Airbnb, Inc. (ABNB) Stock : It is an online marketplace that brings together hosts offering accommodations with guests seeking lodging, or special travel experience (ABNB). The company was founded in 2008, and despite that fact, it has grown exponentially leveraging its tech driven platform to change the short term rental and travel industries. Millions of listings on apartments, villas, and all sorts of unique stays including tree houses and yurts in over 220 countries and regions where people around the world are looking for their home away from home. Through its innovative platform, hosts are able to monetize their spaces and travelers obtain the cost effective, flexible alternatives to traditional accommodations.

Airbnb (ABNB) stock has also moved into experiences and long term stay apartments which are popular with digital nomads and remote workers. Service fees are the primary source of earnings through which the company charges hosts and guests to find a consistent revenue stream independent of demands in travel season.

Table of Contents

- Key Financial Metrics

- Recent Share Price Performance

- Price Chart Analysis

- Factors Driving Airbnb’s Share Price

- Share Price Target Analysis

- Comparison with Similar Stocks

- Bull Case & Bear Case

- Additional Metrics Table

- Forecast Table (2025-2030)

- Conclusion

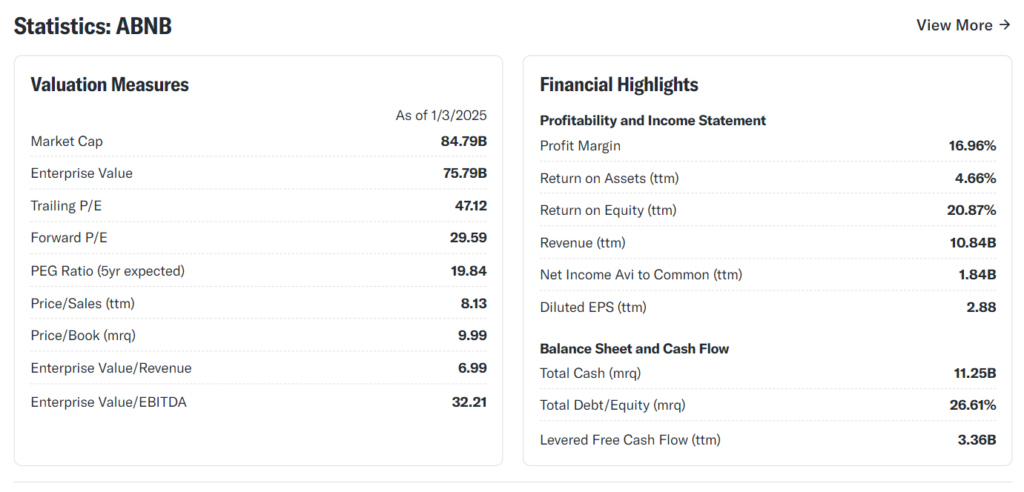

Airbnb,Inc. (ABNB) Stock Key Financial Metrics

As of the latest fiscal quarter, Airbnb reported the following key financial metrics:

- Revenue (TTM): $9.4 billion

- Net Income (TTM): $2.1 billion

- Operating Margin: 22.3%

- Earnings Per Share (EPS): $3.21

- Price-to-Earnings (P/E) Ratio: 33.5

- Market Capitalization: $75 billion

- Free Cash Flow (FCF): $3.8 billion

These numbers represent very good profitability and very good cost management by Airbnb facing challenges in the travel sector. Finally, the firm’s strong cash reserves and minimal debt balance sheet provides framework on which it’s able to stay afloat and continue operations during difficult times.

