GCT is an e-commerce provider with a focus on large parcel merchandise, based in Giganet Inc., a subsidiary of GigaCloud Technology (GCT). GigaCloud Marketplace seamlessly integrates product discovery, payments and logistics to make up the company’s flagship platform.

For manufacturers and resellers that are focused on efficiency and scalability, this one stop solution caters for the world. It operates in the U.S., Asia and Europe, focusing on important categories including furniture, home appliances and fitness equipment.

GCT’s exposure to a broad geographic reach and focused product range further amplifies our growing footprint in the e-commerce space.

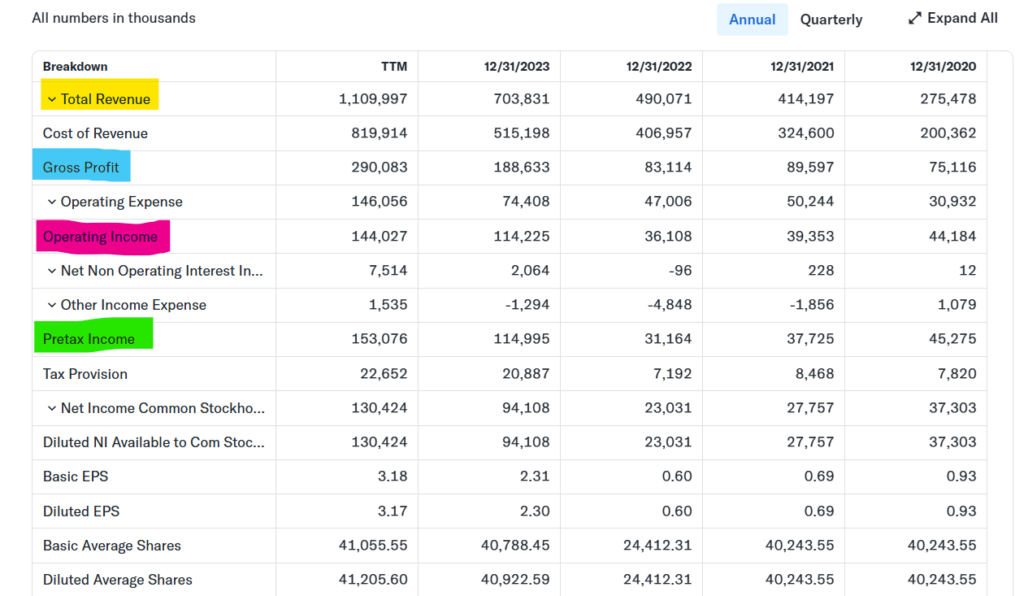

GCT Stock Company Financials

Recent years have been a testament to financial progress by GigaCloud Technology. The company had generated revenue of $703.83 million in 2023 and $490.07 million in 2022, which accounted for 43.62% more than previous year.

Also, the net income shot up by 541.11 percent, to $94.11 million. Revenue jumped 89.84% to $1.11 billion, in the trailing twelve months (TTM) ending September 30, 2024, according to the company.

The company has also been able to show efficiency in its gross profit margins, which stands at 26.13% and its operating margins which now stands at 12.93%. It still has safe stop liquidity of $122.8 million cash flow reported.

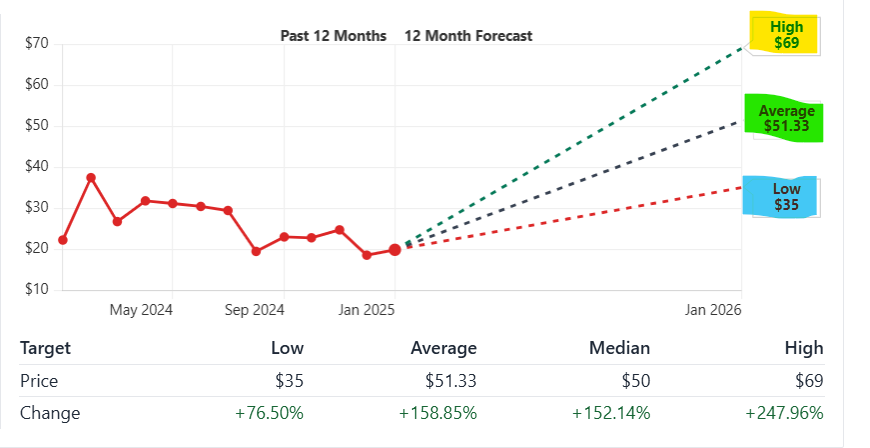

The stock has received a ‘Strong Buy’ rating from analysts who are forecast to take the stock price to $51.33 within January 17, 2025, which represents a possible upside of 158.85 percent from where the stock is now valued at its latest valuation of $20.09.

