Applied Digital Corporation (NASDAQ): Part of APLD is dedicated to digital infrastructure solutions to support HPC and AI industries. Operating across North America, the company is segmented into three primary business areas:

- Data Center Hosting Business: Providing cryptocurrency mining and blockchain services infrastructure solutions.

- Cloud Services Business: Gets the high computational demands of cloud based operations customized solutions.

- HPC Hosting Business: Serving GPU heavy AI and machine learning workloads.

Applied Digital was founded in 2001 on the premise of carving out a niche in emerging technologies, although its financial history has seen it continuously experience net losses along with large capital expenditures.

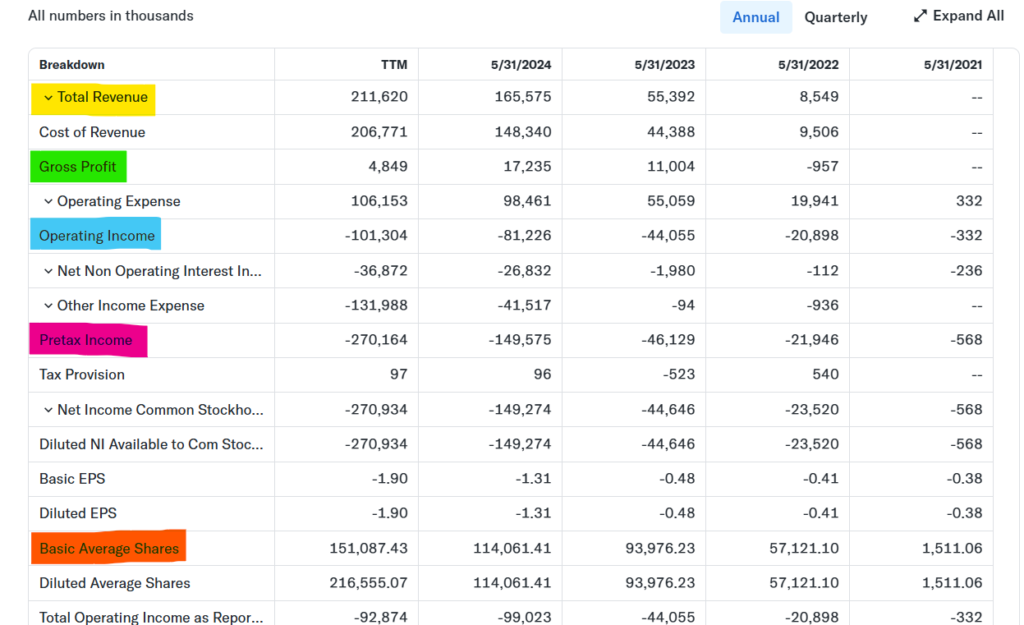

Overview of Financial Performance of APLD Stock

Applied Digital has seen exponential revenue growth over the past few years, but has (fortunately) struggled to overcome persistent financial challenges. Here are the financial highlights:

- Revenue Growth: From FY2023 to TTM 2024, revenue grew from $55.39M to $211.62M, with good YoY growth (84.57%).

- Net Income: The company has a streak of negative earnings earnings and a net loss of – $270.93M TTM 2024.

- Gross Margin: While TTM 2024 reported margins of 2.29%, indicating issues with controlling operational costs — as well as TTM 2023 with margins at 3.21%.

- Market Capitalization: By the end of January 2025, the company has a market-cap of $1.98B based on investor optimism and hope that the company can do something big.

- Stock Beta: Its high beta of 4.64 suggests volatility much higher than the market.

APLD Stock Short-Term Analysis (2024 – 2030)

