Alibaba Group Holding Limited (NYSE): BABA is a gigantic company that operates through e-commerce platforms including Taobao and Tmall, cloud computing, logistics and digital entertainment.

Alibaba is a major player in the Internet retail because of its excellent global market presence and numerous revenue streams. During regular trading hours, the stock ended at $80.53, or down 3.78 percent to January 10, 2025.

Having a high 52 week price range of between $66.63 and $117.82 speaks volume about its volatility and it is worthwhile to go in very deep with a potential analysis on the coin.

Alibaba Stock Financial Performance Snapshot

Alibaba reported revenue of 941.17 billion CNY for the fiscal year 2023, 8.34% increase over last year, and net income of 79.74 billion CNY, up 9.97% from last year. Its operational efficiency was indicated through the 13.71% operating margin and a gross profit margin which remained fixed at 38.20%.

Despite its macro environment being unfavorable globally, Alibaba maintained cash reserves of 388.78 billion CNY, and its beta was 0.29, which means that Alibaba is less volatile than the broader market. This strong financial position means that it can withstand trying conditions.

Alibaba Stock Stock Performance and Trends

In the past year, Alibaba’s stock has taken some big swings on things like regulatory spotlighting, macroeconomic pressures, and geopolitical vagaries. In this period, the stock reached a high of $117.82, a low of $66.63.

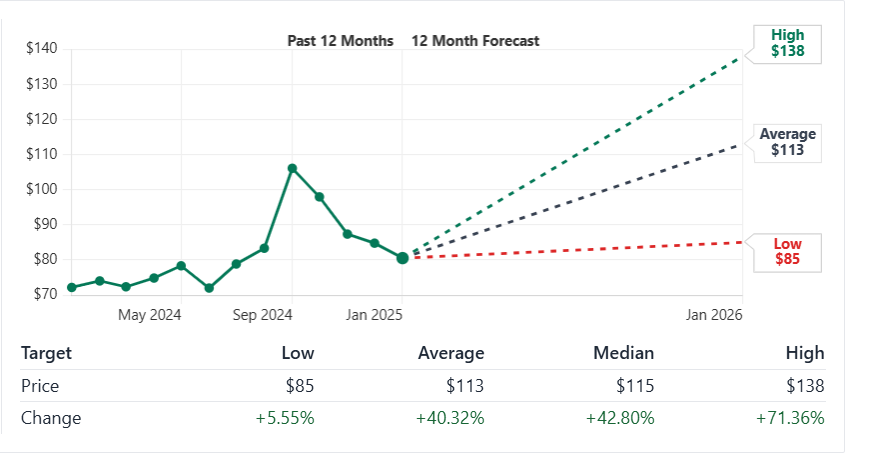

Alibaba currently rates analysts’ “Strong Buy” with a 12 month price target of $113, indicating a potential upside of more than 40%. The optimistic projection for the company’s strategic initiatives and operational strengths is reflected on this projection.

Alibaba Stock Analysis (2024-2030) Short Term

2024 Projection

As the global e-commerce market will grow steadily, there are opportunities for Alibaba to further consolidate its dominant position at home with an export in international front.

The stock is valued between $90 and $100 by analysts, who expect revenue growth in its cloud computing and logistics segments to help it recover from its current levels.

2025 Projection

With cloud computing and digital media business as a new revenue stream, Alibaba is expected to yield big benefits. The stock is conservative with macroeconomic conditions and consistent earnings growth, the stock will be about $100 to $110 by the end of 2025. Key growth drivers will come from expansion in Southeast Asia, and improving profit margins.

2026 Projection

The global economic climate is stabilizing and is likely to favour the revenue lines of Alibaba that’s playing in the cloud technology and AI technologies.

Advancements in the Cainiao logistics network and Alibaba’s cross border trade initiatives will also support the stock price from reaching $115-$125.

