |

| April | 240.00 | 256.50 | +8.00% to +15.57% |

| May | 241.50 | 258.00 | +8.66% to +16.25% |

| June | 243.00 | 260.00 | +9.32% to +17.18% |

| July | 244.50 | 262.00 | +9.99% to +18.11% |

| August | 246.00 | 264.50 | +10.65% to +19.15% |

| September | 247.50 | 266.50 | +11.31% to +20.08% |

| October | 249.00 | 268.50 | +11.97% to +21.01% |

| November | 250.50 | 270.50 | +12.63% to +21.94% |

| December | 252.00 | 273.00 | +13.29% to +23.06% |

2027 Price Forecast

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

|---|---|---|---|

| January | 253.50 | 275.50 | +13.95% to +24.18% |

| February | 255.00 | 277.50 | +14.60% to +25.12% |

| March | 256.50 | 280.00 | +15.26% to +26.23% |

| April | 258.00 | 282.50 | +15.92% to +27.35% |

| May | 259.50 | 284.50 | +16.58% to +28.29% |

| June | 261.00 | 287.00 | +17.23% to +29.40% |

| July | 262.50 | 289.50 | +17.89% to +30.52% |

| August | 264.00 | 292.00 | +18.55% to +31.63% |

| September | 265.50 | 294.50 | +19.21% to +32.75% |

| October | 267.00 | 297.00 | +19.87% to +33.86% |

| November | 268.50 | 299.50 | +20.52% to +34.98% |

| December | 270.00 | 302.00 | +21.18% to +36.09% |

2028 Price Forecast

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

|---|---|---|---|

| January | 272.00 | 305.00 | +22.02% to +37.29% |

| February | 273.50 | 307.50 | +22.67% to +38.41% |

| March | 275.00 | 310.00 | +23.33% to +39.52% |

| April | 276.50 | 312.50 | +23.98% to +40.63% |

| May | 278.00 | 315.00 | +24.64% to +41.75% |

| June | 279.50 | 317.50 | +25.29% to +42.86% |

| July | 281.00 | 320.00 | +25.94% to +43.97% |

| August | 282.50 | 322.50 | +26.60% to +45.08% |

| September | 284.00 | 325.00 | +27.25% to +46.20% |

| October | 285.50 | 327.50 | +27.91% to +47.31% |

| November | 287.00 | 330.00 | +28.56% to +48.42% |

| December | 288.50 | 332.50 | +29.22% to +49.53% |

2029 Price Forecast

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

|---|---|---|---|

| January | 290.00 | 335.00 | +29.87% to +50.64% |

| February | 291.50 | 337.50 | +30.53% to +51.75% |

| March | 293.00 | 340.00 | +31.18% to +52.87% |

| April | 294.50 | 342.50 | +31.84% to +53.98% |

| May | 296.00 | 345.00 | +32.49% to +55.09% |

| June | 297.50 | 347.50 | +33.15% to +56.20% |

| July | 299.00 | 350.00 | +33.80% to +57.32% |

| August | 300.50 | 352.50 | +34.46% to +58.43% |

| September | 302.00 | 355.00 | +35.11% to +59.54% |

| October | 303.50 | 357.50 | +35.77% to +60.65% |

| November | 305.00 | 360.00 | +36.42% to +61.77% |

| December | 306.50 | 362.50 | +37.08% to +62.88% |

2030 Price Forecast

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

|---|---|---|---|

| January | 308.00 | 365.00 | +37.73% to +63.99% |

| February | 309.50 | 367.50 | +38.39% to +65.10% |

| March | 311.00 | 370.00 | +39.04% to +66.21% |

| April | 312.50 | 372.50 | +39.70% to +67.32% |

| May | 314.00 | 375.00 | +40.35% to +68.44% |

| June | 315.50 | 377.50 | +41.01% to +69.55% |

| July | 317.00 | 380.00 | +41.66% to +70.66% |

| August | 318.50 | 382.50 | +42.32% to +71.78% |

| September | 320.00 | 385.00 | +42.97% to +72.89% |

| October | 321.50 | 387.50 | +43.63% to +74.00% |

| November | 323.00 | 390.00 | +44.28% to +75.11% |

| December | 324.50 | 392.50 | +44.94% to +76.22% |

Opinion

Analysts still rate this stock a strong buy. The e-commerce and cloud services have been booming thanks to its dominant market cap and revenue.

How to Buy Amazon Stock

Choose a Broker: If you’re not already invested, then open a brokerage account on a platform such as Robinhood, Fidelity or E*TRADE.

- Deposit Funds: You will connect your bank account and add funds.

- Search for (AMZN): To find Amazon shares, search the platform’s search bar.

- Decide Your Investment Amount: Find out what you will be investing.

- Place Your Order: Click ‘Buy’, select order type (market or limit) and verify the purchase.

- Monitor Your Investment: Through the brokerage platform, keep track of your shares.

Note: Never trust a financial advisor to provide investment advice without evaluating and discussing it with a qualified adviser who suits your particular circumstances.

Final Thoughts

Even if you’re sold on Amazon’s stock as a long-term investment, you still have the option of making short-term gains. Due to its diversified business model along with a focus on innovation, I believe that the company has a good chance to maintain its leadership of the global market. As a reliable addon to your portfolio, investment worth considering in Amazon would be depending on market trends and Company updates to find entry points.

Optimistic predictions for stock performance, but it’s important to mention that market conditions and unforeseen challenges will affect stock performance. Always, we recommend a balanced investment approach.

Frquently Asked Questions

1. What is Amazon.com, Inc.?

It is a multinational technology company that sells its products and services online primarily through Amazon.com, but also through its development sites, like Lab126. Amazon.com, Inc. is a global company selling services in their e-commerce cloud computing digital streaming technologies, artificial intelligence and software development. Based in Seattle, Washington, it is one of the world’s largest Internet retailers.

2. What are the major revenue sources for Amazon?

Amazon’s revenue primarily comes from:

1.Online retail sales.

2.Subscription services (Amazon Prime for example).

3.Amazon web services (AWS) cloud computing.

4.Advertising services

3. How can I invest in Amazon stock?

You can purchase Amazon stock (AMZN) through:

1.Brokerage platforms.

2.Financial advisors.

3.Robinhood or E*TRADE stock market apps.

4. Is Amazon stock a good investment?

The decisions made in investment are based on the individual financial goals and risk tolerance. While often regarded as a strong long term investment because of its diversified business model and continuous innovation, Amazon is a special company. While speaking to a financial adviser is a good idea.

Pingback: BlackBerry (BB) Stock Price Forecast, Stock, Target 2025, 2026, (2027-2030)

Pingback: Ameriprise Financial (AMP) Stock Price Forecast, Price Target (2024-2030)

Pingback: Alibaba Group (Alibaba) Stock Forecast, analysis, and Price target (2025 to 2030)

Pingback: Albemarle Corporation (ALB) Stock Forecast, Price Target (2025 to 2030)

Pingback: SoFi Technologies (SOFI) Stock Price Prediction and Analysis (2024–2030)

Pingback: Disney Company (DIS) Stock Forecast, Price Targets (2025-2030)