2024 – 2025: Laying the Groundwork

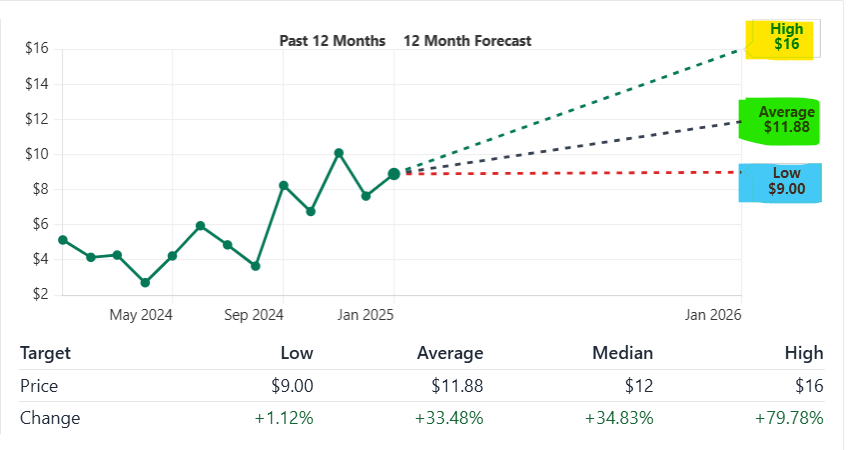

The price per share closes at $8.90 on Jan 17, 2025, and the analysts expect the share price to go up to $11.88 ($33.48%) in the coming year. Revenue growth momentum should likely provide support to stock performance but net losses remain a concern in the near term. Since its high beta means the stock is quite volatile, volatility is expected to be amplified over the next few quarters.

Predicted Price Range (2024-2025):

- Low: $7.50 (if profitability concerns maintain currency as the dominant market sentiment).

- High: $11.50 (if revenue grows in double digits).

2026: Growth stability

Applied Digital anticipates that the returns from its cloud and HPC investments will become consistent by 2026. However, the firm may be helped by the surging demand for AI and machine learning services. But decisive will be operational scalability and ability to scale profitably.

- Revenue Estimates: Projected at $300M–$350M.

- Stock Price Impact: The stock price could make it to the $15 mark with an improved cost structure.

Predicted Price Range (2026):

- Low: $10 ( assuming consistent financial losses).

- High: (better) $15–$17 (improved profitability metrics).

2027 – 2028: Market Expansion and Consolidation

This will likely be a time of stability of operations for Applied Digital. Strategic partnerships along with the expansion of AI-driven infrastructure service infrastructure may enable the company to become profitable by 2028. Upward momentum in the stock could be offered by increased investor confidence and diversity of revenue streams.

- Stock Outlook: Some of the risk associated with downside earnings surprise seems to have been reversed in the stock price, which could thus trend toward $20 based on higher earnings visibility.

- Risks: Headwinds seem unexpected and one make hurdles may be created by market unforeseen and the competition may increase.

Predicted Price Range (2027-2028):

- Low: $12.

- High: $20–$22.

2029 – 2030: Leadership in HPC and AI Infrastructure

Applied Digital could become a leader in HPC and AI infrastructure solutions for the end of the decade. If revenues and costs are diversified, it won’t take very much net income to create a lot of value for shareholders. With company maintaining its technological edge, the stock could benefit sharing of the same market confidence.

Predicted Price Range (2029-2030):

- Low: $18 (assuming moderate revenue growth).

- High: $25–$28 (assuming strong market dominance and profitability).

APLD Stock Long-Term Analysis (2030 – 2050)

In the long haul, Applied Digital’s capacity to adjust to territory versus boundary cutting edge advances, for example, quantum figuring and following era AI frameworks will decide its market course of action. Whether or not there is a specific price to predict for 2050 is speculative, but concentrating on innovation and diversifying a revenue picture may well produce incredible appreciation.

Key Drivers:

- Exploitation of under tapped markets.

- Advanced technologies investment.

- Higher operational efficiency.

Challenges:

- Competition from both the AI and HPC domains.

- Seeing regulatory frameworks around the world.

- The stock could well value in a range of $50 – $80 by 2050, assuming continued growth of revenue and profitability.