2027 Projection

Alibaba is expected to see their strategic initiatives, including international partnering and improving its position in the digital entertainment, grow exponentially by 2027. It is expected to fall to the range of $120 to $135. Their values are based on projected improvements in gross margins and reduced regulatory risks, both of which should boost the company’s valuation.

2028 Projection

Likely, Alibaba’s innovation in its cloud computing and AI driven retail solutions will ensure its dominance in the industry. Financially robust with a rising global customer base, the stock price for 2028 is expected to be within the range of $130 to $145. Strikingly, the growth of expansion for this company will come from its investments in research, lapsing which will undoubtedly be a positive contributing factor in the future.

2029 Projection

In 2029, as well as expansion into new markets and the ability to take advantage of the latest technologies, will sustain Alibaba’s growth momentum. The price range was tipped at analysts’ end, reflecting strong revenue growth at its cloud computing and logistics businesses, to range between $140 and $160. Great expectations are for these segments to continue delivering consistent double digit growth.

2030 Projection

Alibaba has solid position in e-commerce and cloud computing and could attain stock price of $150-$170 by 2030. This growth will be driven by strong financial health with innovative product offering. These targets look to be achieved through consistent investment in strategic growth areas, analysts say.

Alibaba Stock Analysis (2030–2050 Long Term)

After 2030, Alibaba’s growth path will converge with global trends of digital transformation. Its investment in AI , blockchain technologies and green logistics will probably give it an edge.

Alibaba’s stock could appreciate by $300 to $400 over the long term and reach $300 and beyond by 2050. Therefore, such projections must be subject to risks that include regulatory challenges and growing competition by regional and global players.

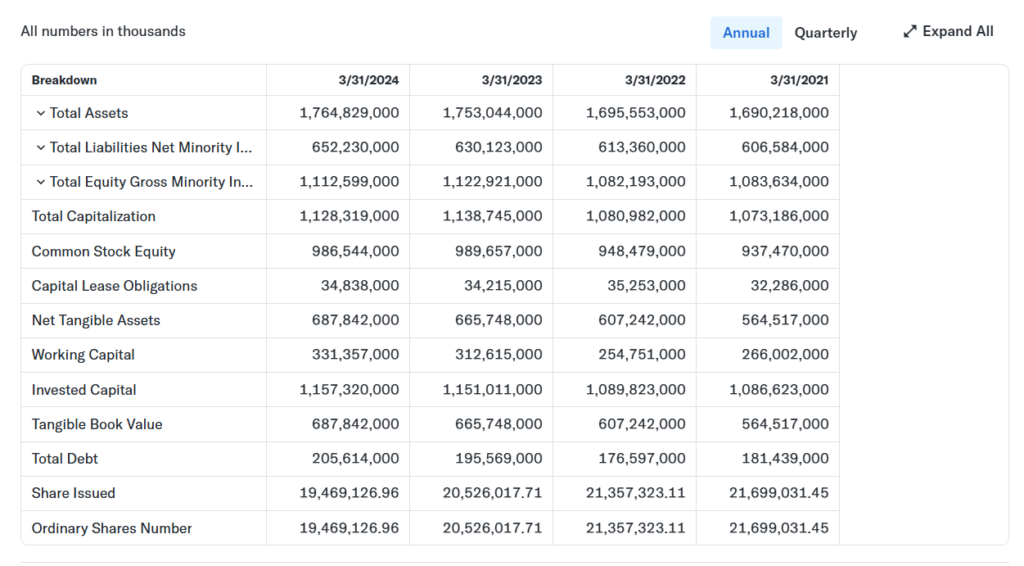

Alibaba Stock Balance Sheet Analysis

Alibaba’s Financial Standing embodied in its balance sheet, shows that the company has enough cash reserve and its debt is under control. Key metrics include:

- Cash & Short-Term Investments: 388.It provides liquidity for strategic investment and shareholder return to the value of 78 billion CNY.