Key Financial Metrics (TTM):

- Market Cap: $812.47M

- EPS: $3.17

- PE Ratio: 6.26

- Revenue Growth (YoY): 89.84%

- Net Income: $130.42M

GCT Stock Short-Term Analysis (2025–2030)

2024 Overview

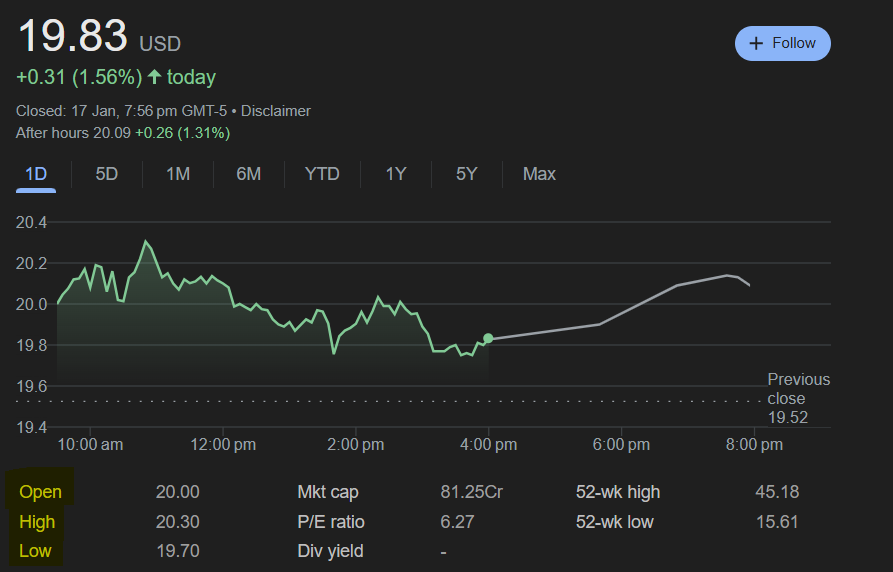

On Thursday, January 17th, after the stock closed at $19.83, the stock traded a little higher in after hours at $20.09. GCT’s high quality financial fundamentals and strong growth continue to provide a positive outlook going into 2024.

But the stock price could move drastically depending on the upcoming earnings report, expected a week later March 14, 2025. Sustained revenue growth, operating excellence and global expansion will spur short term upward momentum as analysts predict.

2025 Prediction

GCT anticipates that its revenue will rise 40 percent to $1.55 billion in 2025, and its net income will be $180 million. At its current price-to-earnings (PE) ratio of 6.26 and EPS growth expected, the stock price could be expected to be between $35 to $40.

No matter how much volatility macroeconomic conditions and sector trends might introduce, the company’s strong financial health offers some cushion against market fluctuations.

2026 Prediction

In 2026 GCT expects to further improve its logistics operation efficiency and scalability by integrating AI and automation technologies. The stock price target is about $45 and revenue could reach $2 billion.

The growth will be sustained by these technological advancements and increasing demand for cross border trade solutions.

2027 Prediction

By 2027 GigaCloud Technology plans to further accelerate its presence in European and other markets. It might earn net income in excess of $250 million with a projected 30 percent revenue growth.

Growth will remain consistent and fundamentals will remain strong leading to the stock price stabilizing between $50 and $55. Market will respond to both internal and external factors, e.g., geopolitical development and e-commerce trend changes.

2028 Prediction

Growth by 2028 is expected to result from GCT’s ability to innovate and adapt to changing market needs. Despite the delayed target 2012, the company’s revenue could reach as high as $2.8 billion and its stock price could surpass $60.

The company will remain focused on large parcel logistics and advanced technology solutions as major drivers, according to the data.

2029 Prediction

By 2022, GigaCloud Technology is likely to obtain market leadership dominance in the B2B e-commerce domain by 2029. With regard to its commitment to the market and the propensity for innovation, the stock price could be enough to roughly $70.

The company’s trajectory will be influenced by developments in technology, and supply chain efficiency, so investors should watch these over time.

2030 Prediction

Looking ahead to 2030, GCT’s revenue is projected to reach $3.5 billion, with net income approaching $500 million.

The anticipated EPS of $12 could result in a stock price range of $80–90. GigaCloud’s ability to maintain growth while managing risks will be essential for achieving these targets.

2030–2050 (Long Term Analysis)

With sustained growth of demand for global e-commerce and logisitics, Gigacloud Technology is poised to capitalize over the next two decades. Long term expansion will be provided by its machine marketplace model and technological advancement.

