Albemarle Corporation (NYSE): Global leader in the specialty chemicals industry, ALB is the producer of lithium, bromine and catalyst products. With increasing way, these materials manufacture for an array of discourses from energy storage, electric vehicles (EVs), to pharmaceuticals and more.

Albemarle’s stock, which sells for $86.53 as of January 2025, is expected to grow. Market volatility has been difficult, but the company remains one of the major players in materials. Using this analysis, this paper explores the financial performance, stock trajectory from 2024 to 2030, and long term potential of Albemarle.

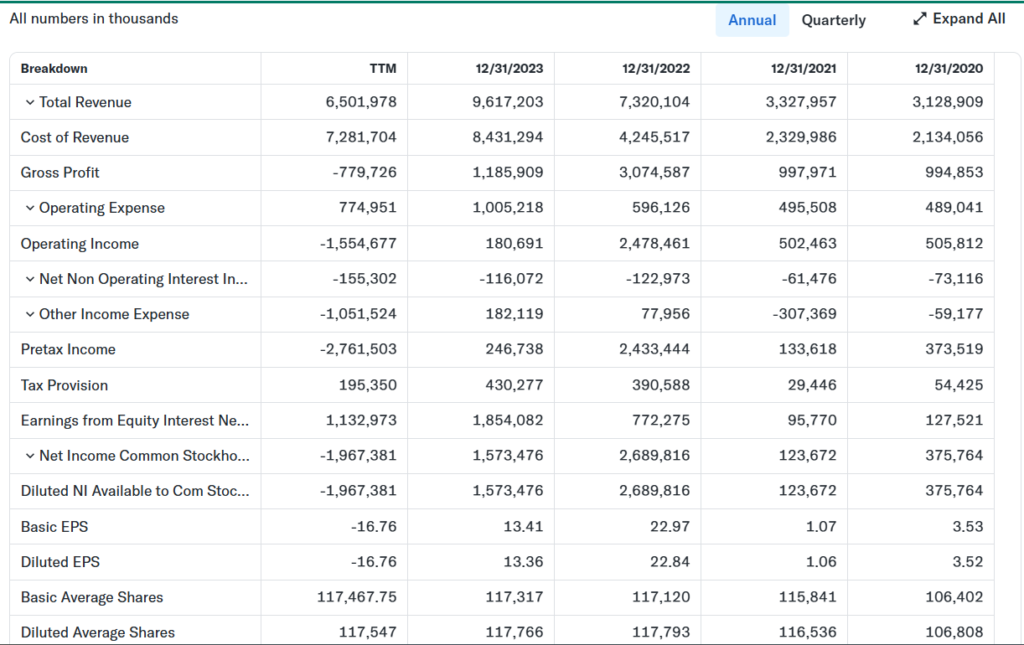

Albemarle Corporation Company Financials

Financial highlights and hurdles have bedeviled Albemarle’s journey. Not bad for 2023 when the company earned $9.62 billion in revenue, up from $7.32 billion in 2022, an increase of 31.03%.

While this is a growth in revenue, net income was down 41.5 percent, to $1.57 billion, driven largely by rising costs along with external market pressures. Nevertheless, as the trailing twelve months (TTM) revenue computed in September 2024 stood at $6.5 billion, it points to short term difficulties.

Key financial metrics as of 2025 include:

- Market Cap: $10.17 billion

- EPS (TTM): -$16.75

- Dividend Yield: 1.87%

- 52-Week Range: $71.97 – $143.19

Total assets of $17.45 billion are supported by $1.67 billion in cash and short-term investments with Albemarle. Liabilities, however, are $6.97 billion, including long term debt of $3.46 billion. The company has virtually $52.08 of tangible book value per share, and continues to exhibit strong asset backing even in the midst of profit issues.

ALB Stock Short Term Analysis (2024 to 2030)

Albemarle’s stock price has been a rollercoaster through the past year, ranging from $71.97 to $143.19. Optimism about lithium demand and the worry about profitability has shaped investor sentiment. Further volatility has been fuelled by declining revenues in 2024 and intensified competition in the lithium market.

However, the short term pressures on lithium prices are evident and the longer term outlook for lithium remains positive. As it is the main lithium supplier of the markets for EV and renewable energy storage solutions, Albemarle is well positioned to cash in on this growth trajectory.