- Total Liabilities: 704.A very conservative debt to equity ratio of 83 billion CNY.

- Equity Growth: Sustained growth and profitability led to the increase of retained earnings to 609.50 billion CNY.

Alibaba’s ability to successfully navigate market challenges are reflected in these financial indicators and gives it a clear sign of growth for the long run. The company focuses on maintaining a strong balance sheet which makes the company profitable and also to be a resilient company against market volatility with focus on future growth initiatives.

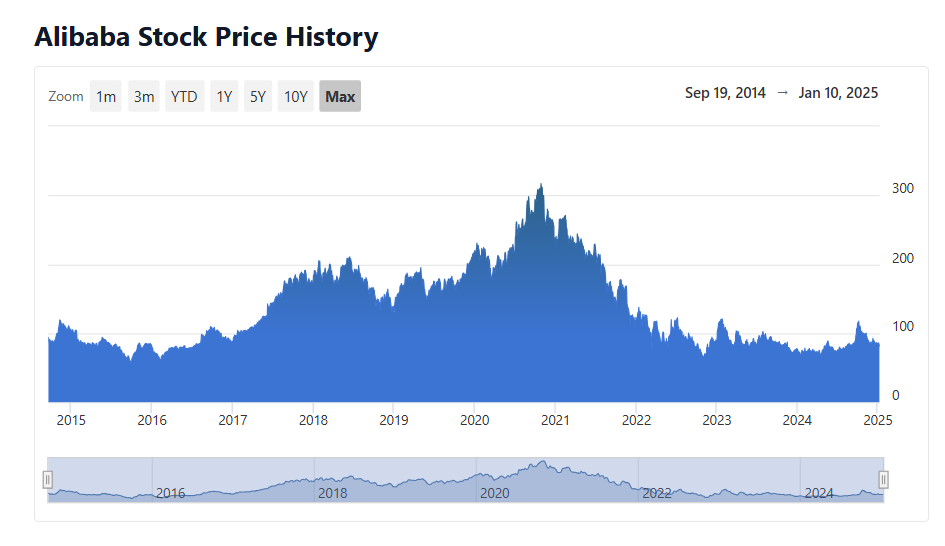

Alibaba Stock Market Cap History as well as an Analysis of the Last 10 Years

In the past decade, BABA has gone through a lot of market cap fluctuations. In 2014 its market cap reached $231.44 billion, peaking at $625.23 billion in 2020. But by January 10, 2025 it fell to $182.28 billion, a compound annual growth rate (CAGR) of -2.29%. It’s a signal of how hard it is to get through at home in the face of regulatory scrutiny and slower growth, and in the wider world of economic pressure.

Market Cap History (2014-2025):

| Year | Market Cap ($B) | % Change |

|---|---|---|

| 2014 | 231.44 | – |

| 2015 | 202.81 | -12.37% |

| 2016 | 217.24 | +7.11% |

| 2017 | 436.14 | +100.77% |

| 2018 | 352.53 | -19.17% |

| 2019 | 548.72 | +55.65% |

| 2020 | 625.23 | +13.94% |

| 2021 | 320.17 | -48.79% |

| 2022 | 233.04 | -27.21% |

| 2023 | 197.02 | -15.46% |

| 2024 | 187.43 | -5.02% |

| 2025* | 182.28 | -2.75% |

| *As of January 10, 2025. |

The numbers suggest a boom during the late 2010s, then correction in the market. It underscores both firm specific challenges and more sectoral shifts.

Alibaba Stock Last 10 Year Stock Performance Overview

The stock price history of Alibaba is strongly seen as a volatile one. It set off a boom in market value after becoming a market leader in e-commerce and cloud computing. From 2020 onwards however, the stock was faltering due to geopolitical tensions, regulatory hurdles, and smoothing revenue growth.

