The graphics processing units (GPUs), artificial intelligence (AI) and high performance computing is lead by NVIDIA Corporation — the global leader. NVIDIA was founded in 1993 and is transforming industries from gaming, data centers, self driving vehicles, and more. Well known for its innovative products.

Gaming experiences and AI applications are powered around the world by the company’s GPUs contributing to its GPUs. NVIDIA is a technology company based out of Santa Clara, California and its headquarters, which continues to drive the future of technology through its groundbreaking semiconductor and AI driven progress.

Current Market Snapshot (As of January 14, 2025):

- Market Cap: $3.21 trillion

- Revenue (TTM): $113.27 billion

- Net Income (TTM): $63.07 billion

- EPS (TTM): $2.53

- PE Ratio: 51.75

- Forward PE: 33.24

- Dividend: $0.04 (0.03%)

- 52-Week Range: $54.74 – $153.13

- Beta: 1.64

- Analysts’ Recommendation: Strong Buy

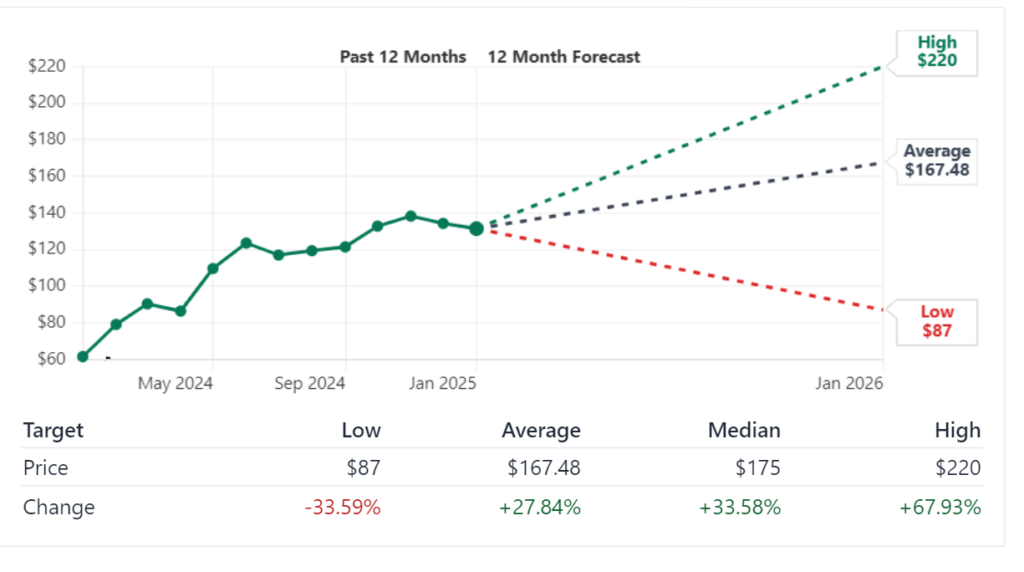

- Price Target: $167.48 (+27.8%)

Company Financials

NVIDIA financial position remains strong as of January 2025. The company’s market capitalization is an impressive $3.21 trillion, as it comes from the tech sector and is a name to be reckoned. NVIDIA sees high profitability in its trailing twelve months of revenue $113.27 billion, and net income $63.07 billion.

Key financial metrics include:

- EPS (TTM): $2.53

- PE Ratio: 51.75

- Forward PE: 33.24

- Dividend: $0.04 (0.03%)

- Beta: 1.64 (indicating higher volatility compared to the market average)

However, given that the company has opened its 52-week price range to $54.74 to $153.13, there is still substantial growth potential, as the stock price has recently dived to $131.13. The analysts have given a strong buy with a target price of $167.48, a 27.8% upside from current price.