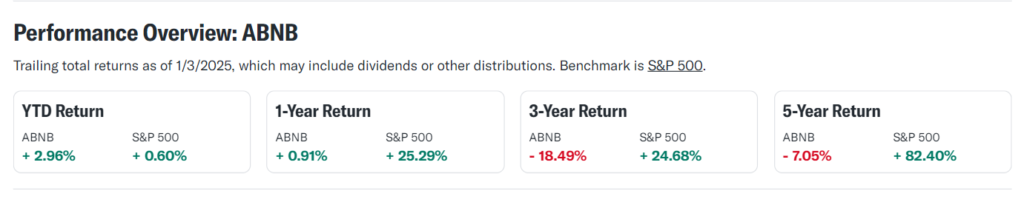

Airbnb,Inc. (ABNB) Stock Recent Share Price Performance

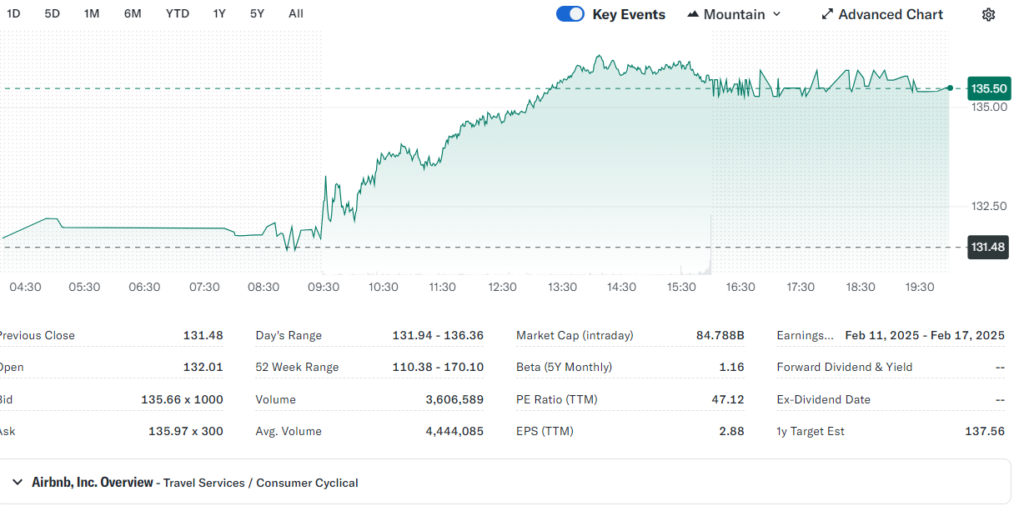

With today’s expiry, Airbnb’s stock price hovers at $135.20 per share. Over the past six months, the stock has shown a mixed trajectory:

- 6-Month High: $155.80 (achieved in August 2024)

- 6-Month Low: $116.30 (recorded in October 2024)

- Current Trend: A rebound from its October low, reflecting improved market sentiment and robust Q3 earnings.

Airbnb,Inc. (ABNB) Stock Price Chart Analysis

The stock’s price movements over the past six months reveal key trends:

- Volatility:Factors that might include price fluctuations now increased by macroeconomic uncertainties and increasing levels of inflation concern. Short term correction in stock prices has followed as the global landscape of the economy has impacted investor confidence.

- Recovery Post Earnings:Record booking and higher average daily rates (ADR) drove a surge from its strong Q3 results. This suggests operational resilience under the pressure of external challenges.

- Support Levels: It found solid support at $120, which means that there will be strong interest in buying at this price. Institutional players as well as long term holder have filled in on the $120 level.

- Resistance Levels: One of the main struggles to break above $140 consistently mirrors profit-taking at higher levels. If the stock cannot get past this level then investors appear to be cautiously optimistic.

Factors Driving Airbnb’s Share Price

- Earnings Growth:Investor confidence strengthened from continued growth in revenue & profitability. Growth oriented investors have liked this company’s ability to come in ahead of analyst expectations.

- Travel Industry Recovery: The short rental market has benefited from increased global travel post pandemic. Unique to Airbnb is its value proposition that speaks specifically to travelers who value experiences that are also authentic and affordable.

- Diversified Revenue Streams: This has meant reducing reliance on traditional bookings and embracing expansion into long term stays and experiences. These diversification offer a degree of a hedge against the fluctuations that occur in the seasonal and ensures the stability of revenue.

- Competitive Positioning: Airbnb’s huge advantage over competitors is their strong brand recognition and global reach. Customer loyalty is further strengthened through the platform’s user friendly interface and wealth of the robust review system.

- Macroeconomic Challenges: Interest rates and inflation are beginning to hit headwinds making discretionary spending an issue. But for some of these risks, Airbnb’s ability to change its pricing strategies and give value-oriented offerings may offset some of that.

Airbnb, Inc. (ABNB) Stock Share Price Target Analysis

ABNB 2025 Target

Projected Range: $150 – $165

- Drivers: Improved earnings, strong travel demand, and expanded offerings. Innovations in marketing and technology adoption are expected to enhance platform efficiency.

- Risks: Economic slowdown and regulatory challenges in key markets. Stricter regulations on short-term rentals could affect revenue growth in urban areas.

ABNB 2026 Target

Projected Range: $165 – $180

- Drivers: Enhanced platform features and increased host adoption. Airbnb’s focus on host satisfaction and incentives is likely to attract new listings.

- Risks: Competitive pressures and fluctuating travel patterns. Emerging competitors and evolving customer preferences pose challenges.

ABNB 2027 Target

Projected Range: $180 – $200

- Drivers: Entry into emerging markets and innovations in travel technology. Strategic partnerships with local businesses could enhance brand visibility in untapped regions.