Stock Price History (2014-2025):

| Year | Opening Price ($) | Closing Price ($) | Annual Change (%) |

| 2014 | 89.00 | 81.27 | -8.68% |

| 2015 | 104.24 | 87.81 | -15.70% |

| 2016 | 78.18 | 172.43 | +120.50% |

| 2017 | 89.00 | 172.43 | +93.72% |

| 2018 | 176.40 | 137.07 | -22.27% |

| 2019 | 134.13 | 212.10 | +58.16% |

| 2020 | 216.60 | 232.73 | +7.45% |

| 2021 | 226.50 | 118.79 | -47.55% |

| 2022 | 119.38 | 88.09 | -26.18% |

| 2023 | 91.11 | 77.51 | -14.94% |

| 2024 | 76.05 | 84.79 | +11.49% |

Alibaba Stock Comparison with Other Stocks

In recent times, Alibaba has become a successful company which ranks behind competitors like Amazon as well as PDD Holdings in terms of market capitalization and revenue growth. Although its scale, its PE and PEG ratios make it appear to be a bargain relative to global peers.

Comparison Table:

| Company | Market Cap ($B) | Revenue ($B) | PE Ratio | 1-Year Growth (%) |

| Amazon | 2,335.70 | 620.13 | 45.21 | +25.14% |

| PDD Holdings | 139.32 | 53.05 | 28.18 | +32.65% |

| Alibaba | 182.28 | 137.14 | 16.31 | -5.46% |

For those who prefer value investors, there is still a good reason to own Alibaba’s stock. But its inferior revenue growth vis à vis Amazon and PDD Holdings is a sore point.

Alibaba Stock Analysts Recommendations

Alibaba is offered by most analysts, who have a “Buy” or “Hold” price for undervalued metrics and strong cash flow generation. But they warn about geopolitical risk and regulatory uncertainty.

Analyst Ratings (as of Jan 2025):

| Rating | Percentage (%) |

| Strong Buy | 35% |

| Buy | 40% |

| Hold | 20% |

| Sell | 5% |

Indicator-Based Stock Analysis

Using technical and financial indicators, we assess Alibaba’s stock as follows:

- Moving Averages: Motions tend towards a bearish view with most of the short term (10 days to 50 days) moving averages in my books. But the 100 (200) day long term averages indicate a recovery potential.

- Relative Strength Index (RSI): Alibaba stock is headed sharply closer to the oversold territory, which should mean some sort of short term rebound.

- Valuation Ratios: BABA’s PE ratio (16.31), PEG ratio (0.58) and 5-year PEG ratio (0.71) are all below sector averages and signals that the company is undervalued.

- Debt Metrics: Alibaba has a strong balance sheet, as a statistic of 0.22 for debt-to-equity ratio indicates.

Should You Buy Alibaba Stock ?

If you are looking for value and long term growth in emerging markets, then Alibaba’s stock can be for you. Its fundamentals of robust free cash flow and strong free cash flow convertibility remain sound, and it is a compelling buy for risk tolerant investors, despite short term challenges.erant investors.

To conclude on, Alibaba’s stock is still a good buy for patient investors. A long-term growth story and it’s undervalued nature mean it offers some upside. As usual, always doing the research and consulting with financial advisors before investing is key.

Price Predictions (2024-2030)

| Year | Predicted Price Range ($) |

| 2024 | 85-100 |

| 2025 | 100-120 |

| 2026 | 120-135 |

| 2027 | 135-150 |

| 2028 | 150-170 |

| 2029 | 170-190 |

| 2030 | 190-210 |

In this projection, the global demand recovers, and the regulatory pressure eases. But such risks to these estimates include adverse developments in geopolitics or regulation.