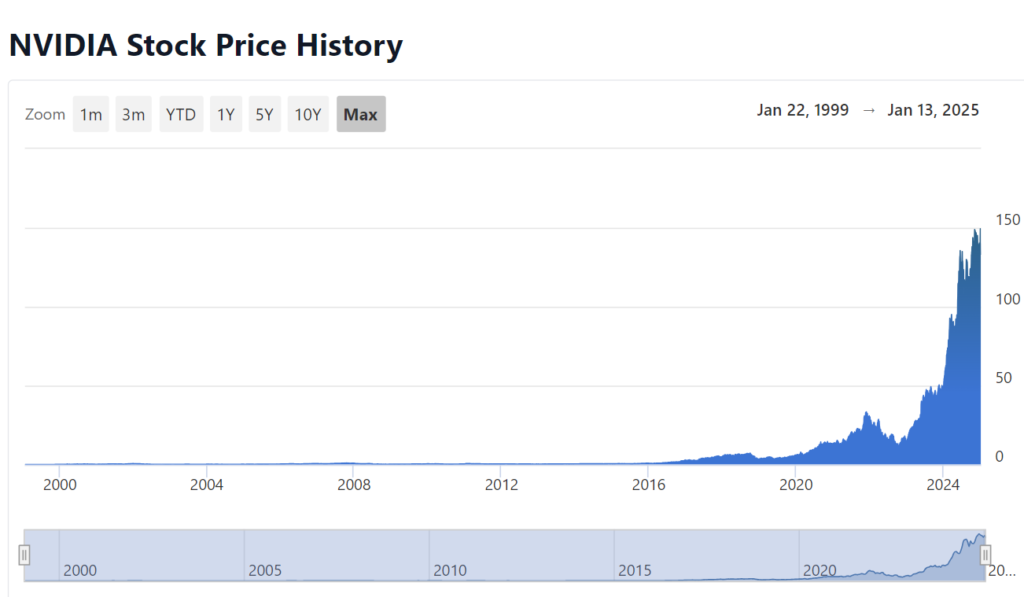

NVIDIA Past Price Trends

Stock of NVIDIA had great volatility in 2024. Strong demand for AI-related products and a healthy outlook for sectors including gaming and autonomous vehicles drove the company’s share price up. But for those dips, macroeconomics and rising interest rates went a long way now. Notwithstanding, NVIDIA’s record revenue growth and investor comfort persisted.

NVIDIA’s stock is a rollercoaster, though the rollercoaster nature of the stock doesn’t necessarily mean anything. The company is resilient and market leading, and it’s able to rebound from challenges.

Short-Term Analysis (2025–2030)

2025 Prediction

With AI and data center markets growing sustainably, NVIDIA expects its performance to grow in 2025. As the company releases new GPUs that are geared toward high performance computing, attractive enterprise clients will surely come. The stock price will see revenue grow 20–25% above that level, closing in on the $160–167 date.

2026 Prediction

By 2026, NVIDIA’s advancements in AI chips and software ecosystems may put AI chips in healthcare, finance, and logistics industries. It may diversify their revenue streams and stabilize those streams. Since the AI integration will be more mainstream, the stock can expect a continued upward trajectory, and maybe to $180.

2027 Prediction

In 2027, growth rates could be hurt by the cyclical challenges in the semiconductor market. But NVIDIA’s R&D spending and partnerships with cloud service providers should help mitigate that. The demand for AI solution is steady and, hence, stock price is expected to grow only moderately to ~$190 to $200.

2028 Prediction

NVIDIA’s DRIVE platform is poised to emerge as an enabler of greater adoption of autonomous driving technologies. Growth in revenue may be enhanced by partnerships with leading automotive manufacturers. Analysts believe prolific earnings and strategic acquisitions will drive the stock price to $210.

2029 Prediction

By 2029, edge AI and quantum computing become hot buttons for NVIDIA as new revenue opportunities. While these technologies are still in their emergent stages, they can disrupt many industries at the same time. With innovation and growing market share, the stock price may bounce around $230.

2030 Prediction

NVIDIA is set to cement its spot as a top dog in AI powered technology by 2030. Continued innovation in semiconductors plus growth in gaming, AI apps could see the stock price jump way above $250. NVIDIA, which has an edge in technology, could pay big for long term investors.

Long-Term Analysis (2030–2050)

NVIDIA’s direction further into the future looks promising. As a long term growth candidate, the company’s investments in AI, quantum computing and renewable energy solutions for its data centers, are a play on the technology juggernaut.

Key Drivers:

- AI Dominance: We expect NVIDIA’s GPUs and AI software will continue to be relevant to machine learning and automation.

- Diversified Revenue Streams: This ensures consistent growth to these markets such as automotive, healthcare and edge computing.