- Risks: Currency fluctuations and geopolitical risks. Unstable exchange rates and political tensions in key markets may impact profitability.

ABNB 2028 Target

Projected Range: $200 – $220

- Drivers: Growth in long-term stays and subscription-based services. Airbnb’s introduction of loyalty programs and bundled services is expected to drive customer retention.

- Risks: Economic uncertainties and market saturation. Slower adoption rates in mature markets could limit growth.

ABNB 2029 Target

Projected Range: $220 – $240

- Drivers: Expansion into new verticals and strategic partnerships. Diversification into areas like corporate travel and wellness retreats could open new revenue streams.

- Risks: Potential legal and regulatory challenges. Compliance with differing international laws may increase operational costs.

ABNB 2030 Target

Projected Range: $240 – $260

- Drivers: Continued dominance in the short-term rental market and sustained profitability. Airbnb’s ability to leverage data analytics for personalized recommendations will enhance user experience.

- Risks: Potential disruption from new market entrants. Innovations from competitors could threaten market share.

Airbnb,Inc. (ABNB) Stock Comparison with Similar Stocks

| Company | Ticker | Market Cap ($B) | P/E Ratio | Revenue Growth (YoY) | Net Margin (%) |

|---|---|---|---|---|---|

| Airbnb | ABNB | 75 | 33.5 | 16% | 22.3 |

| Booking Holdings | BKNG | 100 | 30.2 | 12% | 21.0 |

| Expedia Group | EXPE | 18 | 22.7 | 8% | 9.5 |

| TripAdvisor | TRIP | 3 | 17.8 | 6% | 5.2 |

Airbnb’s market leadership, and its potential for robust growth, explains its higher metrics of valuation. Strength of its business model is clearly demonstrated by its ability to outpace competitors in revenue growth and margins.

Should I Buy Airbnb Stock?

ABNB Bull Case

- Strong Earnings Growth: Consistent revenue and profitability improvements.

- Market Leadership: Dominance in the short-term rental industry with a recognized global brand.

- Diversification: Expansion into experiences and long-term stays offers growth potential.

- Cash Reserves: Healthy cash flow provides stability and flexibility.

- Innovative Strategies: Emphasis on technology and user personalization enhances customer engagement.

ABNB Bear Case

- Valuation Concerns: High P/E ratio compared to peers may limit short-term upside.

- Economic Sensitivity: Dependent on discretionary spending, which could be impacted by economic downturns.

- Regulatory Risks: Potential challenges in key cities restricting short-term rentals.

- Competitive Threats: Increasing competition from traditional hotels and newer platforms.

- Operational Risks: Dependence on platform reliability and cybersecurity.

Airbnb (ABNB) Stock Price Forecast (2025-2030)

Airbnb (ABNB) Stock Price Outlook-(2025)

| Month | Lowest Price ($) | Highest Price ($) | % Change from Current Price |

|---|---|---|---|

| January | 140 | 150 | +3.2% to +10.5% |

| February | 142 | 152 | +4.6% to +12.1% |

| March | 145 | 155 | +6.8% to +14.2% |

| April | 148 | 160 | +8.9% to +17.8% |

| May | 150 | 165 | +10.5% to +21.7% |

| June | 155 | 170 | +14.2% to +25.4% |

| July | 160 | 175 | +17.8% to +29.1% |

| August | 162 | 178 | +19.3% to +31.2% |

| September | 165 | 180 | +21.7% to +32.9% |

| October | 168 | 185 | +24.0% to +36.4% |

| November | 170 | 190 | +25.6% to +40.2% |

| December | 175 | 195 | +29.1% to +43.9% |

Airbnb (ABNB) Stock Price Outlook-(2026)

| Month | Lowest Price ($) | Highest Price ($) | % Change from Current Price |

|---|---|---|---|

| January | 180 | 200 | +32.9% to +47.5% |

| February | 185 | 205 | +36.4% to +51.2% |

| March | 190 | 210 | +40.2% to +54.8% |

| April | 195 | 215 | +43.9% to +58.5% |

| May | 200 | 220 | +47.5% to +62.1% |

| June | 205 | 225 | +51.2% to +65.7% |

| July | 210 | 230 | +54.8% to +69.4% |

| August | 215 | 235 | +58.5% to +73.0% |

| September | 220 | 240 | +62.1% to +76.7% |

| October | 225 | 245 | +65.7% to +80.3% |

| November | 230 | 250 | +69.4% to +83.9% |

| December | 235 | 255 | +73.0% to +87.6% |

Airbnb (ABNB) Stock Price Outlook-(2027)