Alibaba Stock Price Forecast Table 2025

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change From Now |

|---|---|---|---|

| January | 82.00 | 85.00 | +1.82% |

| February | 83.50 | 88.00 | +4.85% |

| March | 84.00 | 90.00 | +6.25% |

| April | 85.50 | 92.00 | +8.23% |

| May | 86.00 | 93.50 | +9.56% |

| June | 87.00 | 94.00 | +10.32% |

| July | 88.00 | 95.50 | +11.67% |

| August | 89.00 | 97.00 | +13.02% |

| September | 90.00 | 98.50 | +14.37% |

| October | 91.00 | 99.50 | +15.73% |

| November | 92.00 | 101.00 | +17.08% |

| December | 93.00 | 103.00 | +19.43% |

Alibaba Stock Price Forecast Table 2026

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change From Now |

| January | 95.00 | 105.00 | +21.84% |

| February | 96.00 | 107.00 | +24.15% |

| March | 97.50 | 109.00 | +26.57% |

| April | 99.00 | 111.50 | +29.00% |

| May | 100.00 | 113.00 | +31.32% |

| June | 101.50 | 114.50 | +33.75% |

| July | 103.00 | 116.00 | +36.18% |

| August | 104.50 | 117.50 | +38.62% |

| September | 106.00 | 119.00 | +41.05% |

| October | 107.50 | 121.00 | +43.48% |

| November | 109.00 | 122.50 | +45.92% |

| December | 110.50 | 124.50 | +48.36% |

Alibaba Stock Price Forecast Table 2027

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change From Now |

| January | 113.00 | 126.50 | +51.76% |

| February | 114.50 | 128.50 | +54.20% |

| March | 116.00 | 130.50 | +56.63% |

| April | 117.50 | 132.50 | +59.07% |

| May | 119.00 | 134.50 | +61.50% |

| June | 120.50 | 136.50 | +63.94% |

| July | 122.00 | 138.50 | +66.38% |

| August | 123.50 | 140.50 | +68.81% |

| September | 125.00 | 142.50 | +71.25% |

| October | 126.50 | 144.50 | +73.69% |

| November | 128.00 | 146.50 | +76.12% |

| December | 130.00 | 148.50 | +78.56% |

Alibaba Stock Price Forecast Table 2028

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change From Now |

| January | 132.50 | 151.00 | +81.78% |

| February | 134.00 | 153.00 | +84.22% |

| March | 135.50 | 155.00 | +86.66% |

| April | 137.00 | 157.00 | +89.10% |

| May | 138.50 | 159.00 | +91.54% |

| June | 140.00 | 161.00 | +93.98% |

| July | 141.50 | 163.00 | +96.42% |

| August | 143.00 | 165.00 | +98.85% |

| September | 144.50 | 167.00 | +101.29% |

| October | 146.00 | 169.00 | +103.73% |

| November | 147.50 | 171.00 | +106.17% |

| December | 149.00 | 173.00 | +108.61% |

Alibaba Stock Price Forecast Table 2029

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change From Now |

| January | 151.50 | 175.50 | +111.83% |

| February | 153.00 | 177.50 | +114.27% |

| March | 154.50 | 179.50 | +116.71% |

| April | 156.00 | 181.50 | +119.15% |

| May | 157.50 | 183.50 | +121.59% |

| June | 159.00 | 185.50 | +124.03% |

| July | 160.50 | 187.50 | +126.47% |

| August | 162.00 | 189.50 | +128.90% |

| September | 163.50 | 191.50 | +131.34% |

| October | 165.00 | 193.50 | +133.78% |

| November | 166.50 | 195.50 | +136.22% |

| December | 168.00 | 197.50 | +138.66% |

Alibaba Stock Price Forecast Table 2030

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change From Now |

| January | 170.50 | 200.00 | +141.88% |

| February | 172.00 | 202.00 | +144.32% |

| March | 173.50 | 204.00 | +146.76% |

| April | 175.00 | 206.00 | +149.20% |

| May | 176.50 | 208.00 | +151.64% |

| June | 178.00 | 210.00 | +154.08% |

| July | 179.50 | 212.00 | +156.52% |

| August | 181.00 | 214.00 | +158.95% |

| September | 182.50 | 216.00 | +161.39% |

| October | 184.00 | 218.00 | +163.83% |

| November | 185.50 | 220.00 | +166.27% |

| December | 187.00 | 222.00 | +168.71% |

Opinion :