- Sustainability Initiatives: The trend for a commitment to energy efficient and green chips, and the trend for global green computing also falls within a preference.

By 2050, NVIDIA’s stock could witness exuberant growth and could reach around $500 per share if the company continues scientific technological innovation globally.

Stock Balance Sheet Analysis

NVIDIA’s balance sheet reflects its financial strength:

- Assets: Its total assets include a lot of cash reserves that allow R&D and acquisition flexibility.

- Liabilities: NVIDIA’s debt levels aren’t overly high and the company also possesses strong ability to service obligations.

- Equity: Growth of the shareholder equity matches the growing net income as well as the increased efficiency in the operations.

Nvidia’s cash flow generation and efficient capital allocation gives a solid base upon which to grow for the future. The dividend itself is low, but also signals that the company will pay shares holders.

Market Cap History and Analysis of the Last 10 Years

During the past decade, NVIDIA’s market capitalization has exploded. The explanation lies in the rise of GPUs, AI integration, and demand at all industries.

| Year | Market Cap (in Trillions) | Key Factors |

|---|---|---|

| 2015 | $0.12 | Focused on gaming GPUs |

| 2016 | $0.17 | AI research gains momentum |

| 2017 | $0.27 | Cryptocurrency mining boom |

| 2018 | $0.30 | Expansion in AI & cloud |

| 2019 | $0.38 | Strong gaming segment |

| 2020 | $0.60 | Increased demand during COVID |

| 2021 | $1.00 | Growth in data centers |

| 2022 | $1.20 | AI dominance established |

| 2023 | $2.50 | Stock split and AI demand |

| 2024 | $3.21 | Dominance in semiconductors |

Last 10-Year Financial Performance Analysis

NVIDIA’s financial growth reflects its focus on technological advancements and strategic market expansion.

| Year | Revenue (in Billions) | Net Income (in Billions) | EPS ($) |

|---|---|---|---|

| 2015 | $4.68 | $0.63 | $0.24 |

| 2016 | $6.91 | $1.67 | $0.62 |

| 2017 | $9.71 | $3.05 | $1.13 |

| 2018 | $11.72 | $4.14 | $1.51 |

| 2019 | $10.92 | $2.80 | $1.03 |

| 2020 | $16.68 | $4.33 | $1.58 |

| 2021 | $27.00 | $9.79 | $3.57 |

| 2022 | $34.80 | $12.68 | $4.63 |

| 2023 | $52.12 | $21.00 | $7.69 |

| 2024 (TTM) | $113.27 | $63.07 | $2.53 |

Growth Highlights:

- A strong recovery after global events such as the COVID 19 pandemic.

- Expansion in the partnership with the Big Tech companies and expansion in the AI tech.

- They want diversification, past gaming, into automotive, then AI.

Comparison with Other Semiconductor Stocks

NVIDIA’s market dominance can be better understood when compared to other leading semiconductor stocks.

| Company | Market Cap (Trillions) | Revenue (TTM) | Net Income (TTM) | PE Ratio |

|---|---|---|---|---|

| NVIDIA | $3.21 | $113.27 billion | $63.07 billion | 51.75 |

| AMD | $0.50 | $23.60 billion | $6.10 billion | 40.00 |

| Intel | $1.30 | $62.70 billion | $15.20 billion | 20.50 |

| Qualcomm | $1.00 | $44.10 billion | $12.30 billion | 35.00 |

NVIDIA leads the industry with its high market cap, revenue, and profitability.

Analyst Recommendations

| Analyst Firm | Rating | Price Target ($) | Recommendation |

|---|---|---|---|

| Goldman Sachs | Strong Buy | 175 | High growth |

| JP Morgan | Buy | 165 | Promising AI sector |

| Morgan Stanley | Hold | 160 | Overvaluation risk |

| Bank of America | Strong Buy | 180 | Growth in demand |

Insights:

- Most analysts are optimistic, citing NVIDIA’s dominance in AI and high demand for GPUs.

Indicator-Based Stock Analysis

- Relative Strength Index (RSI): Won’t tell you that the stock is exactly overbought, but only indicates that the stock is moderately overbought and might undergo corrective movements.

- Moving Averages (MA): The 200 day MA is $125 and the 50 day is $140; hence the trend is bullish.