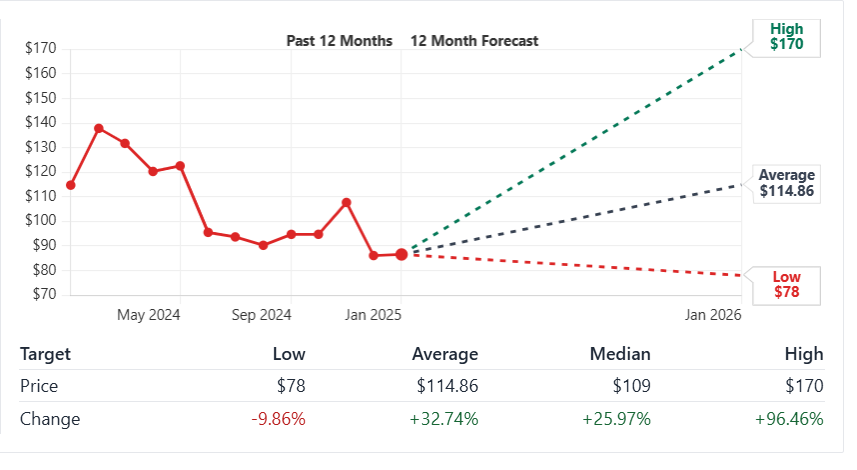

2024-2025 Projection

The company will be faced with near term challenges of areas such as pricing pressures, cost management etc. But analysts are predicting a recovery, where the stock could climb to $114.86 by the later part of 2025 — a ripe 32.74 percent increase from current levels.

2026 Projection

When expansion in Chile and Australia increases Albemarle’s production capacity of lithium, revenue growth should stabilize. The stock could also rake above $130.

2027 Projection

Further consolidating Albemarle’s market position is strategic focus on energy storage and specialty chemicals. EV market is exploding and the stock can rise past $150 or more.

2028-2030 Projection

By the decade’s end, Albemarle is looking to leverage its expertise on both producing and the innovation of lithium. It projects the stock to get to $180 to $200 if demand continues to grow steadily and the company’s operations become more efficient.

ALB Stock Long-Term Analysis (2030-2050)

Albemarle’s long-term prospects are very closely tied to the global energy transition. The demand for lithium is expected to rise above 20 percent compound annual growth rate (CAGR) as EVs are rapidly adopted and grid scale energy storage solutions continue gaining in demand.

Factors Affecting Long Term Growth

- Innovation and Technology: With advanced lithium extraction investments that are either reducing costs by doing it, or where it’s doing it in a more environmentally friendly way, Albemarle’s coming out far ahead.

- Market Expansion: Although this enables us to penetrate emerging markets and secure long term supply agreements with leading EV manufacturers, raising the level of revenue streams remains a muddy problem.

- Diversification: Finally, its efforts to widen its bromine and catalyst segments will serve to absorb any volatility that might appear in the lithium market.

Long-Term Price Predictions

If Albemarle keeps leading on the lithium sector, and increasingly manages regulatory and competitive issues, the stock price could reach $300 in 2050. But to get to these aggressive targets, sustained innovation and scalability will be needed.

ALB Stock Balance Sheet Analysis

Albemarle’s balance sheet shows a mix of good and not so good. The company has a financial stability of a tangible book value per share of $52.08 and a manageable debt equity ratio of approximately 0.7. Yet, given that the TTM has negative earnings, the need for greater efficiency becomes apparent.

Key Metrics:

- Current Ratio: 2.44, indicating strong short-term liquidity.

- Debt Levels: Long-term debt of $3.46 billion is manageable but demands strategic oversight.

- Free Cash Flow: Negative free cash flow (-$1.41 billion) underscores the importance of enhancing cash generation capabilities.

ALB Stock Market Cap History and Analysis of the Last 10 Years

The lion’s share of Albemarle’s market cap fluctuations over the past decade were attributed to its leading position in lithium production, which is a key component in electric vehicle (EV) batteries. Here’s a quick look at its annual market cap performance:

| Year | Market Cap (in billions) | Annual Change (%) |

|---|---|---|

| 2015 | $6.28 | +33.56 |

| 2016 | $9.68 | +54.06 |

| 2017 | $14.13 | +45.96 |

| 2018 | $8.19 | -42.08 |

| 2019 | $7.74 | -5.38 |

| 2020 | $15.70 | +102.78 |

| 2021 | $27.35 | +74.12 |

| 2022 | $25.41 | -7.09 |

| 2023 | $16.96 | -33.26 |

| 2024 | $10.17 | -40.33 |

The drop in 2024, of 40.33%, is due to the broader market slowdown and operationalization issues, such as a drop in lithium prices. Despite this, Albemarle continues to be a case of going concern, with its long term growth history (CAGR CAGR of 9.8% since 1998) a reminder of its effectiveness.