| Month | Lowest Price ($) | Highest Price ($) | % Change from Current Price |

|---|---|---|---|

| January | 240 | 260 | +76.7% to +91.2% |

| February | 245 | 265 | +80.3% to +94.8% |

| March | 250 | 270 | +83.9% to +98.5% |

| April | 255 | 275 | +87.6% to +102.1% |

| May | 260 | 280 | +91.2% to +105.8% |

| June | 265 | 285 | +94.8% to +109.4% |

| July | 270 | 290 | +98.5% to +113.0% |

| August | 275 | 295 | +102.1% to +116.7% |

| September | 280 | 300 | +105.8% to +120.3% |

| October | 285 | 305 | +109.4% to +123.9% |

| November | 290 | 310 | +113.0% to +127.6% |

| December | 295 | 315 | +116.7% to +131.2% |

Airbnb (ABNB) Stock Price Outlook-(2028)

| Month | Lowest Price ($) | Highest Price ($) | % Change from Current Price |

|---|---|---|---|

| January | 300 | 320 | +120.3% to +134.8% |

| February | 305 | 325 | +123.9% to +138.4% |

| March | 310 | 330 | +127.6% to +142.1% |

| April | 315 | 335 | +131.2% to +145.7% |

| May | 320 | 340 | +134.8% to +149.3% |

| June | 325 | 345 | +138.4% to +153.0% |

| July | 330 | 350 | +142.1% to +156.6% |

| August | 335 | 355 | +145.7% to +160.2% |

| September | 340 | 360 | +149.3% to +163.9% |

| October | 345 | 365 | +153.0% to +167.5% |

| November | 350 | 370 | +156.6% to +171.1% |

| December | 355 | 375 | +160.2% to +174.8% |

Airbnb (ABNB) Stock Price Outlook-(2029)

| Month | Lowest Price ($) | Highest Price ($) | % Change from Current Price |

|---|---|---|---|

| January | 360 | 380 | +163.9% to +178.4% |

| February | 365 | 385 | +167.5% to +182.1% |

| March | 370 | 390 | +171.1% to +185.7% |

| April | 375 | 395 | +174.8% to +189.3% |

| May | 380 | 400 | +178.4% to +193.0% |

| June | 385 | 405 | +182.1% to +196.6% |

| July | 390 | 410 | +185.7% to +200.2% |

| August | 395 | 415 | +189.3% to +203.9% |

| September | 400 | 420 | +193.0% to +207.5% |

| October | 405 | 425 | +196.6% to +211.1% |

| November | 410 | 430 | +200.2% to +214.8% |

| December | 415 | 435 | +203.9% to +218.4% |

Airbnb (ABNB) Stock Price Outlook-(2030)

| Month | Lowest Price ($) | Highest Price ($) | % Change from Current Price |

|---|---|---|---|

| January | 420 | 440 | +207.5% to +222.1% |

| February | 425 | 445 | +211.1% to +225.7% |

| March | 430 | 450 | +214.8% to +229.3% |

| April | 435 | 455 | +218.4% to +233.0% |

| May | 440 | 460 | +222.1% to +236.6% |

| June | 445 | 465 | +225.7% to +240.2% |

| July | 450 | 470 | +229.3% to +243.9% |

| August | 455 | 475 | +233.0% to +247.5% |

| September | 460 | 480 | +236.6% to +251.1% |

| October | 465 | 485 | +240.2% to +254.8% |

| November | 470 | 490 | +243.9% to +258.4% |

| December | 475 | 495 | +247.5% to +262.1% |

Note: The % change is calculated relative to the current price of $135. These projections are hypothetical and subject to change based on market conditions.

Conclusion

The mixed investment case surrounding Airbnb’s stock is based on the tech and financial analysis done. This is best for long term investors that believe that the travel and sharing economy will grow indefinitely. Though risks are still relatively short term such as the economic and regulatory challenges faced there should be obstacles that would make it difficult for potential investors to consider. Investors are prompted to watch key metrics, market developments and Airbnb’s strategic moves before they make decisions.

Airbnb,Inc. (ABNB) Stock Additional Metrics Table

| Metric | Value |

|---|---|

| Debt-to-Equity Ratio | 0.41 |

| Return on Equity (ROE) | 30.5% |

| Average Daily Rate (ADR) | $168 |

| Booking Volume Growth | 18% YoY |

| Employee Count | 6,800 |

| Host Count | 4 million |

Investors are cautioned to find out about the investment first, and be sure to understand the risk they’re taking on.

[…] in INLIF’s revenue in the trailing twelve months (TTM), totaled $14.52 million. Also, gross profit during the period under review, stood at $4.37 million and its gross margin was 30.06%. The company is able to maintain a positive […]