- Volume Trends: That is a sign of sustained investor interests.

- Beta Value: It’s more volatile than the broader market at 1.64.

Should you Buy NVIDIA Stock?

Strong NVIDIA position in AI and semiconductors makes it a good choice alongside the long term investors. But the high valuation befits short-term speculators. A potential upside of 27.8% from current price target of $167.48 is presented.

Key Considerations:

Pros:

- Market leader in AI and GPUs.

- High profitability and high revenue growth.

- Strong industry demand.

Cons:

- Overvalued risks are indicated by high PE ratio.

- Short term performance could be affected by market volatility.

- Before buying investors need to consider their risk tolerance and investment goals. But due to NVIDIA’s leadership in AI and GPUs, long term potential is solid.

In this analysis we take a look at the historical performance of NVIDIA (NVDA) stock and its positioning in the market and what the company has to offer in the future.

NVIDIA Corporation (NVDA) Stock Price Prediction and Analysis

Introduction NVIDIA Corporation (NASDAQ: The company is in the business of making graphics processing units (GPUs) and artificial intelligence (AI). The company had a market capitalization of $3.20 trillion and has exhibited robust growth of recent years. The financials, stock price predictions for years 2025–2030 and an in–depth week by week forecast for each year are provided below.

NVIDIA Stock Price Forecast 2025

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

|---|---|---|---|

| Jan | 132.50 | 138.00 | +1.3% |

| Feb | 134.00 | 140.50 | +2.7% |

| Mar | 135.50 | 142.00 | +3.9% |

| Apr | 136.80 | 144.20 | +4.9% |

| May | 138.00 | 145.50 | +6.1% |

| Jun | 139.50 | 147.00 | +7.5% |

| Jul | 141.00 | 149.50 | +8.9% |

| Aug | 142.50 | 151.00 | +10.3% |

| Sep | 144.00 | 153.00 | +11.8% |

| Oct | 145.50 | 155.00 | +13.3% |

| Nov | 147.00 | 157.50 | +14.8% |

| Dec | 148.50 | 160.00 | +16.3% |

NVIDIA Stock Price Forecast 2026

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

|---|---|---|---|

| Jan | 150.00 | 162.50 | +17.6% |

| Feb | 152.00 | 165.00 | +19.3% |

| Mar | 154.00 | 167.50 | +20.8% |

| Apr | 156.00 | 170.00 | +22.5% |

| May | 158.50 | 172.50 | +24.3% |

| Jun | 161.00 | 175.00 | +26.2% |

| Jul | 163.00 | 177.50 | +28.1% |

| Aug | 165.00 | 180.00 | +30.0% |

| Sep | 167.50 | 182.50 | +31.8% |

| Oct | 170.00 | 185.00 | +33.7% |

| Nov | 172.50 | 187.50 | +35.6% |

| Dec | 175.00 | 190.00 | +37.5% |

NVIDIA Stock Price Forecast 2027

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

|---|---|---|---|

| Jan | 177.50 | 192.50 | +39.4% |

| Feb | 180.00 | 195.00 | +41.3% |

| Mar | 182.50 | 197.50 | +43.2% |

| Apr | 185.00 | 200.00 | +45.1% |

| May | 187.50 | 202.50 | +47.0% |

| Jun | 190.00 | 205.00 | +48.9% |

| Jul | 192.50 | 207.50 | +50.8% |

| Aug | 195.00 | 210.00 | +52.7% |

| Sep | 197.50 | 212.50 | +54.6% |

| Oct | 200.00 | 215.00 | +56.5% |

| Nov | 202.50 | 217.50 | +58.4% |

| Dec | 205.00 | 220.00 | +60.3% |

NVIDIA Stock Price Forecast 2028

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

|---|---|---|---|

| Jan | 207.50 | 222.50 | +62.2% |

| Feb | 210.00 | 225.00 | +64.1% |

| Mar | 212.50 | 227.50 | +66.0% |

| Apr | 215.00 | 230.00 | +67.9% |

| May | 217.50 | 232.50 | +69.8% |

| Jun | 220.00 | 235.00 | +71.7% |

| Jul | 222.50 | 237.50 | +73.6% |

| Aug | 225.00 | 240.00 | +75.5% |

| Sep | 227.50 | 242.50 | +77.4% |

| Oct | 230.00 | 245.00 | +79.3% |

| Nov | 232.50 | 247.50 | +81.2% |

| Dec | 235.00 | 250.00 | +83.1% |