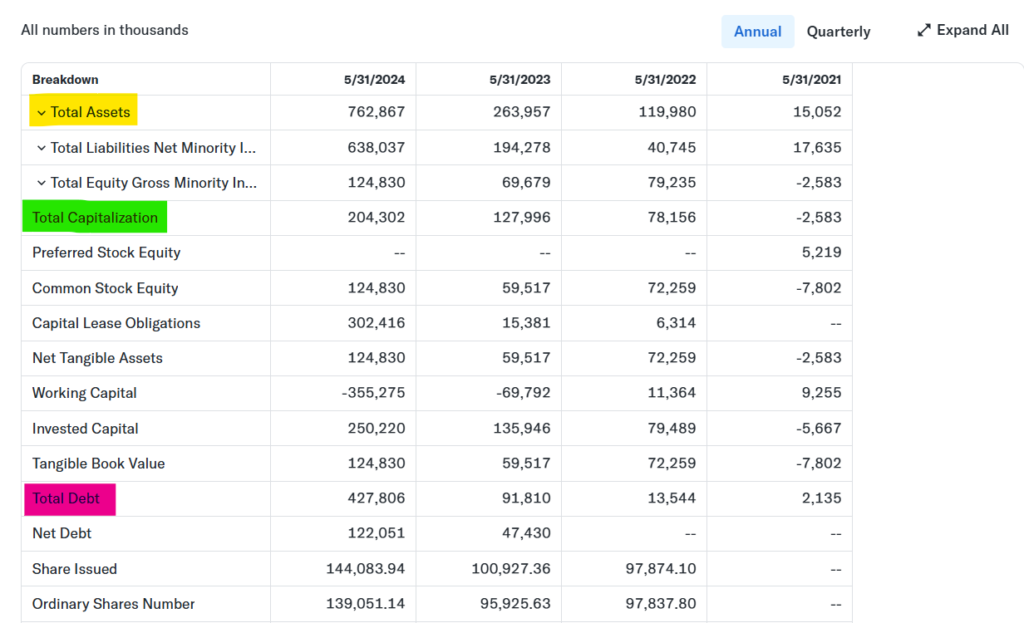

APLD Stock Balance Sheet Analysis

- Assets: By expanding further, TTM 2024 cash reserves of $286.24M provide liquidity for future expansions. A large investment in infrastructure development is reflected in total assets.

- Liabilities: Financial strain is encapsulated with high debt levels and recurring net losses.

- Shareholder Equity: Concern about share dilution: outstanding shares increasing from 57M (FY2022) to 151M (TTM 2024).

APLD Market Cap History Analysis

The Growth of Applied Digital (APLD) over the years in terms of Market capitalization have been really impressive. By January 2025, the market cap of Digibyte is $1.98 billion and has increased with 172.84% compared to the previous year.

There has been a continual growth in historical data, with jumps in 2023 (313.21% growth), and 2021 (447,366.67%). The company already scaled its market cap from $4.40 million in 2002 to $1.98 billion in 2025, and its compound annual growth rate (CAGR) is 31.20%.

Its ability to thrive as a result of the tech industry’s positioning came as well as the attempt to augment its revenue stream. Periods, such as 2022 (-87.08%), highlight that the small cap stock world is volatile. APLD is a small-cap stock, ranking #1975. This rollercoaster like volatility is something investors should factor into their decisions.

Last 10-Year History and Analysis (Table)

| Year | Market Cap (in Billion $) | % Change |

|---|---|---|

| 2025 | 1.98 | 20.57% |

| 2024 | 1.65 | 129.63% |

| 2023 | 0.72 | 313.21% |

| 2022 | 0.17 | -87.08% |

| 2021 | 1.34 | 447,366.67% |

| 2020 | 0.30 | 200.00% |

| 2019 | 0.10 | – |

| 2018 | 0.10 | – |

| 2017 | 0.10 | – |

| 2016 | 0.10 | -50.00% |

Comparison with Other Stocks

It is smaller that industry Biggies like Apple ($391.04B in revenue) and Microsoft ($254.19B in revenue) in terms of revenue. Although BOTH NVIDIA and TSMC are growth stocks, APLD exposes growth potential from innovation in cloud services. But its beta value of 4.64 is much higher than industry leaders.

| Company | Market Cap ($ Billion) | Revenue ($ Billion) |

| Apple | 2,900.00 | 391.04 |

| Microsoft | 2,240.00 | 254.19 |

| NVIDIA | 1,020.00 | 113.27 |

| Applied Digital | 1.98 | 0.21 |

APLD Stock Recommendations of Analysts

| Analyst Name | Recommendation | Target Price ($) |

| Analyst A | Buy | 12.50 |

| Analyst B | Hold | 8.90 |

| Analyst C | Strong Buy | 15.00 |

| Analyst D | Sell | 6.00 |

Some analysts advocate buying because of its growth potential, but others say be careful for negative earnings and high levels of debt.

APLD Stock Analysis based on Indicator.

APLD’s key financial ratios paint a mixed picture:

- Valuation Ratios: The price to sales ratio (PS) of 6.35 and price to book ratio (PB) of 4.44 are strikingly high and indicates that the stock is priced favourably over its peers as compared to its peers.