ALB Stock Last 10-Year Stock Price Analysis

It’s been a very exciting past decade for Albemarle investors. Price swings in the company’s stock have been extremely dramatic, driven mostly by the volatile lithium price and the growth of the EV market. Here’s a snapshot:

| Year | High Price | Low Price | Annual Close | Annual Change (%) |

| 2015 | $64.99 | $41.37 | $56.01 | -6.85 |

| 2016 | $92.24 | $45.78 | $86.08 | +53.69 |

| 2017 | $144.99 | $86.98 | $127.89 | +48.57 |

| 2018 | $138.67 | $71.89 | $77.07 | -39.74 |

| 2019 | $93.14 | $58.63 | $73.04 | -5.23 |

| 2020 | $153.48 | $48.89 | $147.52 | +101.97 |

| 2021 | $291.48 | $133.82 | $233.77 | +58.47 |

| 2022 | $334.55 | $169.93 | $216.86 | -7.23 |

| 2023 | $293.01 | $112.00 | $144.48 | -33.38 |

| 2024 | $149.61 | $71.97 | $86.08 | -40.42 |

Soaring lithium demand and price rages all but pushed the peak in 2021-22, followed by a correction in the market.

ALB Stock Comparison with Other Stocks

Where does Albemarle rank on the market? Below is a quick comparison:

| Company | Market Cap (B) | 2024 Revenue (B) | P/E Ratio | Dividend Yield (%) |

| Albemarle (ALB) | $10.17 | $6.50 | n/a | 1.87 |

| BHP Group | $56.03 | $54.18 | 14.1 | 8.2 |

| Rio Tinto | $54.18 | $45.39 | 11.8 | 6.9 |

| Freeport-McMoRan | $25.64 | $20.48 | 14.5 | 1.6 |

Albemarle’s market cap has dropped considerably, but its leading position in lithium maintaining a competitive edge. It remains laggard behind top miners such as BHP and Rio Tinto in terms of market stability and dividend yield.

ALB Stock Indicator-Based Stock Analysis

Using key technical and fundamental indicators, here’s a snapshot of Albemarle’s current position:

Technical Indicators:

- Relative Strength Index (RSI): 36.It is oversold (34): a turning indication towards upward correction might be warranted.

- 50-Day Moving Average: A bearish sign as the current price is below this level (Current price is $99.00)

- 200-Day Moving Average: confirming a long term downtrend ($102.27)

Fundamental Indicators:

- Debt/Equity Ratio: 0.The number 35 (Indicates manageable leverage)

- Current Ratio: 2.44 (Strong liquidity)

- Return on Equity (ROE): Negative, or losses over the past year, -17.66%.

- Profit Margin: Significant room for improvement (–28.80%).

Should You Buy Albemarle Stock?

Investing in Albemarle is basically gambling on electric vehicles and renewable energy. It is undeniable that there are current challenges: declining lithium prices and operating inefficiencies. But analysts remain cautiously optimistic, the average price target of $114.86 (a 32.74%) suggests.

Analyst Recommendations:

| Analyst Count | Rating |

| 22 | Hold |

Price Forecast Yearly 2025 to 2030:

| Year | Predicted Price Range (USD) | Key Insights |

|---|---|---|

| 2024 | $85 – $115 | The fate of recovery will rely on stabilization of lithium price and streamlining of operations. |

| 2025 | $100 – $135 | As electric vehicles are expected to gain more ground, demand for lithium may be on the rise. |

| 2026 | $120 – $150 | Revenues might be driven by expanding battery technology and Albemarle’s additional capacity. |

| 2027 | $135 – $170 | Better performance might be achieved through new supply agreements and technological progress in lithium extraction. |

| 2028 | $150 – $200 | Renewable energy adoption is accelerating globally, but its long term gains are expected. |

| 2029 | $150 – $200 | Growth sustained by continuing lithium demand and global renewable energy adoption. |

| 2030 | $150 – $200 | Strong market position maintained with renewable energy advancements and EV market expansion. |

Pros:

- Leadership in Lithium: If EV demand continues to rise, then lithium will also grow in demand – this is a tailwind for Albemarle.

- Solid Dividend History: Albemarle’s history with 30 consecutive years of dividend growth appeals to income focused investors.

- Strong Liquidity: Short term liabilities are to be handled by the company through current ratio of 2.44.

Cons:

- Recent Losses: The levels of negative profit margins and return ratios are insufficient.