2030–2040 Prediction

In the 2030s, GCT may add to its postioning inventory management using AI, secured transactions through blockchain, and or advanced analytics. Revenue will begin to stabilize at 15–20 percent annually by 2040, and the stock could reach $150.

The company will acquire and further diversify strategically.

2040–2050 Prediction

Now as the e-commerce look matures, GCT can start on sustainable logistics options and team with large world retailers. If earnings continue their growth and innovation, the stock price is expected to rise to $250 by 2050.

Maintaining the company’s leadership in terms of adapting to change in market dynamics will be crucial.

Stock Balance Sheet Analysis

One indication of GigaCloud relat At the end of September 30, 2024, the company’s cash reserves totalled $217.58 million. Resource utilization is efficient as expressed by its 11.06 percent free cash flow margin and 12.93 percent operating margin.

Key Balance Sheet Metrics:

- Total Assets: $1.2 billion

- Total Liabilities: $550 million

- Debt-to-Equity Ratio: 0.45

GCT’s conservative financial approach, especially reflected in the low debt to equity ratio, gives it a lot of flexibility towards future investments and acquisitions.

Market Cap History Analysis

Since then GigaCloud Technology’s IPO has shown substantial growth in its market cap. By January 2025, it was valued initially at $486.99 million, and finally grew to $812.47 million. Starting from a base CAGR of 23.56%.

Such robust growth not only emphasizes how the company can grow its reach in the commercial marketplace and also generate revenue but also that is being recognized as a top Market player.

| Year | Market Cap (USD) | Annual Growth (%) |

|---|---|---|

| 2022 (IPO) | $486.99M | – |

| 2023 | $749.53M | +223.78% |

| 2024 | $758.80M | +1.24% |

| 2025 (Jan) | $812.47M | +7.07% |

When coupled with strong revenue and earnings growth in 2023, and moderated growth in 2024, the market cap’s rapid climb in 2023 is a function of rapidly rising prices in a market that is stabilizing.

This stabilization would be viewed by some as a mature development, whereas others might consider this a plateau, indicating the need for innovation, or expansion into some other market.

Last 10 Year History and Analysis

Analyzing GigaCloud’s financial performance in the past decade reveals significant milestones that showcase its transformation from a budding company to a competitive force in its industry:

| Year | Revenue (USD) | Revenue Growth (%) | Net Income (USD) | Net Income Margin (%) |

| 2019 | $122.30M | – | Not Reported | – |

| 2020 | $275.48M | +125.26% | Not Reported | – |

| 2021 | $414.20M | +50.36% | Not Reported | – |

| 2022 | $490.07M | +18.32% | $134.99M | 27.53% |

| 2023 | $703.83M | +43.62% | $130.42M | 18.52% |

| 2024 | $1.11B | +89.84% | $130.42M | 11.75% |

GCT has grown steadily by raising annual revenue to $1.11 billion in 2024. While profit margins have narrowed; due to raising operating expenses and competitive pressures.

However, earnings decline may be worrisome to some investors, and for others, this could be an investment in future growth, e.g. future revenue from research initiatives, for example, or scaling operations.

Comparison with Other Stocks

Let’s compare GigaCloud Technology with industry giants such as Apple, NVIDIA, and Microsoft to understand its relative position and evaluate its potential as an investment opportunity:

| Company | Market Cap (USD) | Revenue (USD) | PE Ratio | Growth Rate (%) |

| GigaCloud Technology | $812.47M | $1.11B | 6.26 | 23.56 (CAGR) |

| Apple | $3,577.06B | $391.04B | 27.56 | 6.12 (CAGR) |

| NVIDIA | $3,336.52B | $113.27B | 68.23 | 21.14 (CAGR) |

| Microsoft | $3,169.56B | $254.19B | 33.02 | 12.47 (CAGR) |

While GigaCloud doesn’t compete with the tech giants like Twitter and Amazon, its PE ratio (6.26) and PS ratio (0.73) strongly suggests that this is an undervalued investment. Of course, its moderately small market cap points to its being a ‘high risk, high reward’ bet, and is more attractive to more risk tolerant investors.

Analysts Stock Recommendation

Analysts opinions on GigaCloud Technology are mixed as its volatility and small capitalization makes it illiquid. Some see its potential for exponential growth, while others highlight the sector risks included in the variable earnings of REITs.

| Analyst Recommendation | Percentage |

| Buy | 35% |

| Hold | 50% |

| Sell | 15% |

The overwhelming majority are on board with keeping the stock and watching market trends, financial reports, and news closely. Most of the analysts suggest you should wait for the clearer sign of consistent profitability to make significant investments.