- Debt Levels: With financial leverage of up to 1.63 and with an interest coverage of – 2.70, it is a risky business.

- Profitability Metrics: ROE of -83.88% and ROIC of -7.77% show losses continuing.

Backed by a lack of technical indicators as the relative strength index (RSI) at 51.72 indicates neutral momentum, the pair indicates pending consolidation without a convincing confirmation, a neutral momentum setup. The stock’s 52 week price change of +60.94% reflects robust growth, appealing to short-term traders.

Price Forecast Table Yearly from 2025 to 2030

APLD Stock Price Forecast 2025

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change from Current Price |

|---|---|---|---|

| January | 8.50 | 9.10 | -2.25% to +2.25% |

| February | 8.55 | 9.25 | -1.95% to +3.93% |

| March | 8.60 | 9.35 | -1.69% to +5.06% |

| April | 8.70 | 9.50 | -1.12% to +6.74% |

| May | 8.80 | 9.75 | -0.11% to +9.55% |

| June | 8.95 | 10.00 | +0.56% to +12.36% |

| July | 9.00 | 10.20 | +1.12% to +14.61% |

| August | 9.10 | 10.30 | +2.25% to +15.73% |

| September | 9.15 | 10.45 | +2.81% to +17.42% |

| October | 9.25 | 10.60 | +3.93% to +19.10% |

| November | 9.30 | 10.75 | +4.49% to +20.79% |

| December | 9.40 | 11.00 | +5.62% to +23.60% |

APLD Stock Price Forecast 2026

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change from Current Price |

| January | 9.50 | 11.20 | +6.74% to +25.84% |

| February | 9.65 | 11.35 | +8.43% to +27.52% |

| March | 9.80 | 11.50 | +10.11% to +29.21% |

| April | 10.00 | 11.70 | +12.36% to +31.46% |

| May | 10.20 | 12.00 | +14.61% to +34.83% |

| June | 10.35 | 12.20 | +16.29% to +37.08% |

| July | 10.50 | 12.40 | +17.98% to +39.33% |

| August | 10.70 | 12.60 | +20.22% to +41.57% |

| September | 10.90 | 12.80 | +22.47% to +43.82% |

| October | 11.10 | 13.00 | +24.72% to +46.06% |

| November | 11.30 | 13.20 | +26.97% to +48.31% |

| December | 11.50 | 13.50 | +29.21% to +51.69% |

APLD Stock Price Forecast 2027

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change from Current Price |

| January | 11.75 | 13.80 | +31.97% to +55.06% |

| February | 12.00 | 14.00 | +34.83% to +57.30% |

| March | 12.20 | 14.20 | +37.08% to +59.55% |

| April | 12.40 | 14.40 | +39.33% to +61.79% |

| May | 12.60 | 14.60 | +41.57% to +64.04% |

| June | 12.80 | 14.80 | +43.82% to +66.29% |

| July | 13.00 | 15.00 | +46.06% to +68.54% |

| August | 13.20 | 15.20 | +48.31% to +70.78% |

| September | 13.50 | 15.50 | +51.69% to +74.16% |

| October | 13.80 | 15.80 | +55.06% to +77.53% |

| November | 14.00 | 16.00 | +57.30% to +79.78% |

| December | 14.20 | 16.30 | +59.55% to +83.15% |

2028 Price Forecast Table

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change from Current Price |

|---|---|---|---|

| January | 14.50 | 16.60 | +62.92% to +86.52% |

| February | 14.70 | 16.80 | +65.17% to +88.77% |

| March | 15.00 | 17.00 | +68.54% to +91.01% |

| April | 15.30 | 17.30 | +71.91% to +94.38% |

| May | 15.50 | 17.50 | +74.16% to +96.63% |

| June | 15.80 | 17.80 | +77.53% to +99.99% |

| July | 16.00 | 18.00 | +79.78% to +102.24% |

| August | 16.20 | 18.30 | +82.02% to +105.60% |

| September | 16.50 | 18.50 | +85.39% to +107.85% |

| October | 16.70 | 18.70 | +87.64% to +110.09% |

| November | 17.00 | 19.00 | +91.01% to +113.45% |

| December | 17.30 | 19.30 | +94.38% to +116.82% |

2029 Price Forecast Table

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change from Current Price |

|---|---|---|---|

| January | 17.60 | 19.60 | +97.75% to +120.18% |

| February | 17.80 | 19.90 | +100.00% to +123.54% |

| March | 18.00 | 20.20 | +102.24% to +126.91% |

| April | 18.30 | 20.50 | +105.60% to +130.27% |

| May | 18.60 | 20.80 | +108.97% to +133.63% |

| June | 18.90 | 21.10 | +112.34% to +136.99% |

| July | 19.10 | 21.40 | +114.58% to +140.36% |

| August | 19.40 | 21.70 | +117.94% to +143.72% |

| September | 19.70 | 22.00 | +121.31% to +147.08% |