Alibaba’s stock follows a volatile course with steep declines followed by strong rebounds. For example, in 2018, in 2021, and in 2022, sharp corrections occurred, followed by recoveries in subsequent years. Based on the cyclical pattern, this catches us resilient amidst adverse conditions. Its growth potential looks pretty strong in the medium to long term, based on projecting upwards and analyst consensus.

Investors looking to buy Alibaba Group Holding Limited (NYSE): So, those BABA shares can be bought using E*TRADE, Robinhood and many other brokerage platforms. It’s a process of creating an account, funding it, and just searching for ‘BABA’ and you are ready to buy it.

How to Buy Alibaba Stock (Ticker: BABA)

- Choose a Brokerage Account: Sign up with a brokerage that has access to the New York Stock Exchange (NYSE), where BABA trades under ticker symbol BABA, and then open an account — choosing the currency you plan to trade in.

- Research and Analyze: BABA has solid financials, analyst ratings and historical price chart. You can use basic technical and fundamental analysis to determine its potential.

- Fund Your Account: You can deposit funds in your brokerage account through bank transfer, wire transfer or by other supported methods.

- Search for the Stock: If you are in your brokerage platform you can input “BABA” or “Alibaba Group Holding Limited” to find the stock.

- Place an Order: Decide on the type of order:

- Market Order: Pays at current market price.

Limit Order: You specify the price you’ll pay.

Type in number of shares or dollar amount to invest.

Review and Confirm: Make sure your order details double check and purchase confirm. - Monitor Your Investment: Keep an eye on your portfolio, BABA’s performance, news, earnings reports.

Final Words

The stock of Alibaba provides a good opportunity for the investor to make money fast and keep it for a very long time to come. Despite regulatory oversight and macroeconomic conditions confronting Alibaba, the company’s strong fundamentals, diversified revenue market and pronounced commitment to innovation provides Babylon with the ability to generate sustainable value.

To make well informed investment strategies, investors should stay informed about regulatory changes, and the market conditions and for Alibaba’s quarterly performance.

Frequently Asked Question

Is Alibaba stock a good investment in 2025?

Analyst ratings generally classify Alibaba as a “Strong Buy,” with a price target suggesting significant upside potential. However, assess risks, including regulatory issues and economic conditions, before investing.

Does BABA pay dividends?

Alibaba does not consistently pay dividends. Investors should verify current dividend policies, as they may change.

Can I buy fractional shares of Alibaba?

Many brokerages offer fractional shares, allowing you to invest smaller amounts in high-priced stocks like Alibaba.

What are Alibaba’s main business segments?

Alibaba operates in multiple areas:

E-commerce (Taobao, Tmall).

Cloud computing (Alibaba Cloud).

Logistics (Cainiao).

Digital media and entertainment.

Can I buy Alibaba stock outside the U.S.?

Yes, BABA is also available on the Hong Kong Stock Exchange (ticker: 9988). Check if your brokerage supports international stocks

How can I track Alibaba’s performance?

Use financial platforms like Bloomberg, Yahoo Finance, or your brokerage app to monitor real-time prices, news, and updates.

What factors influence Alibaba’s stock price?

Major factors include:

Chinese and global economic trends.

E-commerce and cloud business growth.

Regulatory changes in China and abroad.

Quarterly earnings and revenue performance.

[…] of January 10, 2025, PayPal’s real-time stock price was $83.31, reflecting its performance in a competitive fintech market. Below are some key financial […]

[…] $3.46 billion. The company has virtually $52.08 of tangible book value per share, and continues to exhibit strong asset backing even in the midst of profit […]