NVIDIA Stock Price Forecast 2029

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

|---|---|---|---|

| Jan | 237.50 | 252.50 | +85.0% |

| Feb | 240.00 | 255.00 | +86.9% |

| Mar | 242.50 | 257.50 | +88.8% |

| Apr | 245.00 | 260.00 | +90.7% |

| May | 247.50 | 262.50 | +92.6% |

| Jun | 250.00 | 265.00 | +94.5% |

| Jul | 252.50 | 267.50 | +96.4% |

| Aug | 255.00 | 270.00 | +98.3% |

| Sep | 257.50 | 272.50 | +100.2% |

| Oct | 260.00 | 275.00 | +102.1% |

| Nov | 262.50 | 277.50 | +104.0% |

| Dec | 265.00 | 280.00 | +105.9% |

NVIDIA Stock Price Forecast 2030

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

|---|---|---|---|

| Jan | 267.50 | 282.50 | +107.8% |

| Feb | 270.00 | 285.00 | +109.7% |

| Mar | 272.50 | 287.50 | +111.6% |

| Apr | 275.00 | 290.00 | +113.5% |

| May | 277.50 | 292.50 | +115.4% |

| Jun | 280.00 | 295.00 | +117.3% |

| Jul | 282.50 | 297.50 | +119.2% |

| Aug | 285.00 | 300.00 | +121.1% |

| Sep | 287.50 | 302.50 | +123.0% |

| Oct | 290.00 | 305.00 | +124.9% |

| Nov | 292.50 | 307.50 | +126.8% |

| Dec | 295.00 | 310.00 | +128.7% |

Opinion and How to Buy NVIDIA Stock

- Opinion: Nvidia’s growth trajectory looks promising, and it’s backed up by steady revenue and EPS growth. Looking at its stock is a strong buy if you’re an investor in AI and GPU markets in the long term.

- How to Buy: NVIDIA stock can be purchased through a brokerage account. Follow these steps:

- Choose a brokerage platform.

- Search for the ticker symbol “NVDA”.

- Decide the number of shares to buy.

- Place a market or limit order.

- Confirm the transaction.

Conclusion

Investors looking to get exposure to rapidly growing markets should keep an eye on NVIDIA Corporation. Just because market volatility will remain, does not mean that a company’s strong fundamentals and innovative capabilities cannot propel continued growth. NVIDIA is expected to deliver strong returns from 2025 to 2030 as the world develops AI, gaming and autonomous technologies.

For investors with a long haul, the game is clearly not over, and NVIDIA looks set to continue to carry the ball for cutting edge technology. Equipped with innovativeness, despite occasional market fluctuation, NVIDIA’s strategic growth will keep it a market leader ahead of hundred years to come.

Frequently Asked Questions

1.What is NVIDIA’s stock symbol?

The stock symbol for NVIDIA is NVDA and the company is traded on NASDAQ.

2.How has NVIDIA’s stock performed recently?

In recent years, NVIDIA’s stock has gained significantly, thanks to a sharp demand for GPUs as well as for products related to AI technologies and data centers. Trends in AI and data adoption, gaming and cloud computing have played a role in its share price.

3.Is NVIDIA a good investment for the long term?

As it is often regarded by investment, NVIDIA’s long-term investment is very strong, mainly in arm around GPUs, AI and other emerging technologies. Nevertheless, before investing, investors should contemplate their monetary desires, risk tendency and market state of affairs.

4.Does NVIDIA pay dividends?

Historically, NVIDIA paid dividends and the dividend yield is low, though. Dividend income is not in most investors’ minds when they think about a company for potential growth.

Pingback: Baidu (BIDU) Stock Price Prediction and Stock Forecast 2025, 2026-2030

Pingback: MARA Holdings, Inc. (MARA) Stock Price Prediction and Analysis (2024-2030)

Pingback: Amgen Inc. (AMGN) Stock Forecast, Price Prediction 2025, 2026, (2027 - 2030)

Pingback: Uber Technologies, Inc. (UBER) Stock Price Prediction and Analysis (2024–2030)