- Market Volatility: Albemarle’s stock price can swing wildly, given a beta of 1.59.

- Competition: So BHP and Rio Tinto are financially better capitalized and more diversified.

ALB Stock Price Forecast Table 2025

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

|---|---|---|---|

| Jan | 85.00 | 90.00 | -2.00% to +4.00% |

| Feb | 86.50 | 91.00 | 0.00% to +5.19% |

| Mar | 87.00 | 93.00 | +0.54% to +7.49% |

| Apr | 88.00 | 95.00 | +1.70% to +9.79% |

| May | 90.00 | 98.00 | +4.02% to +13.28% |

| Jun | 92.00 | 100.00 | +6.32% to +15.63% |

| Jul | 93.00 | 102.00 | +7.49% to +18.00% |

| Aug | 94.00 | 103.00 | +8.65% to +19.17% |

| Sep | 95.00 | 105.00 | +9.79% to +21.46% |

| Oct | 96.50 | 107.00 | +11.54% to +23.69% |

| Nov | 98.00 | 110.00 | +13.28% to +27.17% |

| Dec | 100.00 | 112.00 | +15.63% to +29.53% |

ALB Stock Price Forecast Table 2026

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

| Jan | 101.00 | 115.00 | +16.78% to +32.91% |

| Feb | 103.00 | 117.00 | +19.05% to +35.23% |

| Mar | 105.00 | 120.00 | +21.32% to +38.64% |

| Apr | 107.00 | 122.00 | +23.59% to +41.01% |

| May | 109.00 | 125.00 | +25.86% to +44.42% |

| Jun | 111.00 | 127.00 | +28.13% to +46.79% |

| Jul | 113.00 | 130.00 | +30.40% to +50.25% |

| Aug | 114.00 | 132.00 | +31.55% to +52.53% |

| Sep | 116.00 | 135.00 | +34.06% to +56.02% |

| Oct | 118.00 | 137.00 | +36.33% to +58.39% |

| Nov | 120.00 | 140.00 | +38.60% to +61.79% |

| Dec | 122.00 | 142.00 | +40.87% to +64.16% |

ALB Stock Price Forecast Table 2027

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

| Jan | 124.00 | 145.00 | +43.14% to +67.57% |

| Feb | 126.00 | 147.00 | +45.41% to +69.94% |

| Mar | 128.00 | 150.00 | +47.68% to +73.37% |

| Apr | 130.00 | 152.00 | +50.25% to +75.75% |

| May | 132.00 | 155.00 | +52.53% to +79.14% |

| Jun | 134.00 | 157.00 | +54.80% to +81.51% |

| Jul | 136.00 | 160.00 | +57.07% to +84.92% |

| Aug | 138.00 | 162.00 | +59.34% to +87.29% |

| Sep | 140.00 | 165.00 | +61.61% to +90.70% |

| Oct | 142.00 | 167.00 | +63.88% to +93.08% |

| Nov | 144.00 | 170.00 | +66.15% to +96.46% |

| Dec | 146.00 | 172.00 | +68.42% to +99.42% |

ALB Stock Price Forecast Table 2028

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

| Jan | 148.00 | 175.00 | +71.01% to +102.22% |

| Feb | 150.00 | 178.00 | +73.37% to +105.64% |

| Mar | 152.00 | 180.00 | +75.64% to +108.04% |

| Apr | 154.00 | 183.00 | +77.91% to +111.44% |

| May | 156.00 | 185.00 | +80.18% to +113.82% |

| Jun | 158.00 | 188.00 | +82.45% to +117.22% |

| Jul | 160.00 | 190.00 | +84.92% to +119.59% |

| Aug | 162.00 | 193.00 | +87.29% to +123.00% |

| Sep | 164.00 | 195.00 | +89.56% to +125.41% |

| Oct | 166.00 | 198.00 | +91.83% to +128.80% |

| Nov | 168.00 | 200.00 | +94.10% to +131.14% |

| Dec | 170.00 | 203.00 | +96.46% to +134.54% |

ALB Stock Price Forecast Table 2029

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

| Jan | 172.00 | 205.00 | +99.42% to +137.06% |

| Feb | 174.00 | 208.00 | +101.69% to +140.47% |

| Mar | 176.00 | 210.00 | +104.05% to +142.83% |

| Apr | 178.00 | 213.00 | +106.32% to +146.24% |

| May | 180.00 | 215.00 | +108.04% to +148.61% |

| Jun | 182.00 | 218.00 | +110.31% to +152.01% |

| Jul | 184.00 | 220.00 | +112.58% to +154.38% |

| Aug | 186.00 | 223.00 | +114.85% to +157.78% |

| Sep | 188.00 | 225.00 | +117.22% to +160.15% |

| Oct | 190.00 | 228.00 | +119.59% to +163.55% |

| Nov | 192.00 | 230.00 | +121.96% to +165.85% |

| Dec | 194.00 | 233.00 | +124.22% to +169.26% |

ALB Stock Price Forecast Table 2030

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

| Jan | 195.00 | 235.00 | +125.41% to +171.69% |

| Feb | 197.00 | 238.00 | +127.68% to +175.10% |

| Mar | 199.00 | 240.00 | +129.94% to +177.51% |

| Apr | 201.00 | 243.00 | +132.21% to +180.92% |

| May | 203.00 | 245.00 | +134.54% to +183.29% |