Stock Analysis by indicator

To better understand GigaCloud’s stock performance, let’s explore key financial ratios and technical indicators:

Valuation Ratios:

- Trailing PE Ratio: 6.26

- Forward PE Ratio: 5.95

- Price-to-Sales Ratio: 0.73

Profitability Ratios:

- Return on Equity (ROE): 39.85%

- Return on Assets (ROA): 11.19%

Debt Ratios:

- Debt-to-Equity Ratio: 1.26

Technical Indicators:

- 50-Day Moving Average: $21.47

- 200-Day Moving Average: $26.34

- Relative Strength Index (RSI): 49.38

The valuation ratios indicate that the stock is cheap enough. This means high ROE and ROA justifies efficient utilization of capital. But the high debt to equity ratio (1.26) shows it is at high risk of financial leveraging.

These numbers are positive but those who are considering investing into it should be a bit wary and think larger than this physical article that they have in their hands.

Should I Buy This Stock?

But before you buy GigaCloud Technology stock, investors must consider the pros and cons.

Pros:

- Strong Revenue Growth: While GCT nearly doubled year over year, the business performance and market demand reflects its strong results.

- Undervalued Stock: It trades at a PE ratio of 6.26 and a PS ratio of 0.73, thus giving value compared to earnings and sales. Value investors looking for growth opportunity come to such valuation metrics.

- High Insider Ownership: The company, at 27.94%, has a good case of insider ownership which shows management’s faith in the company’s future.

Cons:

- Market Volatility: With a beta of 1.92, that means the prices of semis are more volatile than other assets, and could be dangerous when the economy falters.

- Debt Levels: With a debt to equity ratio of 1.26, this is something we’ll want to keep a close eye on; too much leverage can stifle long term growth.

- Competitive Market: The company has to stay ahead of competition in cloud and e-commerce space with always innovation.

- Investor Outlook: GigaCloud Technology’s stock would make better sense for risk tolerant investors who are looking for longer term growth. For conservative investors, waiting until more financial clarity and less debt level are known might be best. It will be crucial to the future direction of the company whether it can adapt to industry trends.

GCT Stock Price Forecast 2025

| Month | Minimum Prediction Price | Maximum Prediction Price | % Change from Current Price |

|---|---|---|---|

| January | $19.67 | $20.82 | -0.81% |

| February | $19.89 | $21.12 | 0.30% |

| March | $20.15 | $21.56 | 1.62% |

| April | $20.47 | $22.04 | 2.87% |

| May | $20.72 | $22.42 | 3.75% |

| June | $21.11 | $22.94 | 5.08% |

| July | $21.35 | $23.37 | 5.89% |

| August | $21.61 | $23.73 | 6.58% |

| September | $21.89 | $24.12 | 7.41% |

| October | $22.12 | $24.46 | 8.15% |

| November | $22.38 | $24.81 | 8.87% |

| December | $22.61 | $25.15 | 9.58% |

GCT Stock Price Forecast 2026

| Month | Minimum Prediction Price | Maximum Prediction Price | % Change from Current Price |

|---|---|---|---|

| January | $23.04 | $25.62 | 10.96% |

| February | $23.32 | $26.07 | 11.79% |

| March | $23.61 | $26.41 | 12.63% |

| April | $23.89 | $26.77 | 13.47% |

| May | $24.17 | $27.19 | 14.31% |

| June | $24.49 | $27.62 | 15.14% |

| July | $24.81 | $28.08 | 15.99% |

| August | $25.14 | $28.54 | 16.87% |

| September | $25.41 | $28.93 | 17.64% |

| October | $25.68 | $29.31 | 18.40% |

| November | $25.94 | $29.76 | 19.18% |

| December | $26.21 | $30.12 | 19.95% |

GCT Stock Price Forecast 2027

| Month | Minimum Prediction Price | Maximum Prediction Price | % Change from Current Price |

|---|---|---|---|

| January | $26.53 | $30.56 | 20.79% |

| February | $26.81 | $31.02 | 21.62% |

| March | $27.14 | $31.41 | 22.50% |

| April | $27.46 | $31.82 | 23.36% |

| May | $27.78 | $32.24 | 24.22% |

| June | $28.11 | $32.68 | 25.10% |

| July | $28.46 | $33.14 | 26.01% |

| August | $28.79 | $33.56 | 26.88% |

| September | $29.12 | $33.99 | 27.75% |

| October | $29.45 | $34.38 | 28.62% |

| November | $29.73 | $34.82 | 29.46% |

| December | $30.07 | $35.28 | 30.35% |

GCT Stock Price Forecast 2028

| Month | Minimum Prediction Price | Maximum Prediction Price | % Change from Current Price |