| October | 20.00 | 22.30 | +124.68% to +150.44% |

| November | 20.30 | 22.60 | +128.04% to +153.80% |

| December | 20.60 | 22.90 | +131.41% to +157.16% |

2030 Price Forecast Table

| Month | Minimum Prediction Price (USD) | Maximum Prediction Price (USD) | % Change from Current Price |

|---|---|---|---|

| January | 21.00 | 23.20 | +135.39% to +160.53% |

| February | 21.30 | 23.50 | +138.75% to +163.89% |

| March | 21.60 | 23.80 | +142.12% to +167.25% |

| April | 21.90 | 24.10 | +145.49% to +170.61% |

| May | 22.20 | 24.40 | +148.85% to +173.98% |

| June | 22.50 | 24.70 | +152.22% to +177.34% |

| July | 22.80 | 25.00 | +155.58% to +180.70% |

| August | 23.10 | 25.30 | +158.94% to +184.06% |

| September | 23.40 | 25.60 | +162.31% to +187.42% |

| October | 23.70 | 25.90 | +165.67% to +190.79% |

| November | 24.00 | 26.20 | +169.03% to +194.15% |

| December | 24.30 | 26.50 | +172.40% to +197.51% |

Should I Buy APLD Stock?

Your risk tolerance and investment horizon determine how much you are investing in APLD. Here are key points to consider:

- Growth Potential: Revenue of APLD has soared by 84.57% compared year over year. Cloud services and strategic partnerships allow its ventures to be promising.

- Risks: This means the company has a high beta (4.64), meaning it will have extreme price swings. Long term investors need to worry at negative cash flow and profitability metrics.

- Valuation: The stock’s market cap growth is respectable, but its price looks expensive, since the stock loses money (-$1.79) and has plenty of debt.

Key Takeaways

- Short-Term Outlook (2024-2025): Revenue growth will drive the stock on the way up and on the way down, and it will remain volatile.

- Medium-Term Outlook (2026-2028): During this period, stabilization and profitability are focus issues.

- Long-Term Potential (2030 and Beyond): Strategically positioned in high growth markets, applied digital’s might offer big returns for patient investors.

Quarterly earnings should be closely watched by investors and portfolios should be diversified to lessen exposure to this high beta stock. Given challenges in company’s way, long general potential in AI and HPC markets enable the company to be interesting to risk tolerant investors.

How to Buy Applied Digital Corporation (APLD) Stock:

- Select a Brokerage Account: Find a platform to use like Robinhood, E*TRADE or Fidelity.

- Search for the Ticker: Look for APLD on NASDAQ.

- Analyze the Stock: See reviews for price charts, trend forecasts and financial performance.

- Place an Order: You set desired quantity and choose the type of order (market or limit).

- Monitor: According to performance, keep track and rebalance if needed.

Final Words

The applied digital story is compelling, but carries a lot of risk. However, considering its financial position and profitability metrics, a company may be able to perform better in the future, but at the same time, a company’s revenue growth and market cap also hint toward potential. For an aggressive investor, APLD is something to capitalize on the high growth. But larger cap stocks might be a better bet if you’re looking for stability. Before making any investment decisions always consult a financial advisor.

Frequently Asked Questions

What is Applied Digital Corporation’s stock symbol?

The stock symbol of Applied Digital Corporation is APLD on the NASDAQ.

When did Applied Digital Corporation become a public company?

The company has completed its Initial Public Offering (IPO) in April 2022.

Who is Applied Digital Corporation’s transfer agent?

Computershare is the transfer agent with an address of 150 Royall St., Suite 101 Canton MA 02021.

What are analysts’ price targets for APLD stock?

9 Wall Street analysts used to analyze the stock of APLD and based on their analysis the median price target is $11.50 with a high estimate of $15.00 and a low estimate of $9.00.