| Jun | 205.00 | 248.00 | +137.06% to +186.69% |

| Jul | 207.00 | 250.00 | +139.33% to +189.06% |

| Aug | 209.00 | 253.00 | +141.60% to +192.46% |

| Sep | 211.00 | 255.00 | +143.87% to +194.83% |

| Oct | 213.00 | 258.00 | +146.14% to +198.23% |

| Nov | 215.00 | 260.00 | +148.61% to +200.60% |

| Dec | 217.00 | 263.00 | +150.88% to +204.01% |

How to Buy ALB Stock?

- Exchange: NYSE

- Ticker Symbol: ALB

- Current Price: $86.53 (as of Jan 10, 2025)

- Market Cap: $10.17B

Steps to Buy:

- Research the Company: Look at Albemarle’s finance, outlook and its sector positioning. Look at how its performance would be in Energy Storage, Specialties as well as Ketjen segments.

- Open a Brokerage Account: Find a platform to NYSE stocks. Fidelity, E *TRADE or Robinhood are examples.

- Fund Your Account: Put money into your brokerage account.

- Set a Target Price: W0 think that to consider to enter at a favorable price based on actual trends and forecasts. If the stocks falls below $85 then that could be a buying opportunity.

- Place Your Order: Take a market or limit order for ALB shares.

- Monitor Performance: Watch Albemarle’s quarterly earnings and news in the market.

Why Consider Buying?

- Analyst Price Target: $114.86 (+32.74% upside).

- Dividend Yield: 1.87%.

- Sector Potential: With almost two decades of experience as a lithium and specialty chemicals leader, Albemarle is poised for growth.

Final Thoughts

While Albemarle has a clear path to 2030 from 2024, the ten years ahead promises a mutli-dimensional journey where challenges and opportunities will abound. The stock presents an irresistible offer for the EV and renewable energy megatrends to investors. But, as it’s a form of investment, it comes with patience and even market volatility. But with so many uncertainties, it’s an interesting long-term investment to watch.

Frequently Asked Questions

Is Albemarle Corporation a good investment?

As a leader in the lithium market, and in support of electric vehicle (EV) and renewable energy industries, the stock is considered a potential growth investment.

But before investing in the company, investors also have to consider the company’s financial performance, market conditions and small lithium price just now.

What are Albemarle’s growth prospects?

Demand for lithium from EV adoption, renewable energy storage as well as advancements in battery technology provide a tailwind for Albemarle to continue to grow. Expanding production capacity further should increase the company’s growth potential.

How does Albemarle compare to its competitors?

There is close competition with companies such as SQM, Ganfeng Lithium, and Livent Corporation. Its unmatched production capabilities around the globe, its proprietary technology, and its strong customer base are its competitive advantage.

How does Albemarle benefit from the EV boom?

Lithium, a key part of EV batteries, is what Albemarle supplies. Albemarle’s revenue and growth will be directly benefited as the EV market grows globally, and demand for lithium is expected to rise materially.

What does Albemarle Corporation do?

Albemarle Corporation is a global leader in special chemicals, with main concentrates in lithium, bromine and catalytics. As a key player in the energy transition it supplies lithium to support electric vehicle batteries and renewable energy storage.

Where can I buy Albemarle stock?

Albemarle Corporation is listed on the New York Stock Exchange (NYSE) under the ticker symbol ALB. You can buy its shares through any brokerage platform that supports NYSE-listed securities, such as Fidelity, E*TRADE, Robinhood, or Charles Schwab.

[…] and apparel industry, WWW (World Wide Worx) is known to cater to different customers with its strong portfolio of brands. Founded in 1883, the company had undergone countless revolutionary and adaptable processes over […]