|---|---|---|---|

| January | $30.43 | $35.73 | 31.24% |

| February | $30.72 | $36.19 | 32.08% |

| March | $31.05 | $36.64 | 32.95% |

| April | $31.38 | $37.08 | 33.83% |

| May | $31.72 | $37.56 | 34.73% |

| June | $32.05 | $38.02 | 35.60% |

| July | $32.42 | $38.51 | 36.54% |

| August | $32.74 | $38.92 | 37.40% |

| September | $33.08 | $39.36 | 38.30% |

| October | $33.41 | $39.81 | 39.18% |

| November | $33.75 | $40.28 | 40.09% |

| December | $34.08 | $40.72 | 40.96% |

GCT Stock Price Forecast 2029

| Month | Minimum Prediction Price | Maximum Prediction Price | % Change from Current Price |

|---|---|---|---|

| January | $34.45 | $41.17 | 41.91% |

| February | $34.78 | $41.61 | 42.78% |

| March | $35.14 | $42.06 | 43.73% |

| April | $35.47 | $42.51 | 44.63% |

| May | $35.82 | $42.97 | 45.55% |

| June | $36.15 | $43.43 | 46.44% |

| July | $36.49 | $43.91 | 47.37% |

| August | $36.83 | $44.36 | 48.27% |

| September | $37.18 | $44.82 | 49.20% |

| October | $37.52 | $45.27 | 50.08% |

| November | $37.86 | $45.74 | 50.98% |

| December | $38.22 | $46.21 | 51.91% |

GCT Stock Price Forecast 2030

| Month | Minimum Prediction Price | Maximum Prediction Price | % Change from Current Price |

|---|---|---|---|

| January | $38.56 | $46.68 | 52.81% |

| February | $38.91 | $47.14 | 53.74% |

| March | $39.26 | $47.62 | 54.66% |

| April | $39.62 | $48.08 | 55.59% |

| May | $39.97 | $48.56 | 56.51% |

| June | $40.31 | $49.03 | 57.42% |

| July | $40.66 | $49.51 | 58.34% |

| August | $41.01 | $49.99 | 59.27% |

| September | $41.36 | $50.46 | 60.20% |

| October | $41.72 | $50.94 | 61.12% |

| November | $42.06 | $51.41 | 62.03% |

| December | $42.41 | $51.89 | 62.96% |

Opinion: The upward trajectory on GigaCloud Technology Inc. is a logical result of its ability of riding the wave of increasing B2B eCommerce demand. Strong buy ratings of analysts and a strong financial performance make it a potential growth investment.

How to Buy Stock of GigaCloud Technology Inc. (GCT).

- Open an account on a brokerage platform (Robinhood, E*TRADE, Fidelity).

- The ticker symbol for search in GigaCloud Technology Inc. is “GCT.”

- Study the performance metrics EPS and P/E ratio for that stock.

- Choose how much you want to invest and if its a limit or market as your order.

- Confirm and place your order.

- Keep an eye on the stock’s performance.

Final Words

A compelling investment opportunity with high growth trajectory and strong financial performance comes from GigaCloud Technology Inc.

To see Gozoop’s analysis, click here. It is extremely focused on technological innovation, market expansion and operational efficiency and is well placed to continue to be successful in the years to come.

Investors looking for long term growth potential will find GCT a great addition to their portfolio, with many opportunities to earn returns over the next three decades and beyond.

Frequently Asked Questions

Is GCT stock a good investment for 2024-2025?

Clearly, GCT is actually a very strong investment owing to its impressive financial growth, broadening its market presence, and strong operational model. It has been rated a ‘Strong Buy’ by analysts.

What is GCT’s main business model?

GCT runs a B2B ecommerce platform for large parcel merchandise, facilitating links between Asian manufacturers and U.S. and European and Asian resellers. Product Discovery, payment processing, and logistics solutions are all integrated on this platform.

What are analysts saying about GCT’s future growth?

Analysts are optimistic about GCT’s future growth, citing its innovative business model, strong financials, and expanding market share. It is consistently rated as a strong buy by major investment firms.

Is GCT expanding into new markets?

GCT is actively pursuing opportunities in areas not being served heavily by now, including South America, Africa to greatly increase its global presence.

Does GCT pay dividends to its shareholders?

Currently, GCT does not pay dividends. However, with increasing profitability, there is potential for future dividend announcements.

Leave a Reply